-

Materials and Labor Variances. Solar Products, Inc., produces solar power systems for commercial buildings. Each solar power system has three solar panels.

(This is the same company as the previous exercise. This exercise can be assigned independently.)

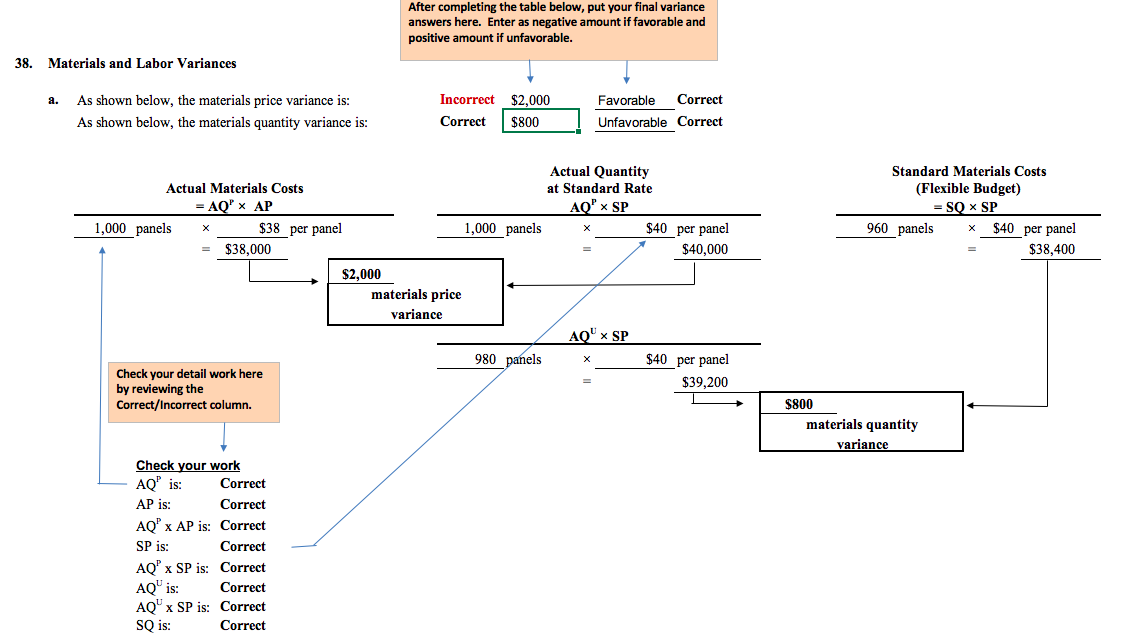

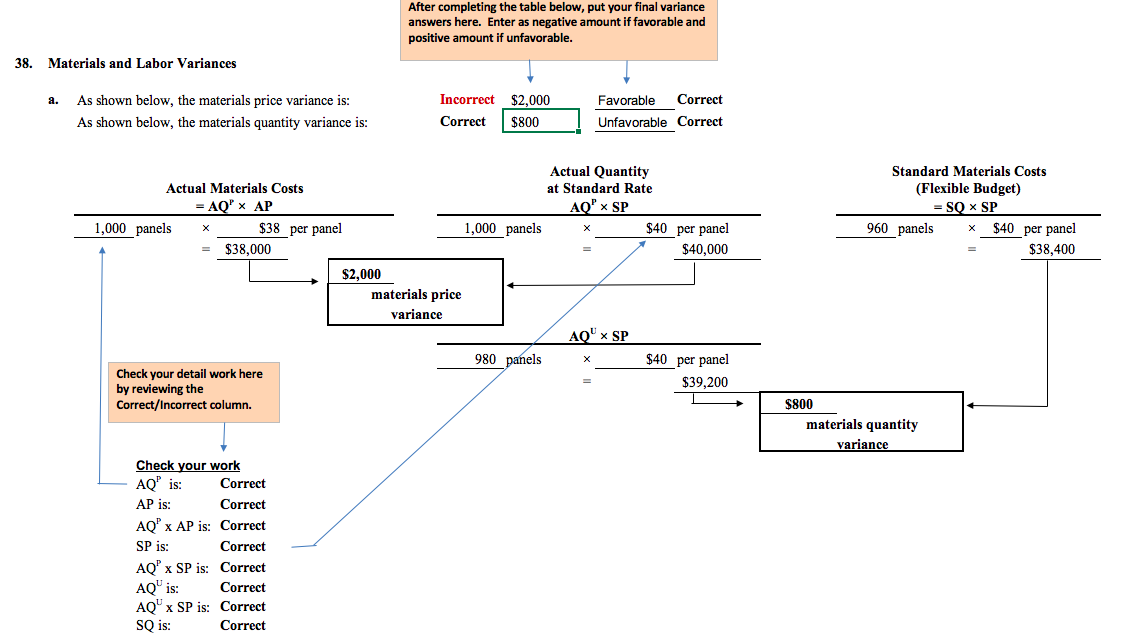

For direct materials, the standard price for a solar panel is $40. A standard quantity of 3 panels is expected to be used in each solar power system produced. During January, the company purchased 1,000 panels for $38,000 and used 980 panels to produce 320 solar power systems.

