Answered step by step

Verified Expert Solution

Question

1 Approved Answer

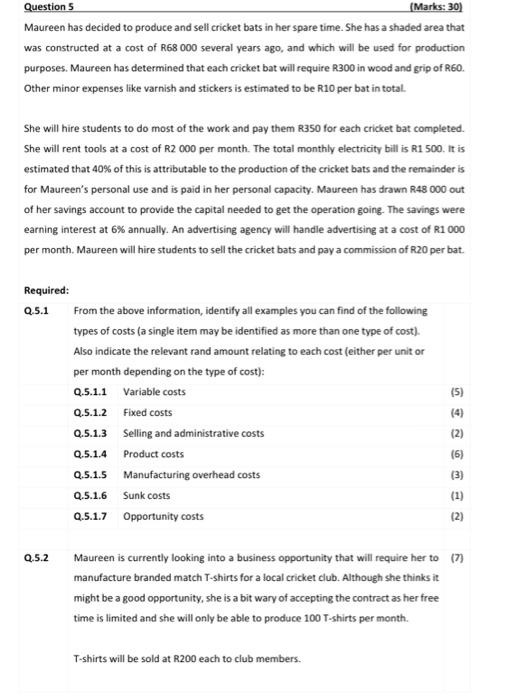

Maureen has decided to produce and sell cricket bats in her spare time. She has a shaded area that was constructed at a cost of

Maureen has decided to produce and sell cricket bats in her spare time. She has a shaded area that was constructed at a cost of R68 000 several years ago, and which will be used for production purposes. Maureen has determined that each cricket bat will require R300 in wood and grip of R60. Other minor expenses like varnish and stickers is estimated to be R10 per bat in total.

She will hire students to do most of the work and pay them R350 for each cricket bat completed. She will rent tools at a cost of R2 000 per month. The total monthly electricity bill is R1 500. It is estimated that 40% of this is attributable to the production of the cricket bats and the remainder is for Maureens personal use and is paid in her personal capacity. Maureen has drawn R48 000 out of her savings account to provide the capital needed to get the operation going. The savings were earning interest at 6% annually. An advertising agency will handle advertising at a cost of R1 000 per month. Maureen will hire students to sell the cricket bats and pay a commission of R20 per bat.

Required:

Q.5.1

From the above information, identify all examples you can find of the following types of costs (a single item may be identified as more than one type of cost). Also indicate the relevant rand amount relating to each cost (either per unit or per month depending on the type of cost):

Q.5.1.1 Variable costs (5)

Q.5.1.2 Fixed costs(4)

Q.5.1.3 Selling and administrative costs(2)

Q.5.1.4 Product costs (6)

Q.5.1.5 Manufacturing overhead costs(3)

Q.5.1.6 Sunk costs(1)

Q.5.1.7 Opportunity costs(2)

Q.5.2

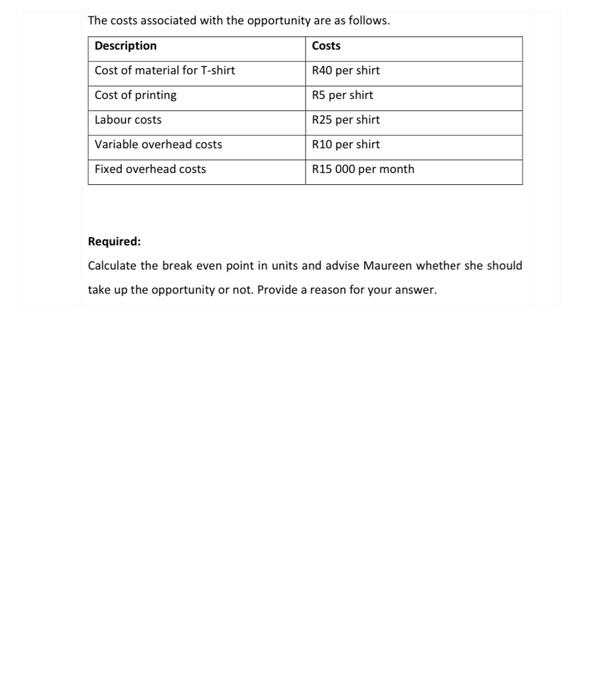

Maureen is currently looking into a business opportunity that will require her to manufacture branded match Tshirts for a local cricket club. Although she thinks it might be a good opportunity, she is a bit wary of accepting the contract as her free time is limited and she will only be able to produce 100 Tshirts per month.

Tshirts will be sold at R200 each to club members.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started