Max and Sarah Smith are a married couple. They are both 30 years old and they have a 3-year-old girl. Max is a loan officer and earns $55,000 a year. Sarah works as a retail store manager and earns $50,000 a year. Max's life expectancy is 80 years and Sarah's is 82. They plan on retiring when they are 65. There are three health insurance policies that they could choose from (see attached).

Health Insurance:

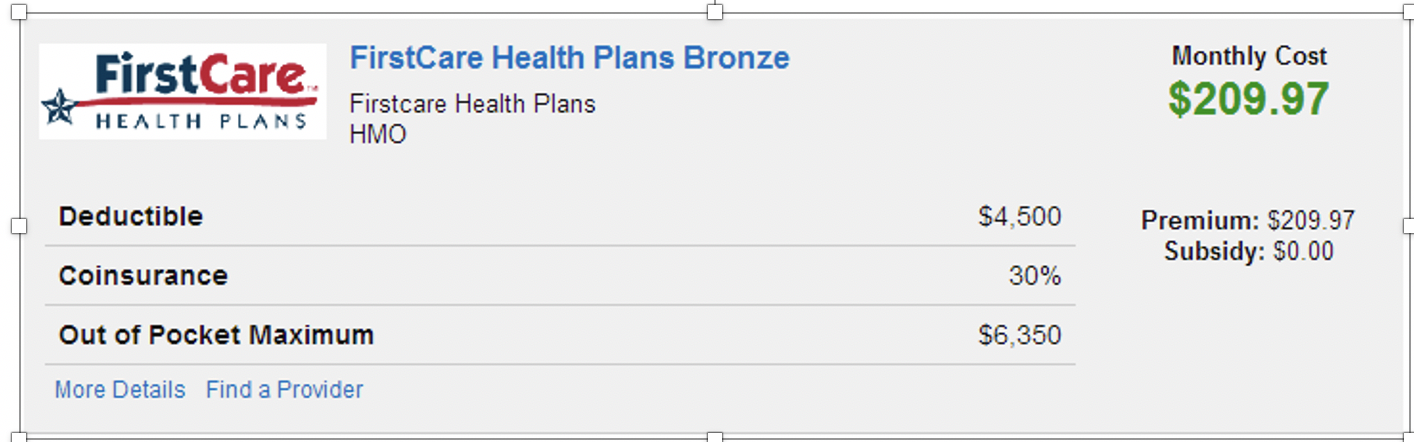

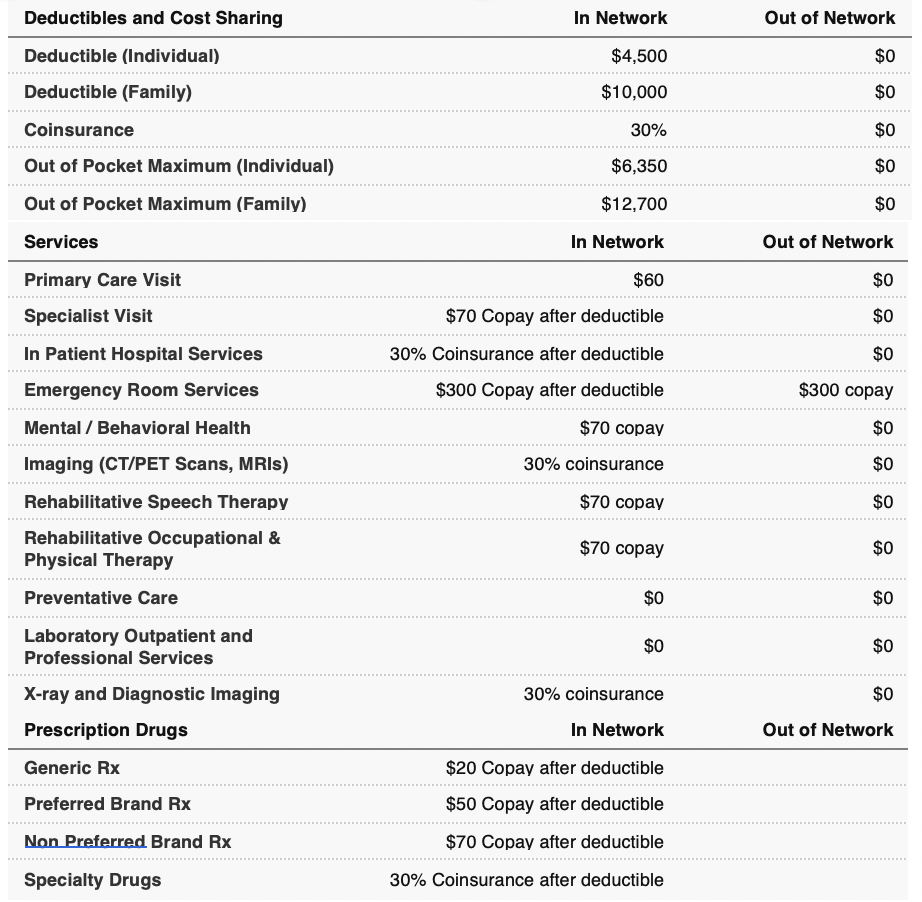

