Answered step by step

Verified Expert Solution

Question

1 Approved Answer

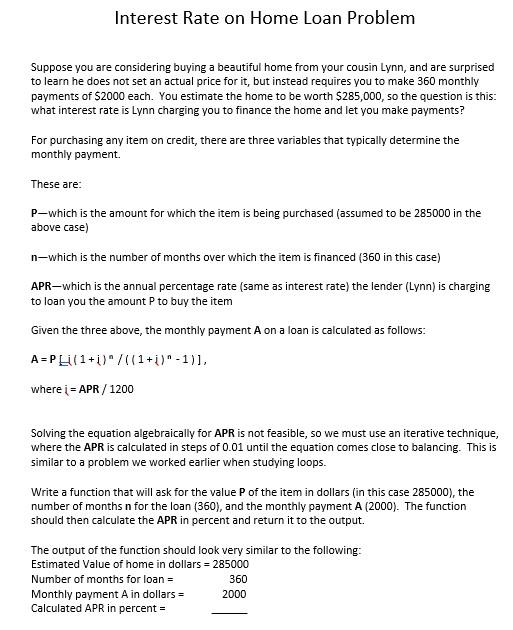

MATLAB using loops. Interest Rate on Home Loan Problem Suppose you are considering buying a beautiful home from your cousin Lynn, and are surprised to

MATLAB using loops.

Interest Rate on Home Loan Problem Suppose you are considering buying a beautiful home from your cousin Lynn, and are surprised to learn he does not set an actual price for it, but instead requires you to make 360 monthly payments of $2000 each. You estimate the home to be worth $285,000, so the question is this: what interest rate is Lynn charging you to finance the home and let you make payments? For purchasing any item on credit, there are three variables that typically determine the monthly payment These are: P-which is the amount for which the item is being purchased (assumed to be 285000 in the above case) nwhich is the number of months over which the item is financed (360 in this case) APR-which is the annual percentage rate (same as interest rate) the lender (Lynn) is charging to loan you the amount P to buy the item Given the three above, the monthly payment A on a loan is calculated as follows: A=PL(1+i) "/((1+i)"-1)], where i = APR / 1200 Solving the equation algebraically for APR is not feasible, so we must use an iterative technique, where the APR is calculated in steps of 0.01 until the equation comes close to balancing. This is similar to a problem we worked earlier when studying loops. Write a function that will ask for the value of the item in dollars (in this case 285000), the number of months n for the loan (360), and the monthly payment A (2000). The function should then calculate the APR in percent and return it to the output. The output of the function should look very similar to the following: Estimated Value of home in dollars = 285000 Number of months for loan = 360 Monthly payment A in dollars = 2000 Calculated APR in percent = Interest Rate on Home Loan Problem Suppose you are considering buying a beautiful home from your cousin Lynn, and are surprised to learn he does not set an actual price for it, but instead requires you to make 360 monthly payments of $2000 each. You estimate the home to be worth $285,000, so the question is this: what interest rate is Lynn charging you to finance the home and let you make payments? For purchasing any item on credit, there are three variables that typically determine the monthly payment These are: P-which is the amount for which the item is being purchased (assumed to be 285000 in the above case) nwhich is the number of months over which the item is financed (360 in this case) APR-which is the annual percentage rate (same as interest rate) the lender (Lynn) is charging to loan you the amount P to buy the item Given the three above, the monthly payment A on a loan is calculated as follows: A=PL(1+i) "/((1+i)"-1)], where i = APR / 1200 Solving the equation algebraically for APR is not feasible, so we must use an iterative technique, where the APR is calculated in steps of 0.01 until the equation comes close to balancing. This is similar to a problem we worked earlier when studying loops. Write a function that will ask for the value of the item in dollars (in this case 285000), the number of months n for the loan (360), and the monthly payment A (2000). The function should then calculate the APR in percent and return it to the output. The output of the function should look very similar to the following: Estimated Value of home in dollars = 285000 Number of months for loan = 360 Monthly payment A in dollars = 2000 Calculated APR in percent =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started