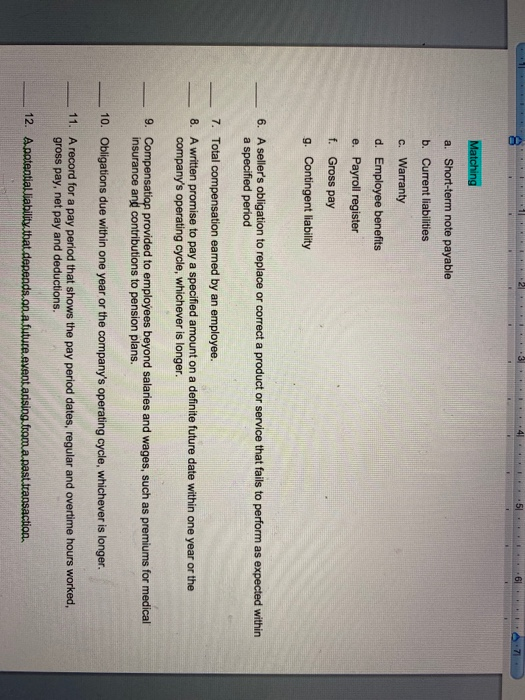

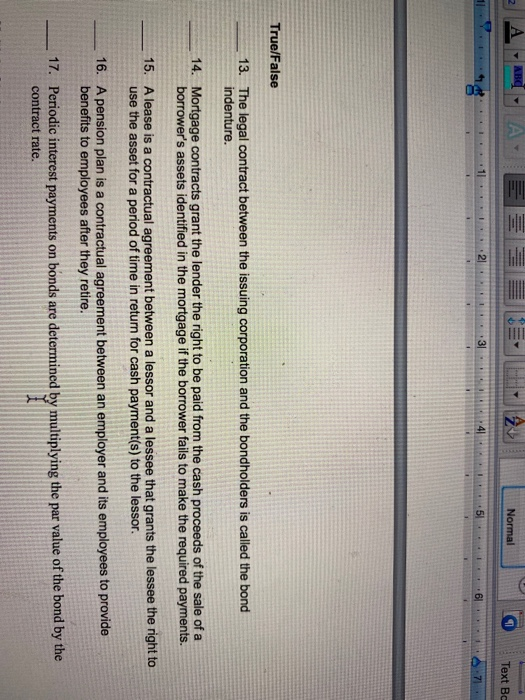

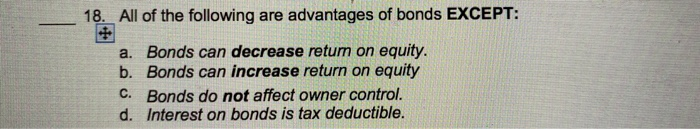

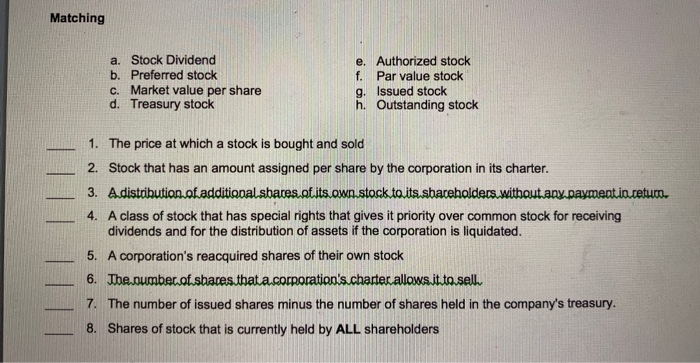

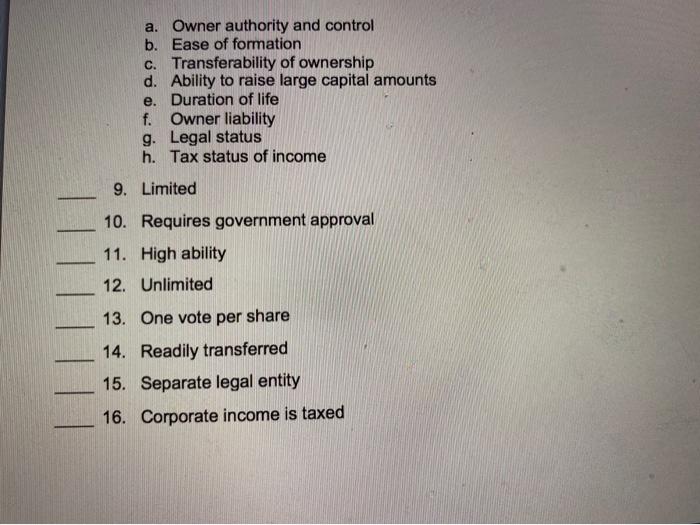

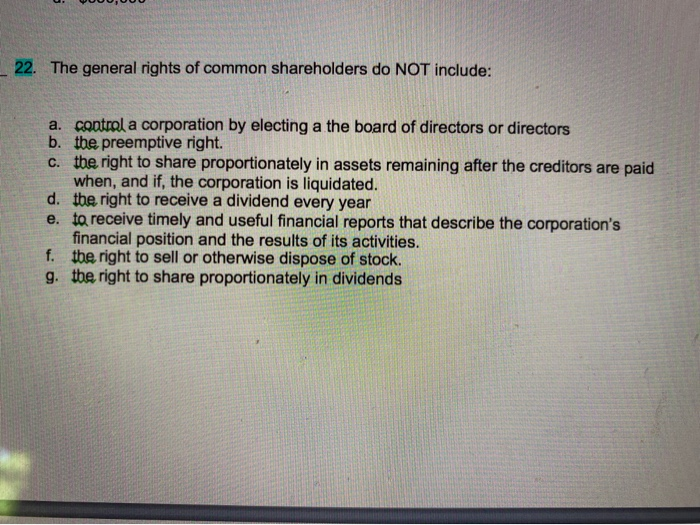

Matching a. Short-term note payable b. Current liabilities c. Warranty d. Employee benefits e. Payroll register f. Gross pay g. Contingent liability 6. A seller's obligation to replace or correct a product or service that fails to perform as expected within a specified period 7. Total compensation eamed by an employee. 8. A written promise to pay a specified amount on a definite future date within one year or the company's operating cycle, whichever is longer. 9. Compensation provided to employees beyond salaries and wages, such as premiums for medical insurance and contributions to pension plans. 10. Obligations due within one year or the company's operating cycle, whichever is longer. 11. A record for a pay period that shows the pay period dates, regular and overtime hours worked, gross pay, net pay and deductions. 12. Apoteolialiability that depends.co.a future avant arising from a pastiransaction A ABONA Normal Text Bc True/False 13. The legal contract between the issuing corporation and the bondholders is called the bond indenture. 14. Mortgage contracts grant the lender the right to be paid from the cash proceeds of the sale of a borrower's assets identified in the mortgage if the borrower fails to make the required payments. 15. A lease is a contractual agreement between a lessor and a lessee that grants the lessee the right to use the asset for a period of time in return for cash payment(s) to the lessor. 16. A pension plan is a contractual agreement between an employer and its employees to provide benefits to employees after they retire. 