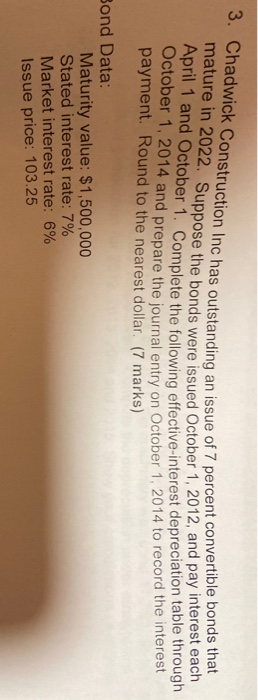

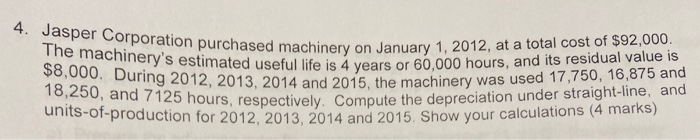

mature in 2022. Suppose the bonds were issued October 1, 20 outstanding an issue of 7 percent convertible bonds that - Suppose the bonds were issued October 1, 2012, and pay interest each April 1 and October 1. Complete the following effective interes October 1, 2014 and prepare the journal entry on October 1, 2014 te the following effective-interest depreciation table through payment. Round to the nearest dollar. (7 marks) me journal entry on October 1, 2014 to record the interest Bond Data: Maturity value: $1,500,000 Stated interest rate: 7% Market interest rate: 6% Issue price: 103.25 4. Jasper Corporation purchased ma The machinery's estimated useful life is 4 $8,000. During 2012, 2013, 2014 and 201 18,250, and 7125 hours, respectively. Cor purchased machinery on January 1, 2012, at a total cost of $92,000. umated useful life is 4 years or 60.000 hours, and its residual value is 12, 2013, 2014 and 2015, the machinery was used 17,750, 16,875 and o nours, respectively. Compute the depreciation under straight-line, and production for 2012, 2013, 2014 and 2015. Show your calculations (4 marks) mature in 2022. Suppose the bonds were issued October 1, 20 outstanding an issue of 7 percent convertible bonds that - Suppose the bonds were issued October 1, 2012, and pay interest each April 1 and October 1. Complete the following effective interes October 1, 2014 and prepare the journal entry on October 1, 2014 te the following effective-interest depreciation table through payment. Round to the nearest dollar. (7 marks) me journal entry on October 1, 2014 to record the interest Bond Data: Maturity value: $1,500,000 Stated interest rate: 7% Market interest rate: 6% Issue price: 103.25 4. Jasper Corporation purchased ma The machinery's estimated useful life is 4 $8,000. During 2012, 2013, 2014 and 201 18,250, and 7125 hours, respectively. Cor purchased machinery on January 1, 2012, at a total cost of $92,000. umated useful life is 4 years or 60.000 hours, and its residual value is 12, 2013, 2014 and 2015, the machinery was used 17,750, 16,875 and o nours, respectively. Compute the depreciation under straight-line, and production for 2012, 2013, 2014 and 2015. Show your calculations (4 marks)