Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mathematics of Business Management 2 Question 1 the debt is amortized by the periodic payment information below. compute the number of payments required to amortize

Mathematics of Business Management 2

Question 1

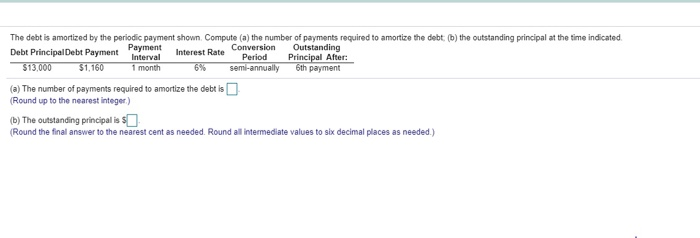

The debt is amortized by the periodic payment shown Compute (a) the number of payments required to amortize the debt. (b) the outstanding principal at the time indicated Payment or Date Co ebt Principal Debt Payment Outstanding Interval Interest Rate Conversion interest Rate Period Principal After: $13,000 $1,160 1 month 6% semi-annually 6th payment (a) The number of payments required to amortize the debt is (Round up to the nearest Integer) (b) The outstanding principal is S . (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) A $180.000 mortgage amortized by monthly payments over 20 years is renewable after five years (a) If interest is 5.77% compounded quarterly, what is the size of each monthly payment? (b) Find the total interest paid during the first year (c) Compute the interest included in the 30th payment (cthe mortgage is renewed after five years at 4 35% compounded quarterly, what is the size of the monthly payment for the renewal period? (e) Construct a partial amortization schedule showing details of the first three payments for each of the two terms Continue sting out the partial amortization schedule. (Round to the nearest cent as needed) Pay Number Amount Paid $ Principal Repaid Outstanding Principal Balance The debt is amortized by the periodic payment shown Compute (a) the number of payments required to amortize the debt. (b) the outstanding principal at the time indicated Payment or Date Co ebt Principal Debt Payment Outstanding Interval Interest Rate Conversion interest Rate Period Principal After: $13,000 $1,160 1 month 6% semi-annually 6th payment (a) The number of payments required to amortize the debt is (Round up to the nearest Integer) (b) The outstanding principal is S . (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) A $180.000 mortgage amortized by monthly payments over 20 years is renewable after five years (a) If interest is 5.77% compounded quarterly, what is the size of each monthly payment? (b) Find the total interest paid during the first year (c) Compute the interest included in the 30th payment (cthe mortgage is renewed after five years at 4 35% compounded quarterly, what is the size of the monthly payment for the renewal period? (e) Construct a partial amortization schedule showing details of the first three payments for each of the two terms Continue sting out the partial amortization schedule. (Round to the nearest cent as needed) Pay Number Amount Paid $ Principal Repaid Outstanding Principal Balance the debt is amortized by the periodic payment information below. compute the number of payments required to amortize the debt and the the outstanding principal after the 6th payment

Debt Principal - $13000

Debt Payment - $1160

Payment Interval - 1 month

Interest Rate - 6% semi annually

Outstanding principal after - 6th payment

Question 2

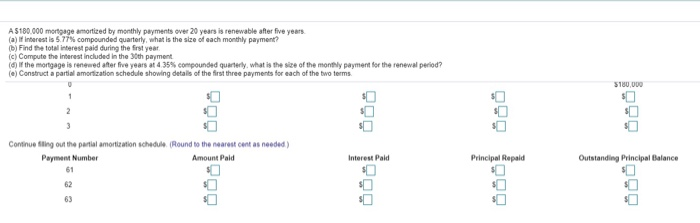

A $180,000 mortgage amortized by monthly payments over 20 years is renewable after 5 years

a) if the interest is 5.77% compounded quaterly, what is the size of each monthly payment

b) find the total interest paid diring the first year

c) compute the interest included in the 30th payment

d) if the mortgage is renewed after 5 years at 4.35% compounded quaterly, what is the size of the monthly payment for the renewal period?

e) Construct a partial amortization schedule showing the first 3 payments for each of the teo terms (ie 0-3....61-63)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started