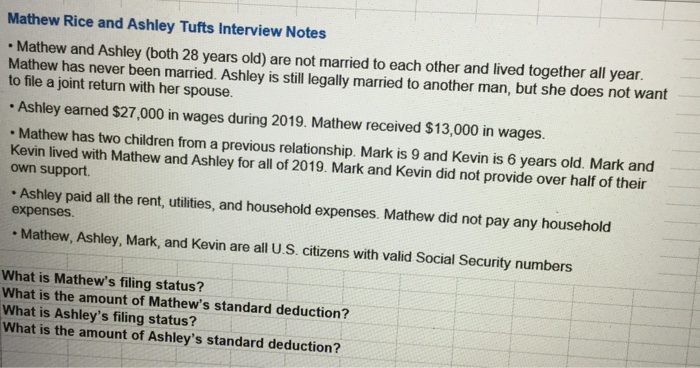

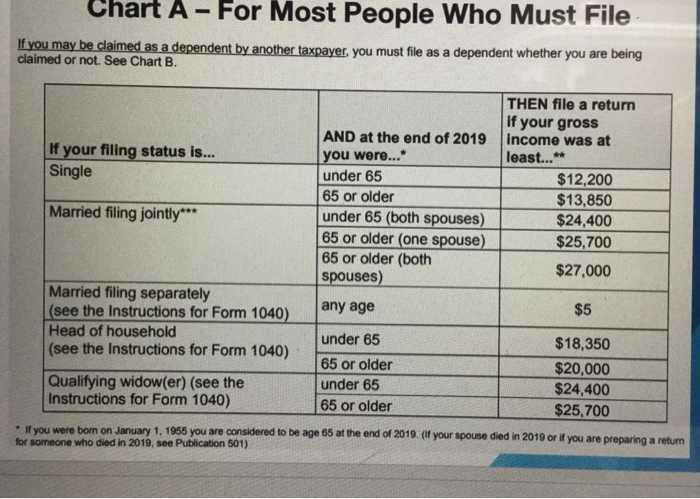

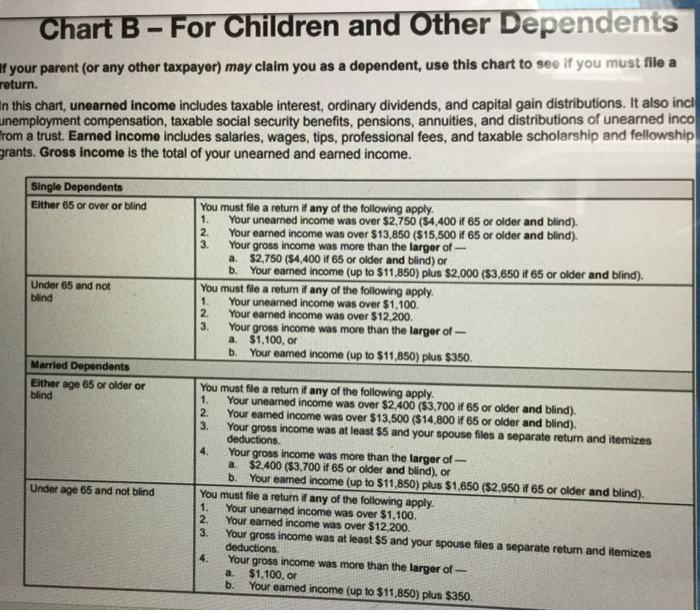

Mathew Rice and Ashley Tufts Interview Notes Mathew and Ashley (both 28 years old) are not married to each other and lived together all year. Mathew has never been married. Ashley is still legally married to another man, but she does not want to file a joint return with her spouse. Ashley earned $27,000 in wages during 2019. Mathew received $13,000 in wages. Mathew has two children from a previous relationship. Mark is 9 and Kevin is 6 years old. Mark and Kevin lived with Mathew and Ashley for all of 2019. Mark and Kevin did not provide over half of their own support Ashley paid all the rent, utilities, and household expenses. Mathew did not pay any household expenses. Mathew, Ashley, Mark, and Kevin are all U.S. citizens with valid Social Security numbers . What is Mathew's filing status? What is the amount of Mathew's standard deduction? What is Ashley's filing status? What is the amount of Ashley's standard deduction? Chart A - For Most People Who Must File If you may be claimed as a dependent by another taxpayer, you must file as a dependent whether you are being claimed or not. See Chart B. If your filing status is... Single THEN file a return if your gross income was at least..." $12,200 $13,850 $24,400 $25,700 $27,000 AND at the end of 2019 you were..." under 65 65 or older under 65 (both spouses) 65 or older (one spouse) 65 or older (both spouses) Married filing jointly*** any age $5 Married filing separately (see the Instructions for Form 1040) Head of household (see the Instructions for Form 1040) Qualifying widow(er) (see the Instructions for Form 1040) under 65 65 or older under 65 65 or older $18,350 $20,000 $24,400 $25,700 * If you were born on January 1, 1955 you are considered to be age 65 at the end of 2019. (If your spou for someone who died in 2019, see Publication 501) died in 2019 or if you are preparing a return Chart B - For Children and Other Dependents If your parent (or any other taxpayer) may claim you as a dependent, use this chart to see if you must file a return In this chart, unearned income includes taxable interest, ordinary dividends, and capital gain distributions. It also incl unemployment compensation, taxable social security benefits, pensions, annuities, and distributions of unearned inco from a trust. Earned income includes salaries, wages, tips, professional fees, and taxable scholarship and fellowship grants. Gross income is the total of your unearned and earned income. Single Dependents Either 65 or over or blind Under 65 and not blind You must file a return if any of the following apply. 1. Your unearned income was over $2,750 (54,400 if 65 or older and blind). 2. Your earned income was over $13,850 ($15,500 if 65 or older and blind). 3. Your gross income was more than the larger of - a $2,750 (54,400 if 65 or older and blind) or b. Your earned income (up to $11,850) plus $2,000 ($3,650 if 65 or older and blind). You must file a return if any of the following apply. 1 Your uneared income was over $1,100. 2. Your earned income was over $12,200 3. Your gross income was more than the larger of a $1,100, or b. Your eared income (up to $11,850) plus $350. Married Dependents Either age 65 or older or blind Under age 65 and not blind You must file a return if any of the following apply. 1. Your uneared income was over $2,400 ($3,700 if 65 or older and blind). 2. Your earned income was over $13.500 ($14,800 if 65 or older and blind). 3. Your gross income was at least $5 and your spouse files a separate return and itemizes deductions. 4. Your gross income was more than the larger of - a. $2,400 ($3.700 if 65 or older and blind), or b. Your eared income (up to $11,850) plus $1.650 ($2.950 if 65 or older and blind). You must file a return if any of the following apply. 1. Your unearned income was over $1,100 2. Your earned income was over $12.200. 3. Your gross income was at least $5 and your spouse files a separate return and itemizes deductions 4. Your gross income was more than the larger of a. $1.100, or b. Your eamed income (up to $11,850) plus $350