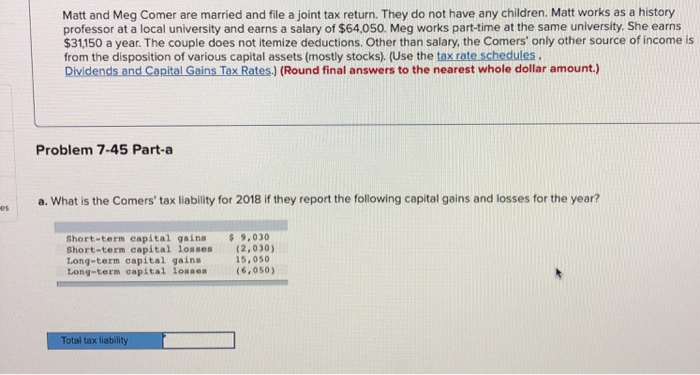

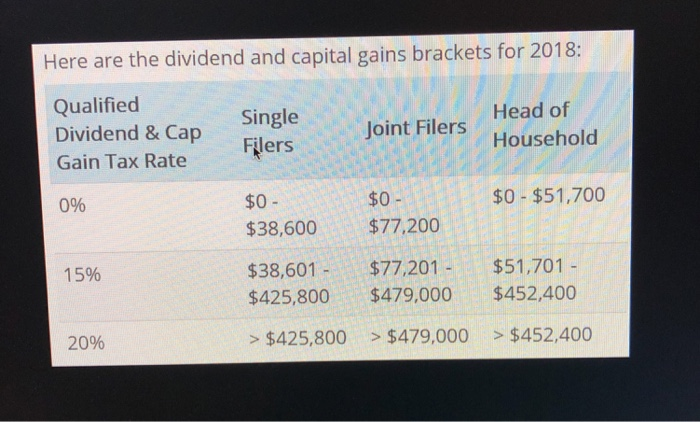

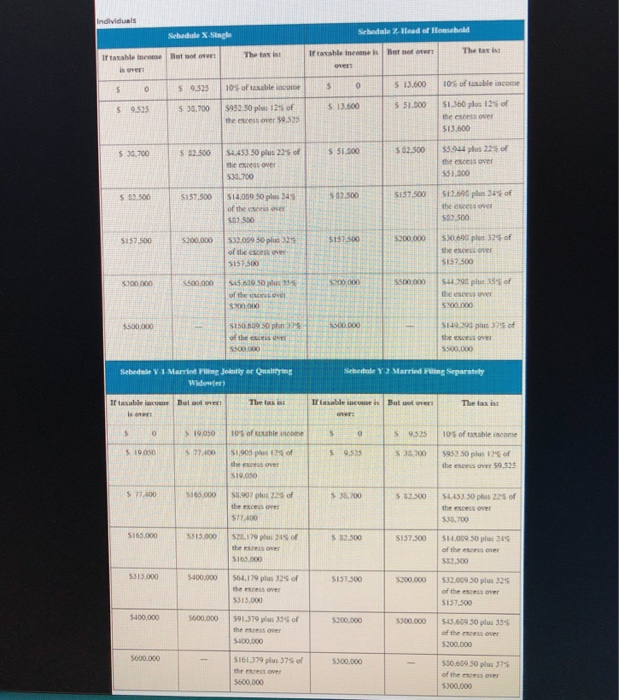

Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $64.050. Meg works part-time at the same university. She earns $31150 a year. The couple does not itemize deductions. Other than salary, the Comers only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules. Dividends and Capital Gains Tax Rates.) (Round final answers to the nearest whole dollar amount.) Problem 7-45 Part-a a. What is the Comers' tax liability for 2018 if they report the following capital gains and losses for the year? Short-term capital gains $9,030 Short-term capital losses (2,030) Long-term capital gains Long-term capital lossen (6,050) 15,050 Total tax liability Here are the dividend and capital gains brackets for 2018: Qualified Dividend & Cap Gain Tax Rate ers 0% Head of Household Single Joint Filers $0- $38,600 $77,200 $38,601-$77,201 $425,800 $479,000 $452,400 > $425,800 >$479,000 $452,400 $0- $0 $51,700 15% $51,701 20% s Schedule % Siagne The tar isd The tax ist If taxable income is Bat nt over If taxable inconse But not oven vert is over 13.600 10% of taxable iacome 0.525 $ s 30.700 110% of usable income .23.005 | $1J60plus 12% of s 51,000 | sa52 50 plui 12%of te excess over 59.525 s 13,600 the excnss Over $13,600 $3.a44 Plus 22% of the excess Ovr $51.300 $ $2.500 s 32.500 4453 50 plus 22% of S 51.300 the escess over 533 700 $S2.500 | S157,500 |s14.009 50 plus 24% 62 500 $157.500 | si 2.640 plas 24 of the escess ove 82.500 of the euces ve sis7,500 s200000 1532,009 50plus 32 $157 500 200,000 | SXeOG plus 32% of ofthe esce over $157.500 the esceis over 157,500 S4479S Plut 35% ef the esoeus ver 5200.000 200,000 5500000 of the evors ov S200.010 swoon plus J7% of the escess over $00,000 s500.000 of the escess uve Sehedale Y 1 Marrled Pling Jointly er Qeality Sehedale Y 2 Married Filing Separately The tax isi If lasable incouse is But wot over Thhe tax isi S 9.gz50 10% of taxable income $ 9325 | 10% of ta table income s 19050 $36,200 Isas? so plus 12%of the esceus oves the escess over $9 525 32.300 $4,453 30 plus 22% of excess ove the excess over 38,700 $77.400 $165,000 53,3,000 |$2179plus 24% of 82.500 157500 $14,009 50 plas 245 the excess over of the excess over $32.300 313000 5400.000 | SOLI 79 plus 32% of $157.500 5200,00 |$32.00950 plus 32% the excess over of the excess oe $157,500 315,000 400,000 5000.000 | S91.379 plus 33% of 5200.000 5300000 | S4560930 plu 35% the rxress over 5400,000 of the excess over 200,000 000.000 $161,379 plub 37% of the excess over SS0609 SO Pluu 37% of the encess over 5300.000