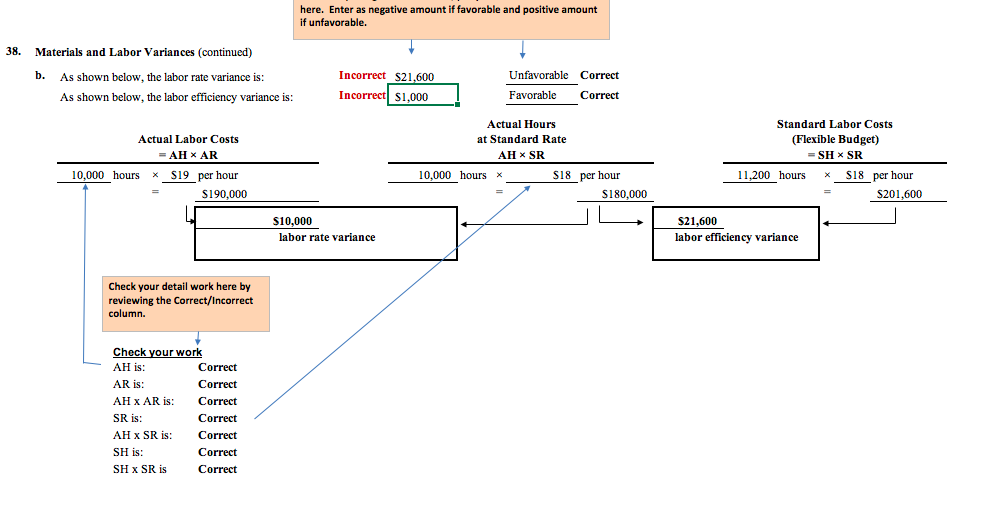

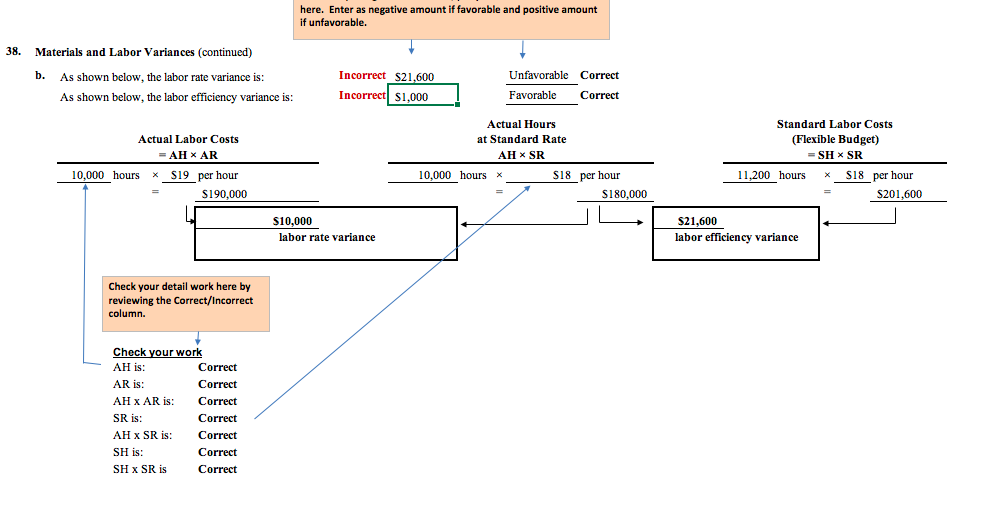

For direct labor, the company established a standard number of direct labor hours at 35 hours per solar power system. The standard rate is $18 per hour. A total of 10,000 direct labor hours were worked during January, at a cost of $190,000, to produce 320 solar power systems.

Required:

-

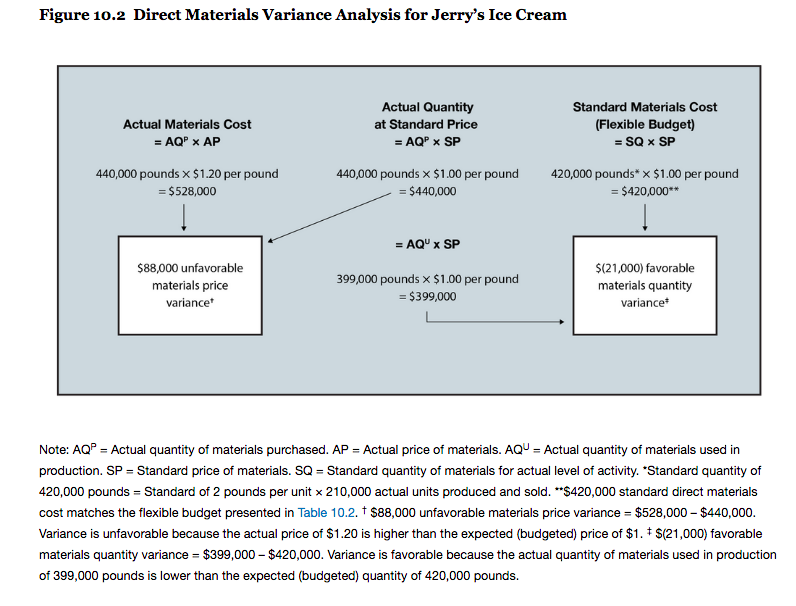

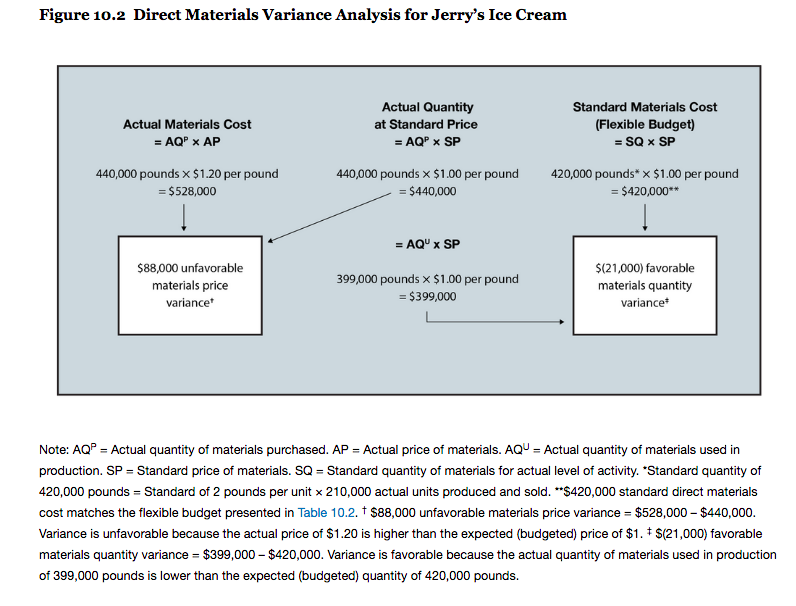

Calculate the materials price variance and materials quantity variance using the format shown in Figure 10.2. Clearly label each variance as favorable or unfavorable.

