Answered step by step

Verified Expert Solution

Question

1 Approved Answer

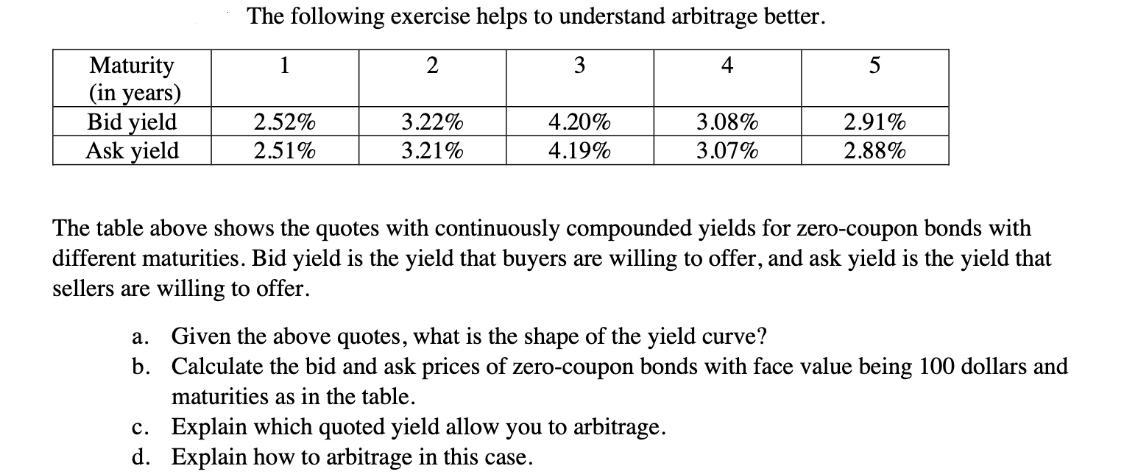

Maturity (in years) Bid yield Ask yield The following exercise helps to understand arbitrage better. 1 2 4 2.52% 2.51% 3.22% 3.21% 3 4.20%

Maturity (in years) Bid yield Ask yield The following exercise helps to understand arbitrage better. 1 2 4 2.52% 2.51% 3.22% 3.21% 3 4.20% 4.19% 3.08% 3.07% 5 c. Explain which quoted yield allow you to arbitrage. d. Explain how to arbitrage in this case. 2.91% 2.88% The table above shows the quotes with continuously compounded yields for zero-coupon bonds with different maturities. Bid yield is the yield that buyers are willing to offer, and ask yield is the yield that sellers are willing to offer. a. Given the above quotes, what is the shape of the yield curve? b. Calculate the bid and ask prices of zero-coupon bonds with face value being 100 dollars and maturities as in the table.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a The shape of the yield curve is downwardsloping in the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started