17. Periodic interest payments on bonds are determined by multiplying the par value of the bond by the contract rate. 18. All of the following are advantages of bonds EXCEPT: a. Bonds can decrease retum on equity. b. Bonds can increase return on equity C. Bonds do not affect owner control. d. Interest on bonds is tax deductible. Matching a. Stock Dividend b. Preferred stock C. Market value per share d. Treasury stock e. Authorized stock f. Par value stock g. Issued stock h. Outstanding stock 1. The price at which a stock is bought and sold 2. Stock that has an amount assigned per share by the corporation in its charter. 3. A distribution of additional shares of its own.stock to its shareholders without any payment in. cetum 4. A class of stock that has special rights that gives it priority over common stock for receiving dividends and for the distribution of assets if the corporation is liquidated. 5. A corporation's reacquired shares of their own stock 6. The number of shares that a.corporation's.charter allows it to sell 7. The number of issued shares minus the number of shares held in the company's treasury. 8. Shares of stock that is currently held by ALL shareholders a. Owner authority and control b. Ease of formation c. Transferability of ownership d. Ability to raise large capital amounts e. Duration of life f. Owner liability g. Legal status h. Tax status of income 9. Limited 10. Requires government approval 11. High ability 12. Unlimited 13. One vote per share 14. Readily transferred 15. Separate legal entity 16. Corporate income is taxed 22. The general rights of common shareholders do NOT include: a. control a corporation by electing a the board of directors or directors b. the preemptive right. c. the right to share proportionately in assets remaining after the creditors are paid when, and if, the corporation is liquidated. d. the right to receive a dividend every year e. to receive timely and useful financial reports that describe the corporation's financial position and the results of its activities. f. the right to sell or otherwise dispose of stock. g. the right to share proportionately in dividends