-

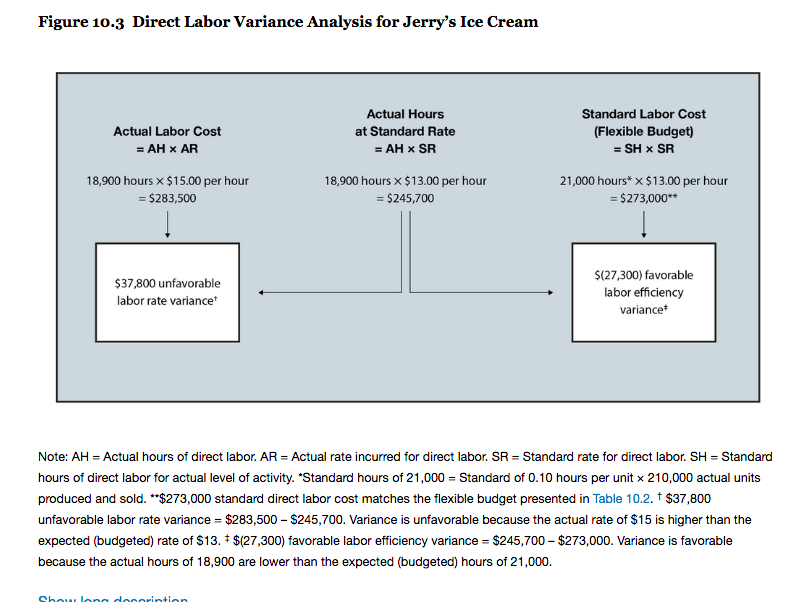

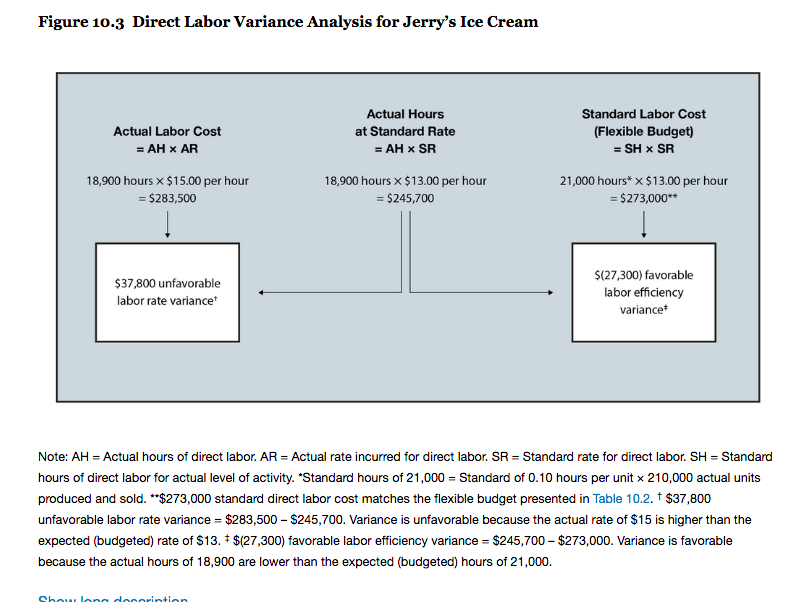

Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 10.3. Clearly label each variance as favorable or unfavorable.

