Question

Maureen meets Eileen, a middle-aged lady, at a nearby coffee joint and learns that she is a property agent based in the United States. She

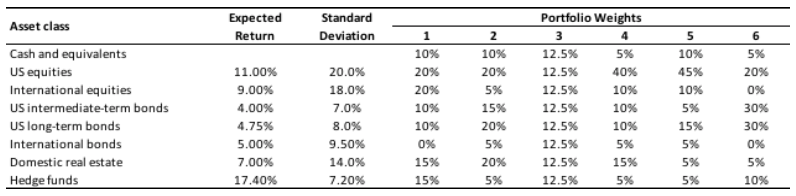

Maureen meets Eileen, a middle-aged lady, at a nearby coffee joint and learns that she is a property agent based in the United States. She has a net worth of USD10 million, of whichshe plans to utilise USD1 million in a month for a charitable commitment that she previously made. Eileen is acheap lady and her expenses do not vary much from month-to-month. She would also like income from her investment portfolio to defray some of her annual expenses and is, at the same time, concerned about the general rise in prices of goods and services over time. In addition, Eileen hopes to have a portfolio that can beliquidated quickly at fair value. Although she is not an American citizen, Eileen hasbenefitted from opportunities afforded to her in the country and wishes that her investments contribute to growth of American businesses and its overall economy. As planned, Maureen reassures Eileen that she has prepared six suitable portfolios for her, as shown below:

Discuss how Eileen's circumstances will affect her allocation to each asset class (low, medium, or high) and, hence, recommend a portfolio that is most suitable for her. No calculations are required.

Asset class Cash and equivalents US equities International equities US intermediate-term bonds US long-term bonds International bonds Domestic real estate Hedge funds Expected Return 11.00% 9.00% 4.00% 4.75% 5.00% 7.00% 17.40% Standard Deviation 20.0% 18.0% 7.0% 8.0% 9.50% 14.0% 7.20% 1 10% 20% 20% 10% 10% 0% 15% 15% 2 10% 20% 5% 15% 20% 5% 20% 5% Portfolio Weights 4 3 12.5% 5% 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% 40% 10% 10% 10% 5% 15% 5% 5 10% 45% 10% 5% 15% 5% 5% 5% 6 5% 20% 0% 30% 30% 0% 5% 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Eileens Investment Portfolio Allocation Based on Eileens circumstances heres how her investment allocation should look across different asset classes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started