Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Math 105 Quantitative and Reasoning Finance Ice 2 200 DAN - a. PpUse your annual gross salary is $69,000. Gross means before taxes and other

Math 105 Quantitative and Reasoning Finance Ice 2

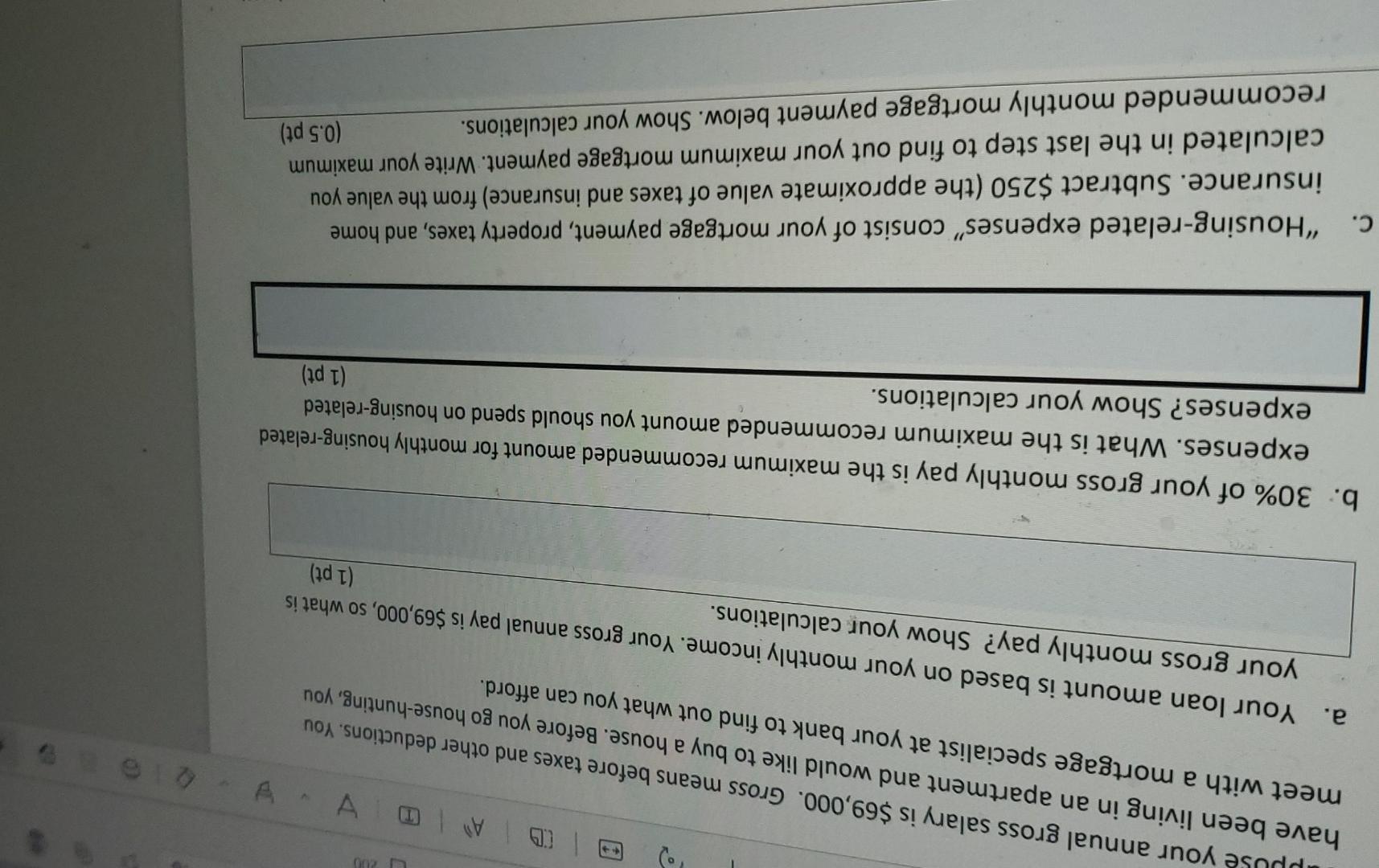

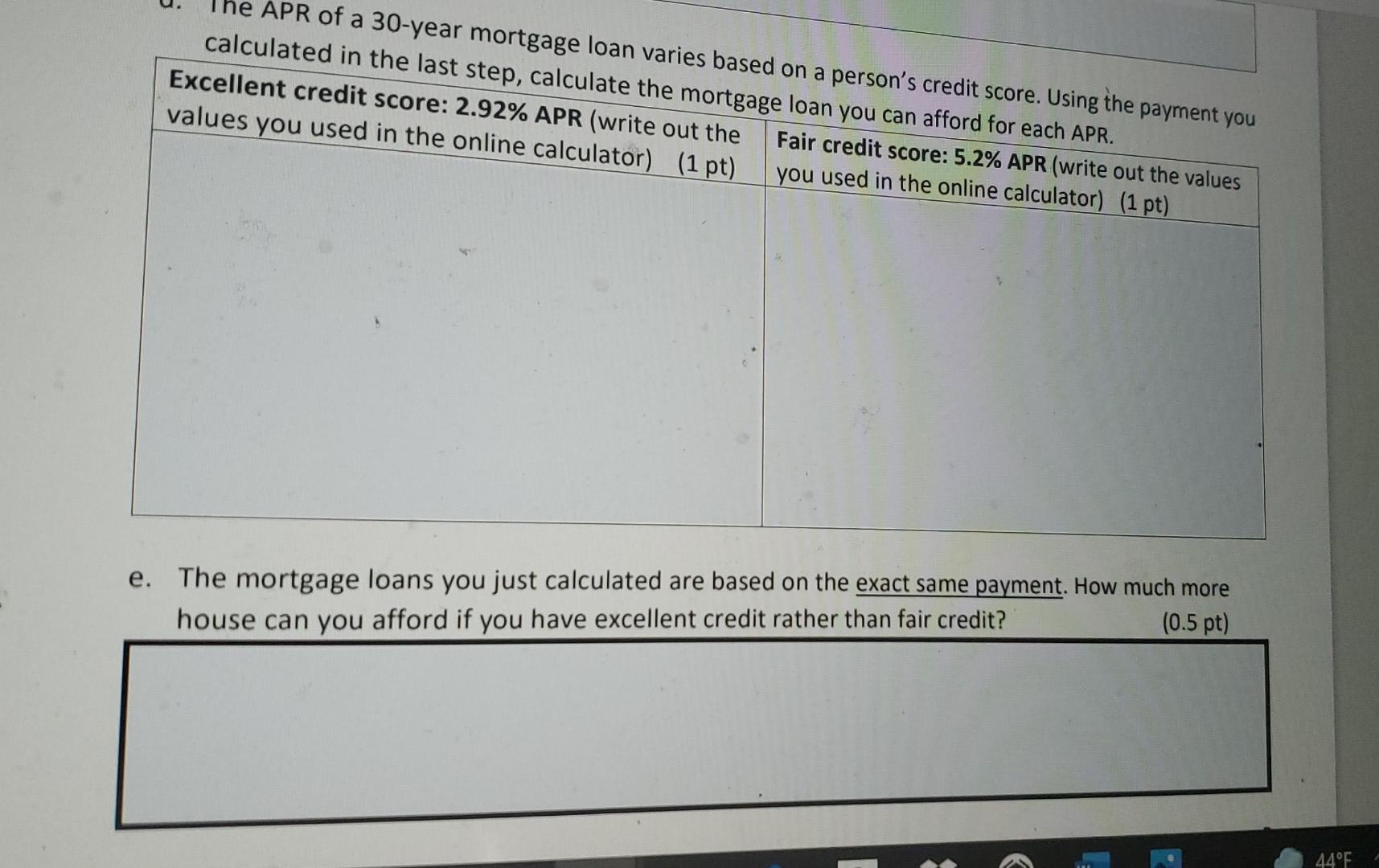

200 DAN - a. PpUse your annual gross salary is $69,000. Gross means before taxes and other deductions. You have been living in an apartment and would like to buy a house. Before you go house-hunting, you meet with a mortgage specialist at your bank to find out what you can afford. Your loan amount is based on your monthly income. Your gross annual pay is $69,000, so what is your gross monthly pay? Show your calculations. (1 pt) b. 30% of your gross monthly pay is the maximum recommended amount for monthly housing-related expenses. What is the maximum recommended amount you should spend on housing-related expenses? Show your calculations. (1 pt) c. "Housing-related expenses" consist of your mortgage payment, property taxes, and home insurance. Subtract $250 (the approximate value of taxes and insurance) from the value you calculated in the last step to find out your maximum mortgage payment. Write your maximum recommended monthly mortgage payment below. Show your calculations. (0.5 pt) The APR of a 30-year mortgage loan varies based on a person's credit score. Using the payment you calculated in the last step, calculate the mortgage loan you can afford for each APR. Excellent credit score: 2.92% APR (write out the Fair credit score: 5.2% APR (write out the values values you used in the online calculator) (1 pt) you used in the online calculator) (1 pt) e. The mortgage loans you just calculated are