Question

Matilda, 24 years old. No children. One-year work experience following graduation and employed in the occupation she is qualified for. Savings $2,500. No other financial

Matilda, 24 years old. No children. One-year work experience following graduation and employed in the occupation she is qualified for. Savings $2,500. No other financial assets, debts. Within the next 10-years Matilda expects to have children with her current partner and expects to buy an apartment."

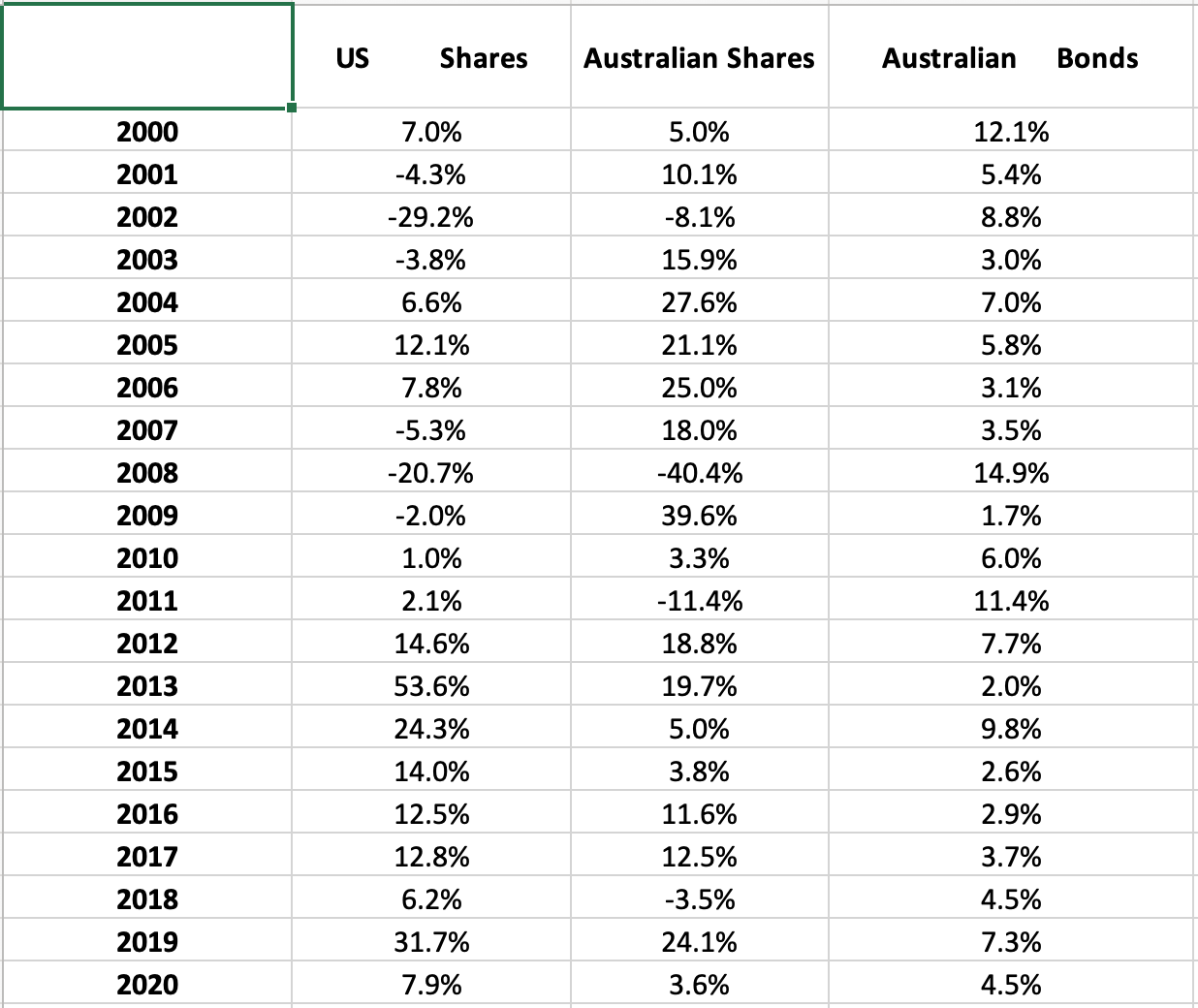

Matilda is looking to make some investments. She is wanting to invest in U.S. companies because she has heard a lot about Amazon, Apple, Microsoft, etc. The data above show the percentage return an investor would have received if they invested in a large portfolio of different U.S. companies. The following questions are based on the data.

Another important factor when making choices about risk is your capacity to deal with risk should the risky (bad) outcome eventuate. In question 5 you used the average return but of course Matilda may not earn those returns. She may in fact lose money. Given the information above about Matilda (in the box on the previous page) explain what factors would suggest she has capacity to tolerate more or less risk?

US Shares Australian Shares Australian Bonds 2000 7.0% 5.0% 12.1% 2001 -4.3% 10.1% 5.4% 2002 -29.2% -8.1% 8.8% 2003 -3.8% 15.9% 3.0% 2004 6.6% 27.6% 7.0% 2005 12.1% 21.1% 5.8% 2006 7.8% 25.0% 3.1% 2007 -5.3% 18.0% 3.5% 2008 -20.7% -40.4% 14.9% 2009 -2.0% 39.6% 1.7% 2010 1.0% 3.3% 6.0% 2011 2.1% -11.4% 11.4% 2012 14.6% 18.8% 7.7% 2013 53.6% 19.7% 2.0% 2014 24.3% 5.0% 9.8% 2015 14.0% 3.8% 2.6% 2016 12.5% 11.6% 2.9% 2017 12.8% 12.5% 3.7% 2018 6.2% -3.5% 4.5% 2019 31.7% 24.1% 7.3% 2020 7.9% 3.6% 4.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started