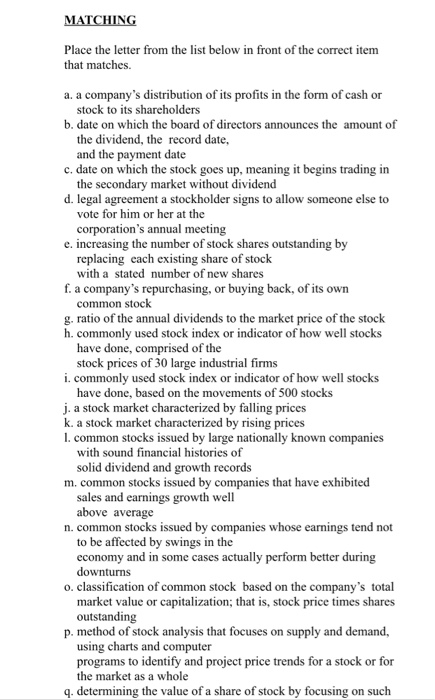

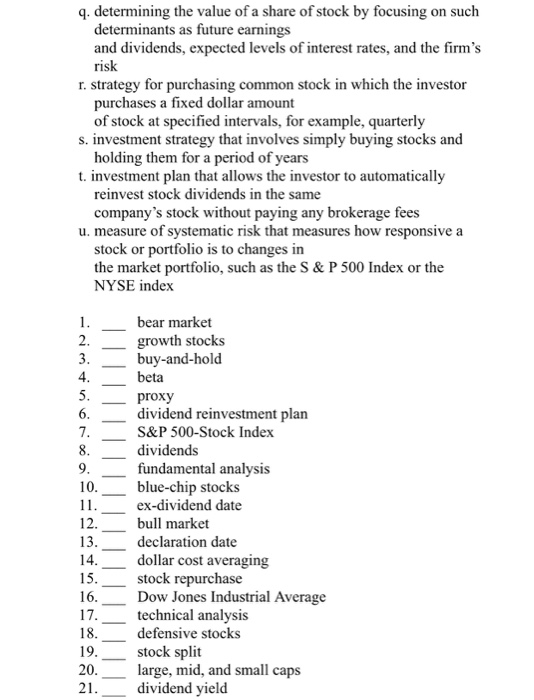

MATCHING Place the letter from the list below in front of the correct item that matches. a. a company's distribution of its profits in the form of cash or stock to its shareholders b. date on which the board of directors announces the amount of the dividend, the record date and the payment date c. date on which the stock goes up, meaning it begins trading in the secondary market without dividend d. legal agreement a stockholder signs to allow someone else to vote for him or her at the corporation's annual meeting e. increasing the number of stock shares outstanding by replacing each existing share of stock with a stated number of new shares f. a company's repurchasing, or buying back, of its own common stock g. ratio of the annual dividends to the market price of the stock h. commonly used stock index or indicator of how well stocks have done, comprised of the stock prices of 30 large industrial firms i. commonly used stock index or indicator of how well stocks have done, based on the movements of 500 stocks j. a stock market characterized by falling prices k. a stock market characterized by rising prices 1. common stocks issued by large nationaly known companies with sound financial histories of solid dividend and growth records m. common stocks issued by companies that have exhibited sales and earnings growth well above average n. common stocks issued by companies whose earnings tend not to be affected by swings in the economy and in some cases actually perform better during downturns o. classification of common stock based on the company's total market value or capitalization; that is, stock price times shares outstanding p. method of stock analysis that focuses on supply and demand, using charts and computer programs to identify and project price trends for a stock or for the market as a whole q. determining the value of a share of stock by focusing on such q. determining the value of a share of stock by focusing on such determinants as future earnings and dividends, expected levels of interest rates, and the firm's risk r. strategy for purchasing common stock in which the investor purchases a fixed dollar amount of stock at specified intervals, for example, quarterly s. investment strategy that involves simply buying stocks and holding them for a period of years t. investment plan that allows the investor to automatically reinvest stock dividends in the same company's stock without paying any brokerage fees u. measure of systematic risk that measures how responsive a stock or portfolio is to changes in the market portfolio, such as the S &P 500 Index or the NYSE index bear market 1 2. growth stocks buy-and-hold beta 3. 4. 5. proxy 6. dividend reinvestment plan S&P 500-Stock Index 7 dividends 8 9 fundamental analysis blue-chip stocks ex-dividend date 10. 11 bull market 12 13. declaration date 14. dollar cost averaging stock repurchase Dow Jones Industrial Average technical analysis defensive stocks stock split large, mid, and small caps dividend yield 15 16 17. 18 19. 20 21