based on the exact same payment. How much more house can you afford if you have excellent credit rather than fair credit? (0.5 pt) 44F 200 DAN - a. PpUse your annual gross salary is $69,000. Gross means before taxes and other deductions. You have been living in an apartment and would like to buy a house. Before you go house-hunting, you meet with a mortgage specialist at your bank to find out what you can afford. Your loan amount is based on your monthly income. Your gross annual pay is $69,000, so what is your gross monthly pay? Show your calculations. (1 pt) b. 30% of your gross monthly pay is the maximum recommended amount for monthly housing-related expenses. What is the maximum recommended amount you should spend on housing-related expenses? Show your calculations. (1 pt) c. "Housing-related expenses" consist of your mortgage payment, property taxes, and home insurance. Subtract $250 (the approximate value of taxes and insurance) from the value you calculated in the last step to find out your maximum mortgage payment. Write your maximum recommended monthly mortgage payment below. Show your calculations. (0.5 pt) The APR of a 30-year mortgage loan varies based on a person's credit score. Using the payment you calculated in the last step, calculate the mortgage loan you can afford for each APR. Excellent credit score: 2.92% APR (write out the Fair credit score: 5.2% APR (write out the values values you used in the online calculator) (1 pt) you used in the online calculator) (1 pt) e. The mortgage loans you just calculated are based on the exact same payment. How much more house can you afford if you have excellent credit rather than fair credit? (0.5 pt) 44FStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started