Question

Matt Smith is currently 28 years old and married to wife, Melanie who is also 28. They have a six-month old son and two-year old

Matt Smith is currently 28 years old and married to wife, Melanie who is also 28. They have a six-month old son and two-year old daughter and plan to have more. They live in Huntington Beach, CA in a 2-bedroom house that they rent for $2000 per month. Their home is nicely furnished with furnishings they financed from Pottery Barn, worth about $5000.

The landlord had supplied new appliances and a backyard with a BBQ. They are saving to buy a home in the next few years and anticipate needing about $35,000 as a down payment. Matt & Melanie know buying a home will bring many expenses such as new appliances (maybe down the road), and moving expenses. Once they get their own home they would love to have a backyard playground type structure for the kids (costing $1200) and possibly even a pool. They have two cars, one is a 2011 Toyota truck that is paid off and probably worth $10,000.

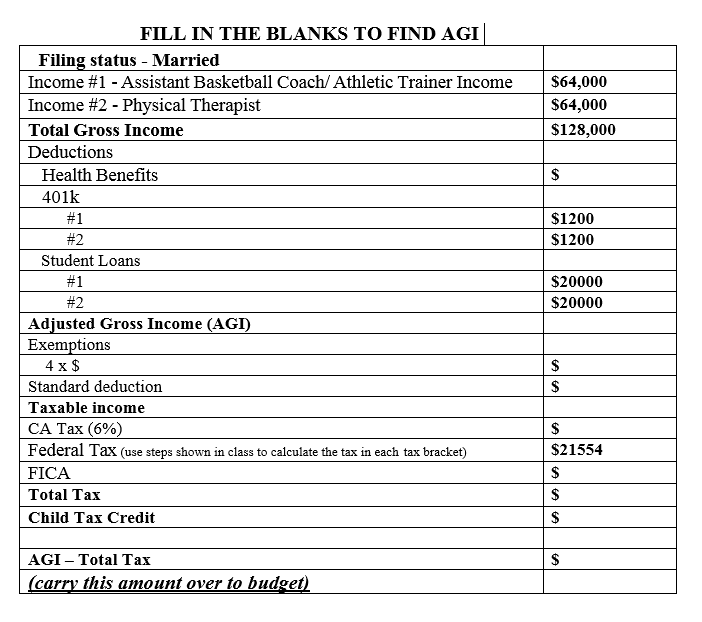

Melanie drives an Acura, probably worth $12,000 that they make $300 per month payment on for one more year. Matt is the Assistant Basketball Coach and Athletic Trainer at Golden West College and Melanie is a Physical Therapist. They have good health insurance through their jobs and only pay $250 per month pre-tax to cover both the dependent children for medical and dental. They have minimal life insurance so they bought an additional 20-year term life plan that only costs $20 per month. Their combined income is close to $128,000.00 a year. (they make close to the same amount). They both still owe about $20,000 each in student loans and each are paying $300 per month (pre-tax - government aid student loans) and once those are paid off they will be in a better situation to really start saving for retirement.

The utilities run them about $250 per month (gas, power and water is $100, and phone and cable is $150). Currently Matt & Melanie only put $100 month each into their company pension plans. Their pension plan balances are roughly at $4,000 each because they just got started with them about two years ago. They would like to have a comfortable retirement and realize they need to save more when their student loans are paid off. Their credit union savings has a current balance of $5500 (which is still not an adequate emergency fund) so they try to save an additional $300 per month.

They live pretty comfortably and are not really materialistic people. They enjoy the outdoors, beach, camping, hiking, skiing and dont really take extravagant vacations. They hope to take their children on a Disney Cruise in the next few years and are saving for that. They pay monthly for their Disney passes and enjoy taking the kids there when they can. They own a two-seater kayak and 2 paddle boards and use them locally most of the time. They estimate their personal belongings to be worth about $8000. They enjoy sporting events and do save up to go to a professional game per month.

Melanies mom watches the kids, so they save quite a bit on child care, although we do pay her about $400.00 a month just for things she needs while taking care of them. They also budget an additional $100 for other babysitting needed for date nights! College planning is already a long-term goal of theirs so they do put $100 per month away and have a balance of about $1200 in the account. They have one major credit card, with a balance of $500, and try to keep it paid off each month and only use for vacations and emergencies. They are trying to learn how to not have debt and to save for what they need. They do not have any pets at the moment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started