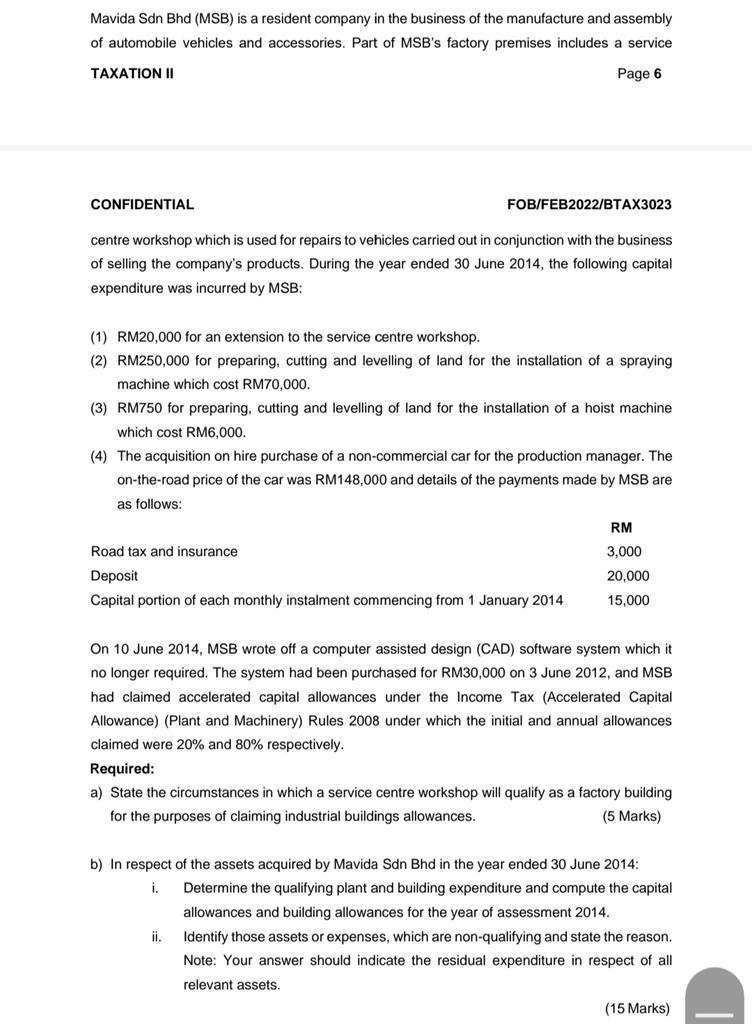

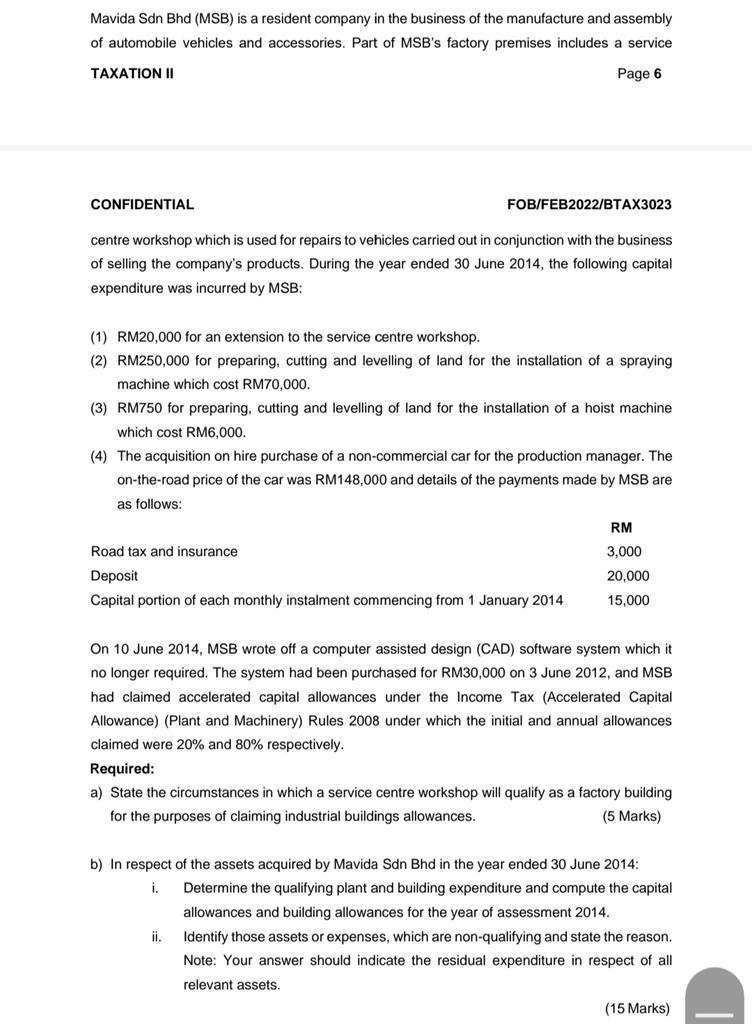

Mavida Sdn Bhd (MSB) is a resident company in the business of the manufacture and assembly of automobile vehicles and accessories. Part of MSB's factory premises includes a service TAXATION 11 Page 6 CONFIDENTIAL FOB/FEB2022/BTAX3023 centre workshop which is used for repairs to vehicles carried out in conjunction with the business of selling the company's products. During the year ended 30 June 2014, the following capital expenditure was incurred by MSB: (1) RM20,000 for an extension to the service centre workshop. (2) RM250,000 for preparing, cutting and levelling of land for the installation of a spraying machine which cost RM70,000. (3) RM750 for preparing, cutting and levelling of land for the installation of a hoist machine which cost RM6,000. (4) The acquisition on hire purchase of a non-commercial car for the production manager. The on-the-road price of the car was RM148,000 and details of the payments made by MSB are as follows: RM Road tax and insurance 3,000 20,000 Deposit Capital portion of each monthly instalment commencing from 1 January 2014 15,000 On 10 June 2014, MSB wrote off a computer assisted design (CAD) software system which it no longer required. The system had been purchased for RM30,000 on 3 June 2012, and MSB had claimed accelerated capital allowances under the Income Tax (Accelerated Capital Allowance) (Plant and Machinery) Rules 2008 under which the initial and annual allowances claimed were 20% and 80% respectively. Required: a) State the circumstances in which service centre workshop will qualify as a factory building for the purposes of claiming industrial buildings allowances. (5 Marks) b) In respect of the assets acquired by Mavida Sdn Bhd in the year ended 30 June 2014: i. Determine the qualifying plant and building expenditure and compute the capital allowances and building allowances for the year of assessment 2014. ii. Identify those assets or expenses, which are non-qualifying and state the reason. Note: Your answer should indicate the residual expenditure in