Answered step by step

Verified Expert Solution

Question

1 Approved Answer

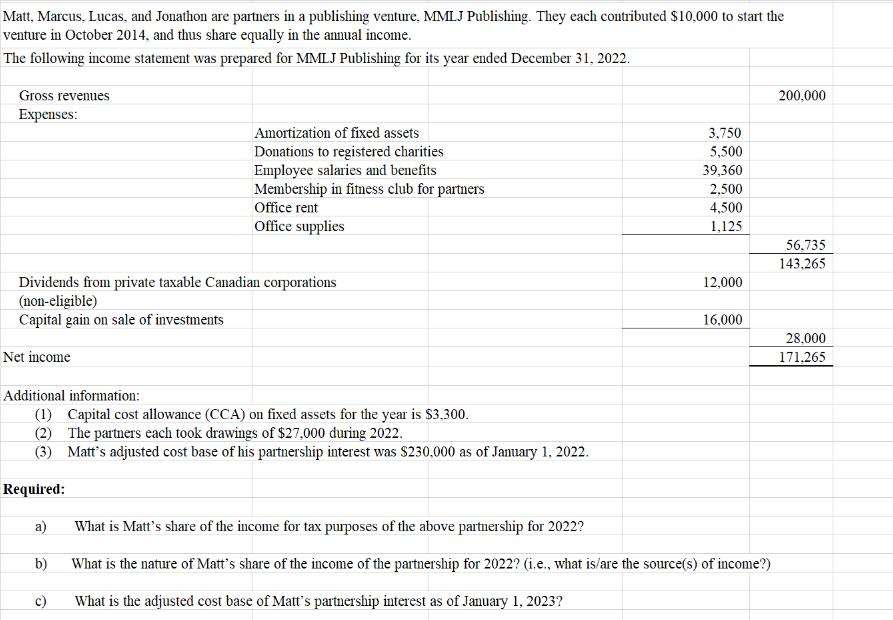

Matt, Marcus, Lucas, and Jonathon are partners in a publishing venture, MMLJ Publishing. They each contributed $10,000 to start the venture in October 2014,

Matt, Marcus, Lucas, and Jonathon are partners in a publishing venture, MMLJ Publishing. They each contributed $10,000 to start the venture in October 2014, and thus share equally in the annual income. The following income statement was prepared for MMLJ Publishing for its year ended December 31, 2022. Gross revenues Expenses: Amortization of fixed assets Donations to registered charities Employee salaries and benefits Membership in fitness club for partners Dividends from private taxable Canadian corporations (non-eligible) Capital gain on sale of investments Net income a) Office rent Office supplies Additional information: (1) Capital cost allowance (CCA) on fixed assets for the year is $3.300. (2) The partners each took drawings of $27,000 during 2022. (3) Matt's adjusted cost base of his partnership interest was $230,000 as of January 1, 2022. Required: b) c) 3,750 5,500 39,360 2,500 4,500 1,125 12,000 16,000 What is Matt's share of the income for tax purposes of the above partnership for 2022? What is the nature of Matt's share of the income of the partnership for 2022? (i.e., what is/are the source(s) of income?) What is the adjusted cost base of Matt's partnership interest as of January 1, 2023? 200,000 56,735 143,265 28,000 171.265

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each part of the question a Matts Share of Income for Tax Purposes in 2022 Since all pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started