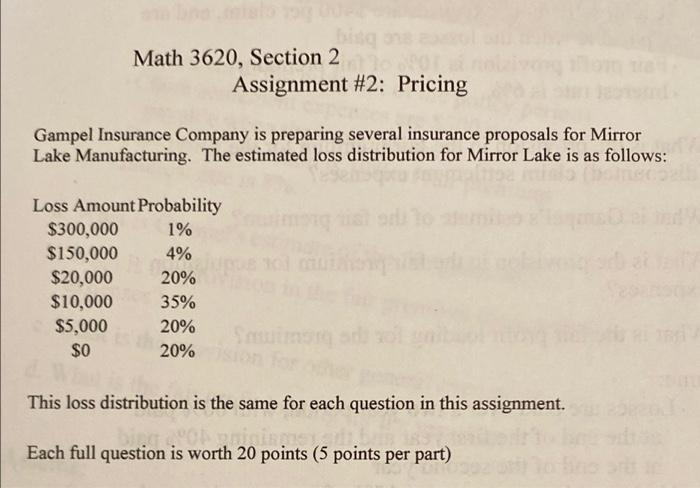

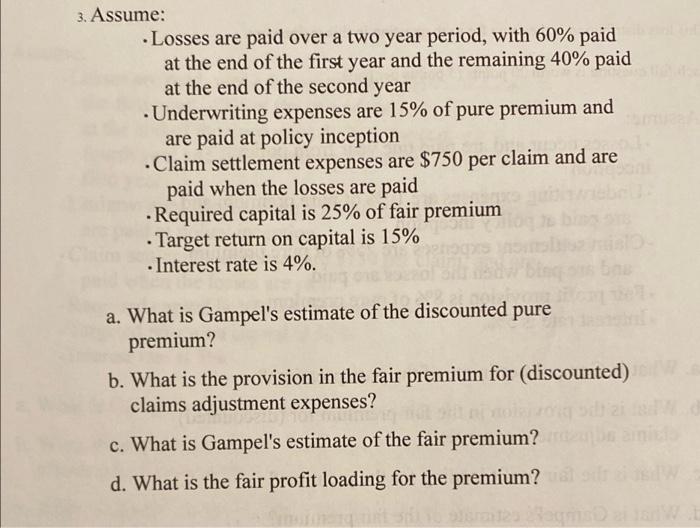

Math 3620, Section 2 Assignment #2: Pricing Gampel Insurance Company is preparing several insurance proposals for Mirror Lake Manufacturing. The estimated loss distribution for Mirror Lake is as follows: Loss Amount Probability $300,000 1% $150,000 4% $20,000 20% $10,000 35% $5,000 20% $0 20% This loss distribution is the same for each question in this assignment. . Each full question is worth 20 points (5 points per part) 3. Assume: Losses are paid over a two year period, with 60% paid at the end of the first year and the remaining 40% paid at the end of the second year - Underwriting expenses are 15% of pure premium and are paid at policy inception Claim settlement expenses are $750 per claim and are paid when the losses are paid Required capital is 25% of fair premium . Target return on capital is 15% . Interest rate is 4%. a. What is Gampel's estimate of the discounted pure premium? b. What is the provision in the fair premium for (discounted) claims adjustment expenses? c. What is Gampel's estimate of the fair premium? d. What is the fair profit loading for the premium? Math 3620, Section 2 Assignment #2: Pricing Gampel Insurance Company is preparing several insurance proposals for Mirror Lake Manufacturing. The estimated loss distribution for Mirror Lake is as follows: Loss Amount Probability $300,000 1% $150,000 4% $20,000 20% $10,000 35% $5,000 20% $0 20% This loss distribution is the same for each question in this assignment. . Each full question is worth 20 points (5 points per part) 3. Assume: Losses are paid over a two year period, with 60% paid at the end of the first year and the remaining 40% paid at the end of the second year - Underwriting expenses are 15% of pure premium and are paid at policy inception Claim settlement expenses are $750 per claim and are paid when the losses are paid Required capital is 25% of fair premium . Target return on capital is 15% . Interest rate is 4%. a. What is Gampel's estimate of the discounted pure premium? b. What is the provision in the fair premium for (discounted) claims adjustment expenses? c. What is Gampel's estimate of the fair premium? d. What is the fair profit loading for the premium