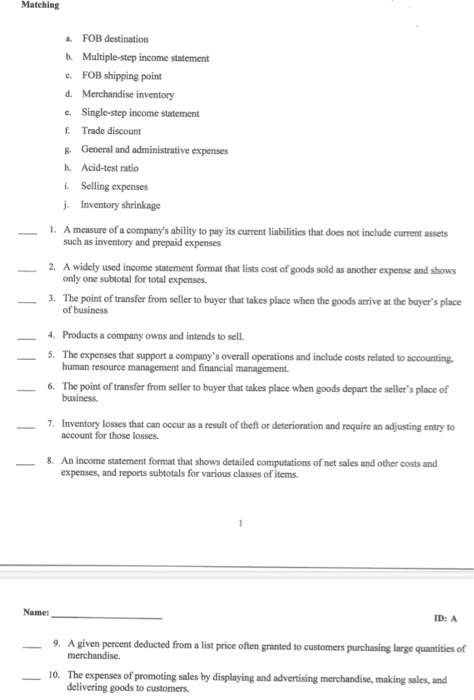

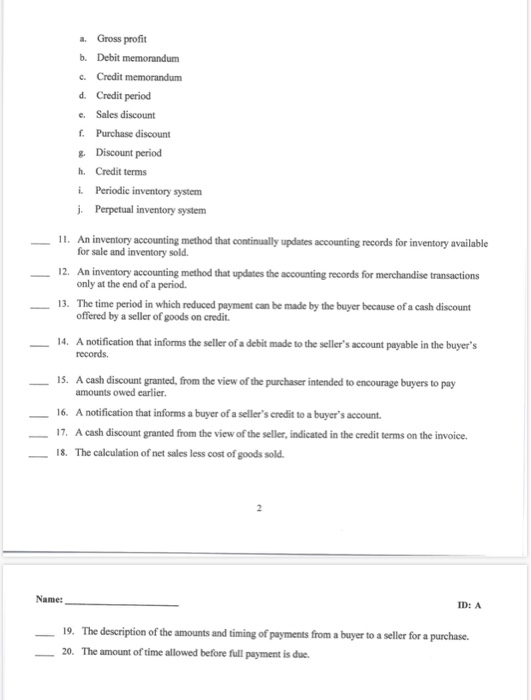

Matching a. FOB destination b. Multiple-step income statement c. FOB shipping point d. Merchandise inventory c. Single-step income statement f. Trade discount & General and administrative expenses h. Acid-test ratio i. Selling expenses j. Inventory shrinkage 1. A measure of a company's ability to pay its current liabilities that does not include current assets such as inventory and prepaid expenses 2. A widely used income statement format that lists cost of goods sold as another expense and shows only one subtotal for total expenses. 3. The point of transfer from seller to buyer that takes place when the goods arrive at the buyer's place of business 4. Products a company owns and intends to sell. 5. The expenses that support a company's overall operations and include costs related to accounting human resource management and financial management 6. The point of transfer from seller to buyer that takes place when goods depart the seller's place of business. 7. Inventory losses that can occur as a result of theft or deterioration and require an adjusting entry to account for those losses. 8. An income statement format that shows detailed computations of net sales and other costs and expenses, and reports subtotals for various classes of items. Name: ID: A 9. A given percent deducted from a list price often granted to customers purchasing large quantities of merchandise. 10. The expenses of promoting sales by displaying and advertising merchandise, making sales, and delivering goods to customers. a Gross profit b. Debit memorandum c. Credit memorandum d. Credit period c. Sales discount f. Purchase discount & Discount period h. Credit terms i Periodic inventory system j. Perpetual inventory system 11. An inventory accounting method that continually updates accounting records for inventory available for sale and inventory sold An inventory accounting method that updates the accounting records for merchandise transactions only at the end of a period. The time period in which reduced payment can be made by the buyer because of a cash discount offered by a seller of goods on credit. 14. A notification that informs the seller of a debit made to the seller's account payable in the buyer's records, A cash discount granted, from the view of the purchaser intended to encourage buyers to pay amounts owed earlier. 16. A notification that informs a buyer of a seller's credit to a buyer's account 17. A cash discount granted from the view of the seller, indicated in the credit terms on the invoice. 18. The calculation of net sales less cost of goods sold. Name: ID: A 19. The description of the amounts and timing of payments from a buyer to a seller for a purchase. 20. The amount of time allowed before full payment is due