Question

Materdor Inc is considering purchase Reya Corp for $250,000.00 (all cash). Complete a 5 year DCF to determine whether the investment will be beneficial for

Materdor Inc is considering purchase Reya Corp for $250,000.00 (all cash). Complete a 5 year DCF to determine whether the investment will be beneficial for Materdor Inc.

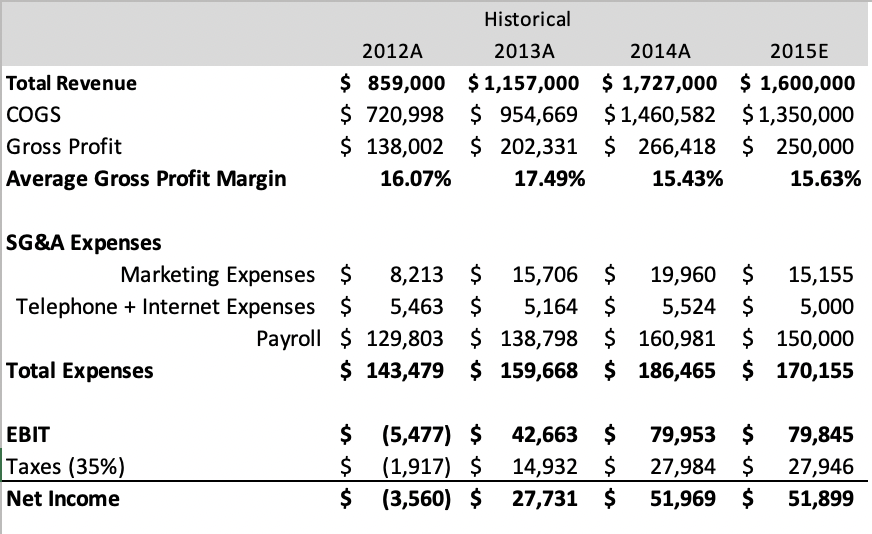

Below are the financials for Reva Corp.

Purchase Price: $250,000.00

Upon acquisition, there will be a decrease in the following costs:

Reduction in marketing expenses by 25%, telephone and internet expenses will decrease to only $120 per month, and long-term labour costs will also decrease by 15%.

Discount rate: 20%

Industry Growth rate: 5%

SG&A totalled approximately 13% (3% for fixed overhead and 10% marginal costs to account for labour)

Payroll consists of 4 employees, 2 of which are salaried, and the other 2 are commission-based consultants who keep 10% of gross revenues each.

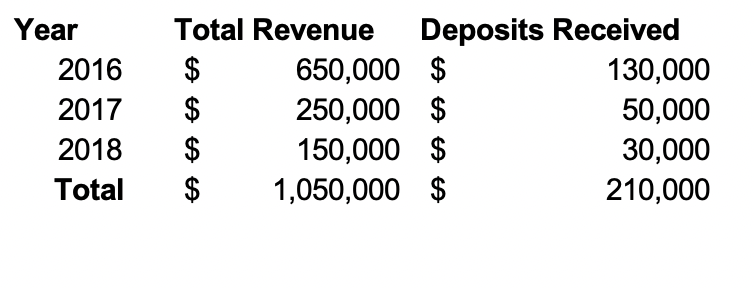

Below are the future sales for Reva Corp however, the deposits received have already been used to pay for COGS therefore they will not transfer to Materdor Inc in cash.

Reva Corp Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started