Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Matthew D. and Melody R. Smith are married and have 3 children. Amy is 5 years old. Amos is 18 and studies at UT

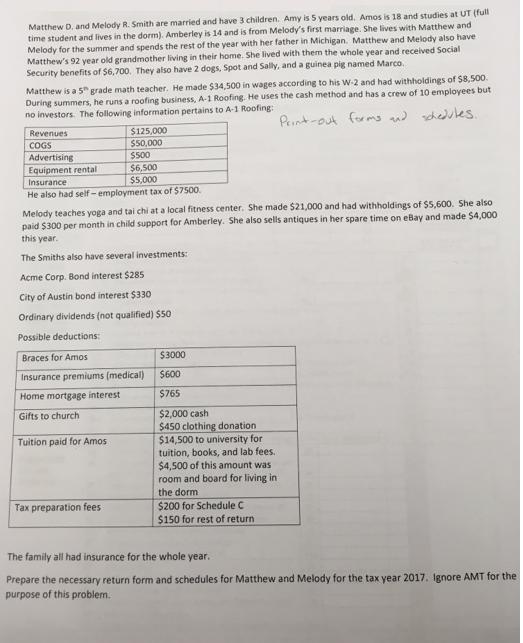

Matthew D. and Melody R. Smith are married and have 3 children. Amy is 5 years old. Amos is 18 and studies at UT (full time student and lives in the dorm). Amberley is 14 and is from Melody's first marriage. She lives with Matthew and Melody for the summer and spends the rest of the year with her father in Michigan. Matthew and Melody also have Matthew's 92 year old grandmother living in their home. She lived with them the whole year and received Social Security benefits of $6,700. They also have 2 dogs, Spot and Sally, and a guinea pig named Marco. Matthew is a 5" grade math teacher. He made $34,500 in wages according to his W-2 and had withholdings of $8,500. During summers, he runs a roofing business, A-1 Roofing. He uses the cash method and has a crew of 10 employees but no investors. The following information pertains to A-1 Roofing: Peint-out forms u deules. Revenues $125,000 COGS $50,000 Advertising Equipment rental S500 $6,500 $5,000 Insurance He also had self- employment tax of $7500. Melody teaches yoga and tai chi at a local fitness center. She made $21,000 and had withholdings of $5,600. She also paid $300 per month in child support for Amberley. She also sells antiques in her spare time on eBay and made $4,000 this year. The Smiths also have several investments: Acme Corp. Bond interest $285 City of Austin bond interest $330 Ordinary dividends (not qualified) $50 Possible deductions: Braces for Amos $3000 Insurance premiums (medical) $600 Home mortgage interest $765 Gifts to church $2,000 cash $450 clothing donation $14,500 to university for tuition, books, and lab fees. $4,500 of this amount was room and board for living in Tuition paid for Amos the dorm Tax preparation fees $200 for Schedule C $150 for rest of return The family all had insurance for the whole year. Prepare the necessary return form and schedules for Matthew and Melody for the tax year 2017. Ignore AMT for the purpose of this problem.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

s and annuities 1040 Department of the TreasuryIntemal Revenue Servios US Individual Income Tax Retu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started