Figure 10.2 Direct Materials Variance Analysis for Jerry's Ice Cream Actual Materials Cost = AQ AP Actual Quantity at Standard Price = AQP SP Standard Materials Cost (Flexible Budget) = SQ SP 440,000 pounds x $1.20 per pound = $528,000 440,000 pounds x $1.00 per pound = $440,000 420,000 pounds* x $1.00 per pound = $420,000** = AQUX SP $88,000 unfavorable materials price variancet 399,000 pounds x $1.00 per pound = $399,000 $(21,000) favorable materials quantity variance Note: AQP = Actual quantity of materials purchased. AP = Actual price of materials. AQU = Actual quantity of materials used in production. SP = Standard price of materials. SQ = Standard quantity of materials for actual level of activity. "Standard quantity of 420,000 pounds - Standard of 2 pounds per unit x 210,000 actual units produced and sold. **$420,000 standard direct materials cost matches the flexible budget presented in Table 10.2. + $88,000 unfavorable materials price variance = $528,000 - $440,000. Variance is unfavorable because the actual price of $1.20 is higher than the expected (budgeted) price of $1. $(21,000) favorable materials quantity variance = $399,000 - $420,000. Variance is favorable because the actual quantity of materials used in production of 399,000 pounds is lower than the expected (budgeted) quantity of 420,000 pounds. Figure 10.3 Direct Labor Variance Analysis for Jerry's Ice Cream Actual Labor Cost = AH X AR Actual Hours at Standard Rate = AH X SR Standard Labor Cost (Flexible Budget) = SH SR 18,900 hours x $15.00 per hour = $283,500 18,900 hours x $13.00 per hour = $245,700 21,000 hours* x $13.00 per hour = $273,000** $37,800 unfavorable labor rate variance $(27,300) favorable labor efficiency variance Note: AH = Actual hours of direct labor. AR = Actual rate incurred for direct labor. SR = Standard rate for direct labor. SH = Standard hours of direct labor for actual level of activity. "Standard hours of 21,000 = Standard of 0.10 hours per unit x 210,000 actual units produced and sold. **$273,000 standard direct labor cost matches the flexible budget presented in Table 10.2. $37,800 unfavorable labor rate variance = $283,500 - $245,700. Variance is unfavorable because the actual rate of $15 is higher than the expected (budgeted) rate of $13. $(27,300) favorable labor efficiency variance = $245,700 - $273,000. Variance is favorable because the actual hours of 18,900 are lower than the expected (budgeted) hours of 21,000. behandonorintion After completing the table below, put your final variance answers here. Enter as negative amount if favorable and positive amount if unfavorable. 38. Materials and Labor Variances As shown below, the materials price variance is: As shown below, the materials quantity variance is: Incorrect $2,000 Correct $800 Favorable Correct Unfavorable Correct Actual Materials Costs = AQ' X AP 1,000 panels $38 per panel $38,000 Actual Quantity at Standard Rate AQ'x SP 1,000 panels $40 per panel $40,000 Standard Materials Costs (Flexible Budget) = SO x SP 960 panels $40 per panel $38,400 X X $2,000 materials price variance AQ" x SP 980 panels X $40 per panel $39,200 Check your detail work here by reviewing the Correct/Incorrect column. $800 materials quantity variance AO is: Check your work Correct AP is: Correct AQ' X AP is: Correct SP is: Correct AQ' x SP is: Correct AQ' is: Correct AQ" x SP is: Correct SQ is: Correct here. Enter as negative amount if favorable and positive amount if unfavorable. 38. Materials and Labor Variances (continued) b. As shown below, the labor rate variance is: As shown below, the labor efficiency variance is: Incorrect $21,600 Incorrect $1,000 Unfavorable Correct Favorable Correct Actual Labor Costs = AHX AR 10,000 hours * $19 per hour S190,000 Actual Hours at Standard Rate AH X SR 10,000 hours x S18 per hour S180,000 Standard Labor Costs (Flexible Budget) =SH X SR 11,200 hours S18 per hour S201,600 $10,000 labor rate variance $21,600 labor efficiency variance Check your detail work here by reviewing the Correct/Incorrect column. Check your work AH is: Correct AR is: Correct AH X AR is: Correct SR is: Correct AH X SR is: Correct SH is: Correct SH X SR is Correct