Answered step by step

Verified Expert Solution

Question

1 Approved Answer

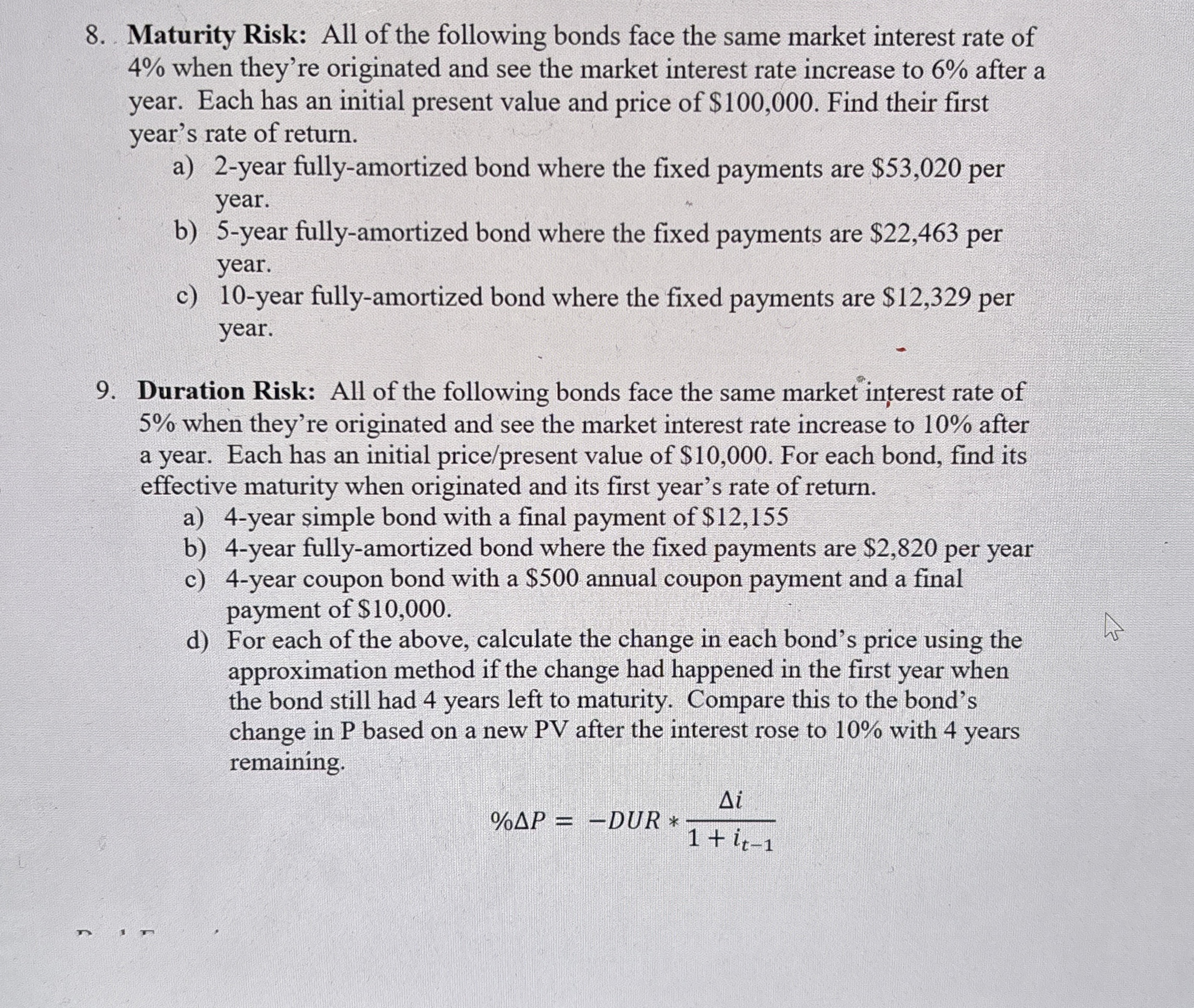

Maturity Risk: All of the following bonds face the same market interest rate of 4 % when they're originated and see the market interest rate

Maturity Risk: All of the following bonds face the same market interest rate of

when they're originated and see the market interest rate increase to after a

year. Each has an initial present value and price of $ Find their first

year's rate of return.

ayear fullyamortized bond where the fixed payments are $ per

year.

byear fullyamortized bond where the fixed payments are $ per

year.

cyear fullyamortized bond where the fixed payments are $ per

year.

Duration Risk: All of the following bonds face the same market interest rate of

when they're originated and see the market interest rate increase to after

a year. Each has an initial pricepresent value of $ For each bond, find its

effective maturity when originated and its first year's rate of return.

ayear simple bond with a final payment of $

byear fullyamortized bond where the fixed payments are $ per year

cyear coupon bond with a $ annual coupon payment and a final

payment of $

d For each of the above, calculate the change in each bond's price using the

approximation method if the change had happened in the first year when

the bond still had years left to maturity. Compare this to the bond's

change in P based on a new PV after the interest rose to with years

remaining.

DUR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started