respect of all relevant assets. (15 Marks) Mavida Sdn Bhd (MSB) is a resident company in the business of the manufacture and assembly of automobile vehicles and accessories. Part of MSB's factory premises includes a service TAXATION 11 Page 6 CONFIDENTIAL FOB/FEB2022/BTAX3023 centre workshop which is used for repairs to vehicles carried out in conjunction with the business of selling the company's products. During the year ended 30 June 2014, the following capital expenditure was incurred by MSB: (1) RM20,000 for an extension to the service centre workshop. (2) RM250,000 for preparing, cutting and levelling of land for the installation of a spraying machine which cost RM70,000. (3) RM750 for preparing, cutting and levelling of land for the installation of a hoist machine which cost RM6,000. (4) The acquisition on hire purchase of a non-commercial car for the production manager. The on-the-road price of the car was RM148,000 and details of the payments made by MSB are as follows: RM Road tax and insurance 3,000 20,000 Deposit Capital portion of each monthly instalment commencing from 1 January 2014 15,000 On 10 June 2014, MSB wrote off a computer assisted design (CAD) software system which it no longer required. The system had been purchased for RM30,000 on 3 June 2012, and MSB had claimed accelerated capital allowances under the Income Tax (Accelerated Capital Allowance) (Plant and Machinery) Rules 2008 under which the initial and annual allowances claimed were 20% and 80% respectively. Required: a) State the circumstances in which service centre workshop will qualify as a factory building for the purposes of claiming industrial buildings allowances. (5 Marks) b) In respect of the assets acquired by Mavida Sdn Bhd in the year ended 30 June 2014: i. Determine the qualifying plant and building expenditure and compute the capital allowances and building allowances for the year of assessment 2014. ii. Identify those assets or expenses, which are non-qualifying and state the reason. Note: Your answer should indicate the residual expenditure in respect of all relevant assets. (15 Marks)