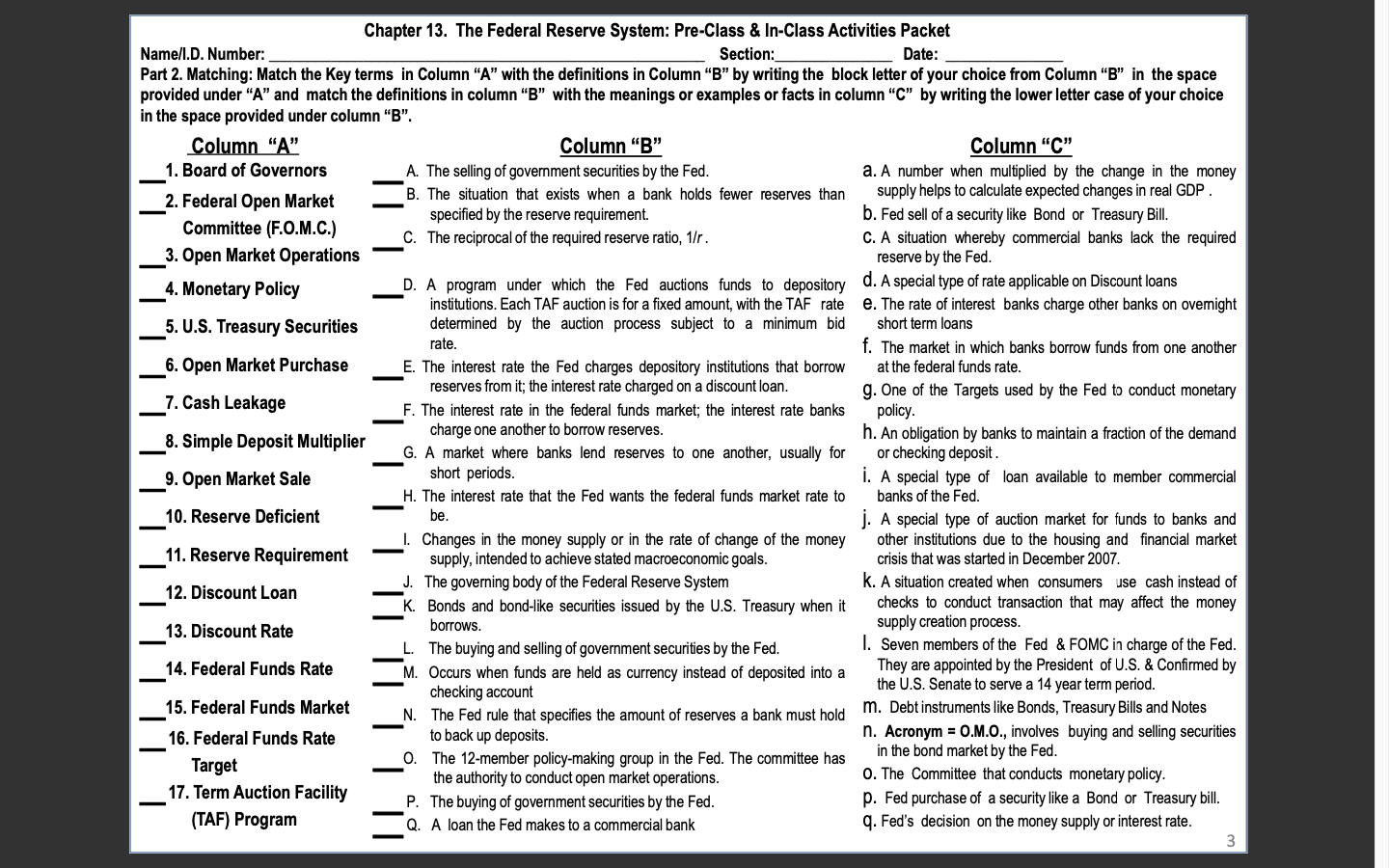

Matching: Match the Key terms in Column "A" with the definitions in Column "B" by writing the block letter of yourchoice from Column "B" in the space provided under "A" and match the definitions in column "B" with the meanings or examples or facts in column "C" by writingthe lower letter case of your choicein the space provided under column "B". I only need questions # 1, 3, 5, 7, 9, 11, 13, 15 & 17. Thank you.

Chapter 13. The Federal Reserve System: Pre-Class & In-Class Activities Packet Name/I.D. Number: Section: Date: Part 2. Matching: Match the Key terms in Column "A" with the definitions in Column "B" by writing the block letter of your choice from Column "B" in the space provided under "A" and match the definitions in column "B" with the meanings or examples or facts in column "C" by writing the lower letter case of your choice in the space provided under column "B". Column "A" Column "B" Column "C" 1. Board of Governors A. The selling of government securities by the Fed. a. A number when multiplied by the change in the money 2. Federal Open Market B. The situation that exists when a bank holds fewer reserves than supply helps to calculate expected changes in real GDP Committee (F.O.M.C.) specified by the reserve requirement. b. Fed sell of a security like Bond or Treasury Bill. 3. Open Market Operations C. The reciprocal of the required reserve ratio, 1/r . C. A situation whereby commercial banks lack the required reserve by the Fed. 4. Monetary Policy D. A program under which the Fed auctions funds to depository @. A special type of rate applicable on Discount loans institutions. Each TAF auction is for a fixed amount, with the TAF rate e. The rate of interest banks charge other banks on overnight 5. U.S. Treasury Securities determined by the auction process subject to a minimum bid short term loans rate 6. Open Market Purchase . The market in which banks borrow funds from one another E. The interest rate the Fed charges depository institutions that borrow at the federal funds rate. 7. Cash Leakage reserves from it; the interest rate charged on a discount loan. g. One of the Targets used by the Fed to conduct monetary F. The interest rate in the federal funds market; the interest rate banks policy. 8. Simple Deposit Multiplier charge one another to borrow reserves. h. An obligation by banks to maintain a fraction of the demand G. A market where banks lend reserves to one another, usually for or checking deposit . 9. Open Market Sale short periods. i. A special type of loan available to member commercial H. The interest rate that the Fed wants the federal funds market rate to banks of the Fed. 10. Reserve Deficient be. j. A special type of auction market for funds to banks and 11. Reserve Requirement Changes in the money supply or in the rate of change of the money other institutions due to the housing and financial market supply, intended to achieve stated macroeconomic goals. crisis that was started in December 2007. 12. Discount Loan J. The governing body of the Federal Reserve System K. A situation created when consumers use cash instead of K. Bonds and bond-like securities issued by the U.S. Treasury when it checks to conduct transaction that may affect the money 13. Discount Rate borrows. supply creation process. The buying and selling of government securities by the Fed. I. Seven members of the Fed & FOMC in charge of the Fed. 14. Federal Funds Rate M. Occurs when funds are held as currency instead of deposited into a They are appointed by the President of U.S. & Confirmed by checking account the U.S. Senate to serve a 14 year term period. 15. Federal Funds Market N. The Fed rule that specifies the amount of reserves a bank must hold . Debt instruments like Bonds, Treasury Bills and Notes 16. Federal Funds Rate to back up deposits. n. Acronym = O.M.O., involves buying and selling securities Target O. The 12-member policy-making group in the Fed. The committee has in the bond market by the Fed. 17. Term Auction Facility the authority to conduct open market operations. O. The Committee that conducts monetary policy. P. Fed purchase of a security like a Bond or Treasury bill. (TAF) Program P. The buying of government securities by the Fed. Q. A loan the Fed makes to a commercial bank q. Fed's decision on the money supply or interest rate. 3