Answered step by step

Verified Expert Solution

Question

1 Approved Answer

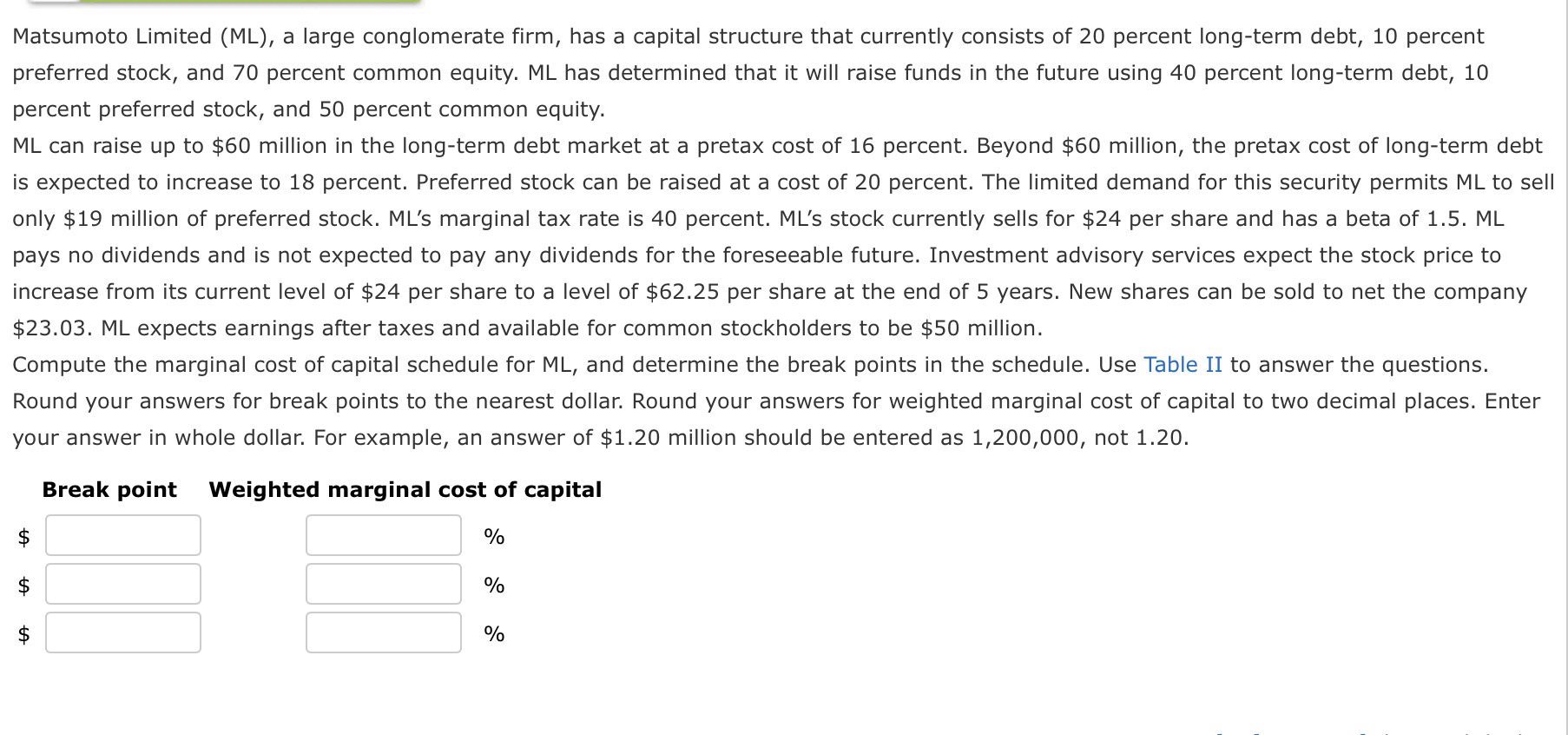

Matsumoto Limited ( ML ) , a large conglomerate firm, has a capital structure that currently consists of 2 0 percent long - term debt,

Matsumoto Limited ML a large conglomerate firm, has a capital structure that currently consists of percent longterm debt, percent preferred stock, and percent common equity. ML has determined that it will raise funds in the future using percent longterm debt, percent preferred stock, and percent common equity.

ML can raise up to $ million in the longterm debt market at a pretax cost of percent. Beyond $ million, the pretax cost of longterm debt is expected to increase to percent. Preferred stock can be raised at a cost of percent. The limited demand for this security permits ML to sell only $ million of preferred stock. MLs marginal tax rate is percent. MLs stock currently sells for $ per share and has a beta of ML pays no dividends and is not expected to pay any dividends for the foreseeable future. Investment advisory services expect the stock price to $ ML expects earnings after taxes and available for common stockholders to be $ million.

Compute the marginal cost of capital schedule for ML and determine the break points in the schedule. Use Table II to answer the questions.

Round your answers for break points to the nearest dollar. Round your answers for weighted marginal cost of capital to two decimal places. Enter your answer in whole dollar. For example, an answer of $ million should be entered as not

Break point Weighted marginal cost of capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started