Answered step by step

Verified Expert Solution

Question

1 Approved Answer

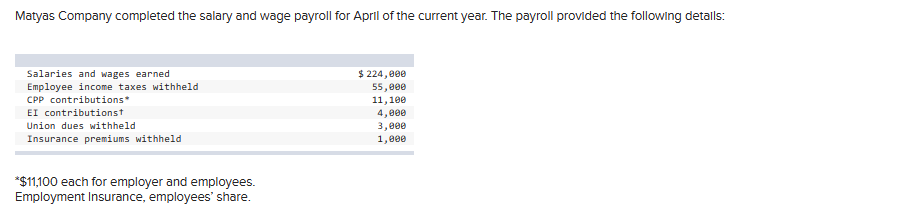

Matyas Company completed the salary and wage payroll for April of the current year. The payroll provided the following details: Salaries and wages earned

Matyas Company completed the salary and wage payroll for April of the current year. The payroll provided the following details: Salaries and wages earned Employee income taxes withheld CPP contributions* EI contributionst Union dues withheld Insurance premiums withheld *$11,100 each for employer and employees. Employment Insurance, employees' share. $224,000 55,000 11,100 4,000 3,000 1,000 Required: 1. Prepare the journal entry to record the payroll for April, Including employee deductions. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account field.) View transaction list 1 Record payroll for April including employee deductions. x 2. Prepare the journal entry to record the employer's additional payroll expenses. (If no entry is required for a transaction/event, select "No journal entry required" In the first account field.) View transaction list 1 Record employer's additional payroll expenses for April. 3. Prepare a combined journal entry to show the payment of amounts owed to governmental agencies and other organizations. (If no entry is required for a transaction/event, select "No journal entry required" In the first account field.) View transaction list 1 Record entry for remittance of employee deductions and employer-related amounts for April. ated 4-a. What was the total compensation expense for the company? Total compensation expense 4-b. What percentage of the payroll was take-home pay? (Round the final answer to nearest whole percentage.) Take-home pay %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started