Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MATHEMATICS OF FINANCE Task (100 points) The Andreotti family-comprising Mr. Andreotti, aged 40, Mrs. Andreotti, aged 38, and their three young children-relocated to Barcelona in

MATHEMATICS OF FINANCE

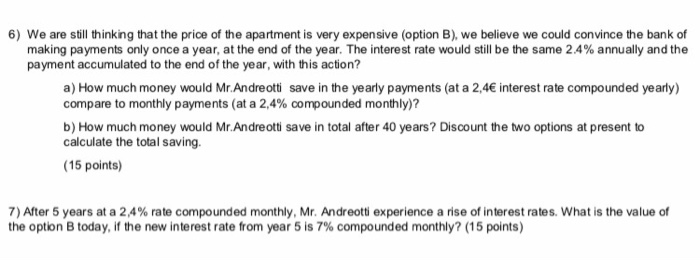

Task (100 points) The Andreotti family-comprising Mr. Andreotti, aged 40, Mrs. Andreotti, aged 38, and their three young children-relocated to Barcelona in 2020 when Mr. Andreotti received a job offer from a leading investment banking giant. For the next six years, they rented a three-bedroom condominium for 2.000 in Barcelona per month, which included parking and condominium fees. While renting made life easy, the Andreotti family began weighing the pros and cons of purchasing a flat, in the same building, that became available in June 2020. In the past three years, the real estate market had softened somewhat, and the cost of the flats were stable. The idea of home ownership as a form of pension investment appealed to the couple. The monthly rents could be used for mortgage payments instead. While searching for the right property they found a nice apartment with 200 square meters, very close to Diagonal-Numancia, one of the best locations of the city. The apartment was owned and been promoted by a state-owned construction company and was offering to type of alternatives: 6) We are still thinking that the price of the apartment is very expensive (option B), we believe we could convince the bank of making payments only once a year, at the end of the year. The interest rate would still be the same 2.4% annually and the payment accumulated to the end of the year, with this action? a) How much money would Mr. Andreotti save in the yearly payments (at a 2,4 interest rate compounded yearly) compare to monthly payments (at a 2,4% compounded monthly)? b) How much money would Mr.Andreotti save in total after 40 years? Discount the two options at present to calculate the total saving. (15 points) 7) After 5 years at a 2,4% rate compounded monthly, Mr. Andreotti experience a rise of interest rates. What is the value of the option B today, if the new interest rate from year 5 is 7% compounded monthly? (15 points) Task (100 points) The Andreotti family-comprising Mr. Andreotti, aged 40, Mrs. Andreotti, aged 38, and their three young children-relocated to Barcelona in 2020 when Mr. Andreotti received a job offer from a leading investment banking giant. For the next six years, they rented a three-bedroom condominium for 2.000 in Barcelona per month, which included parking and condominium fees. While renting made life easy, the Andreotti family began weighing the pros and cons of purchasing a flat, in the same building, that became available in June 2020. In the past three years, the real estate market had softened somewhat, and the cost of the flats were stable. The idea of home ownership as a form of pension investment appealed to the couple. The monthly rents could be used for mortgage payments instead. While searching for the right property they found a nice apartment with 200 square meters, very close to Diagonal-Numancia, one of the best locations of the city. The apartment was owned and been promoted by a state-owned construction company and was offering to type of alternatives: 6) We are still thinking that the price of the apartment is very expensive (option B), we believe we could convince the bank of making payments only once a year, at the end of the year. The interest rate would still be the same 2.4% annually and the payment accumulated to the end of the year, with this action? a) How much money would Mr. Andreotti save in the yearly payments (at a 2,4 interest rate compounded yearly) compare to monthly payments (at a 2,4% compounded monthly)? b) How much money would Mr.Andreotti save in total after 40 years? Discount the two options at present to calculate the total saving. (15 points) 7) After 5 years at a 2,4% rate compounded monthly, Mr. Andreotti experience a rise of interest rates. What is the value of the option B today, if the new interest rate from year 5 is 7% compounded monthly? (15 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started