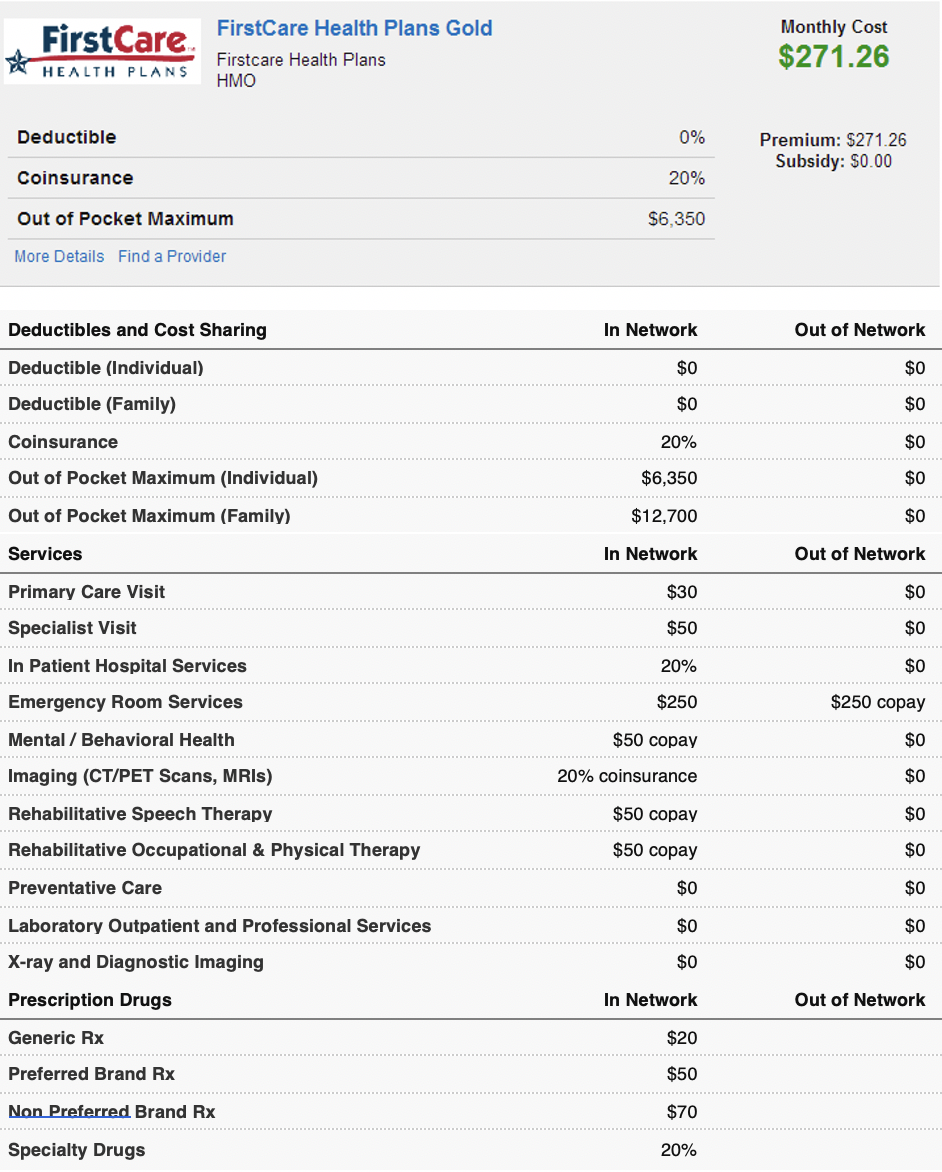

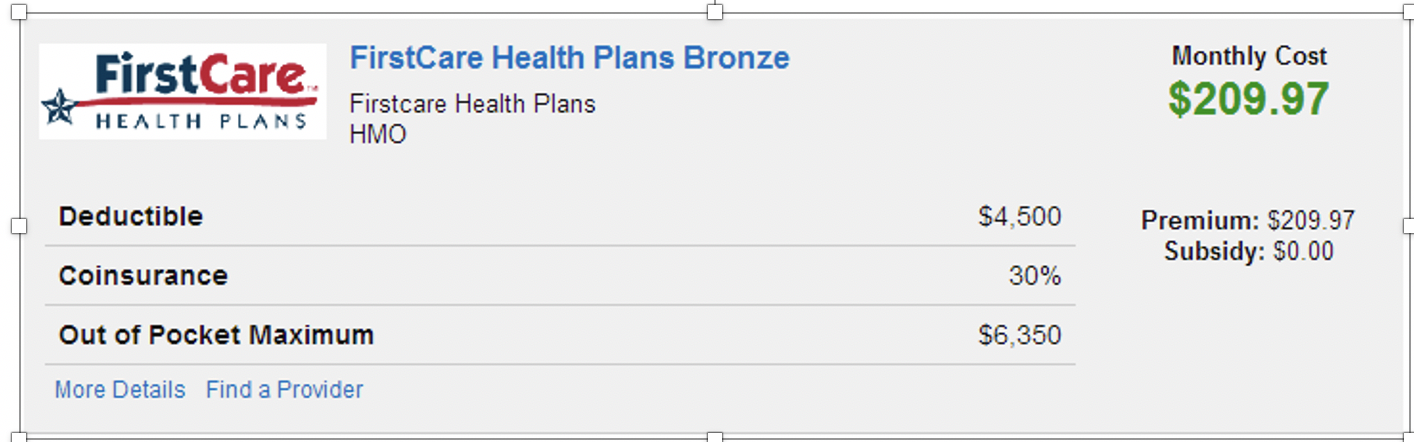

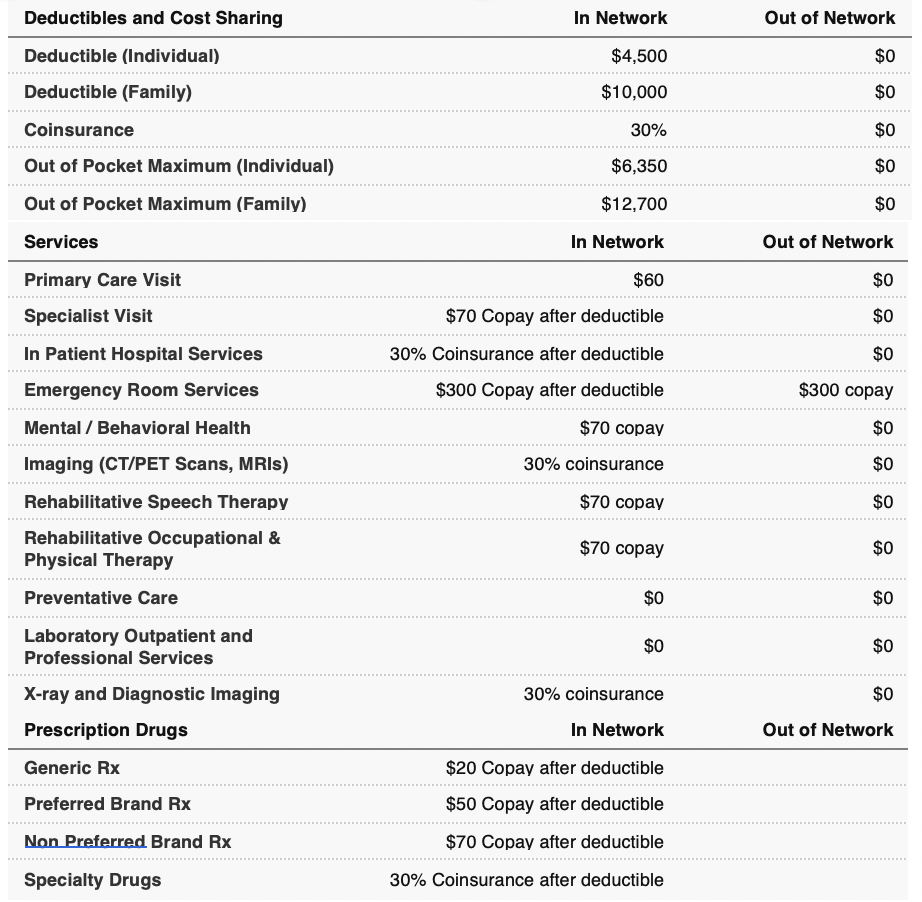

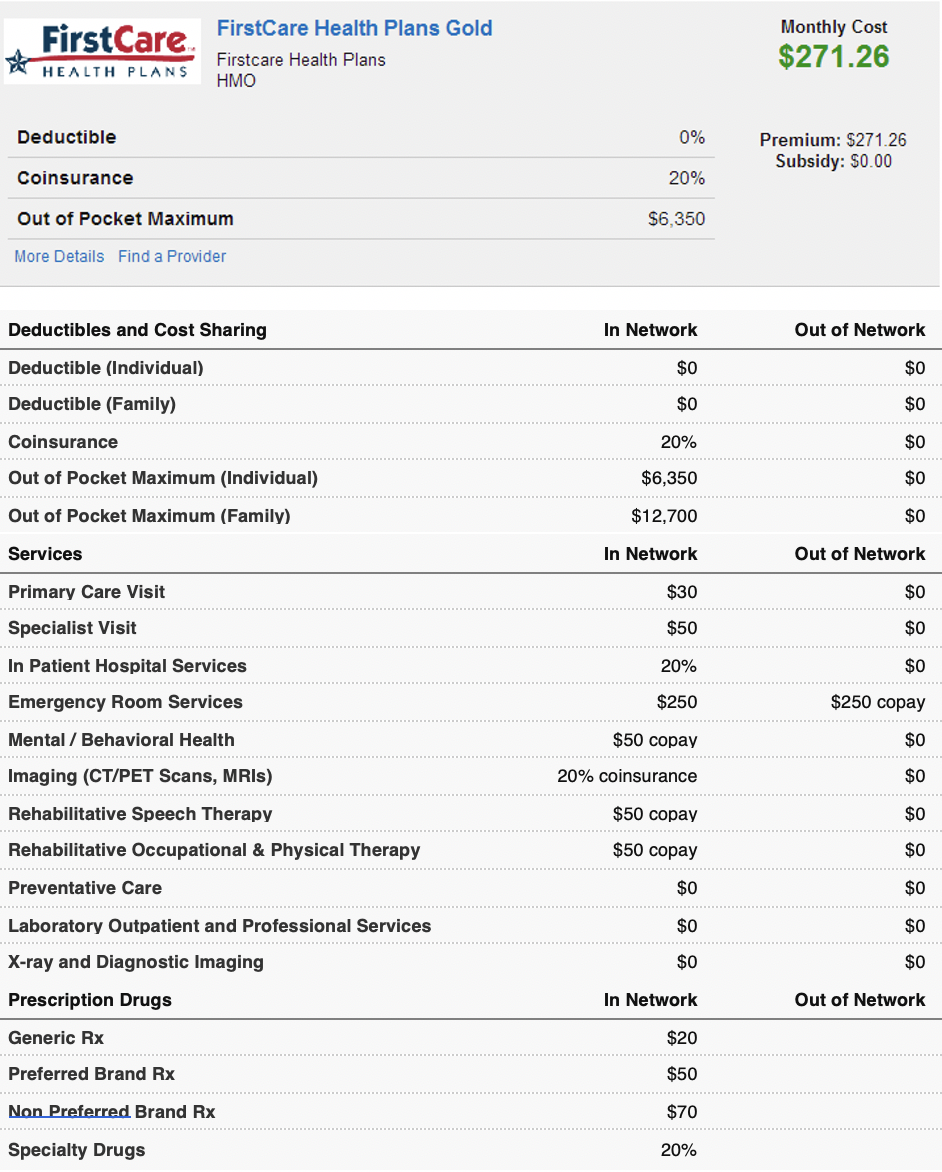

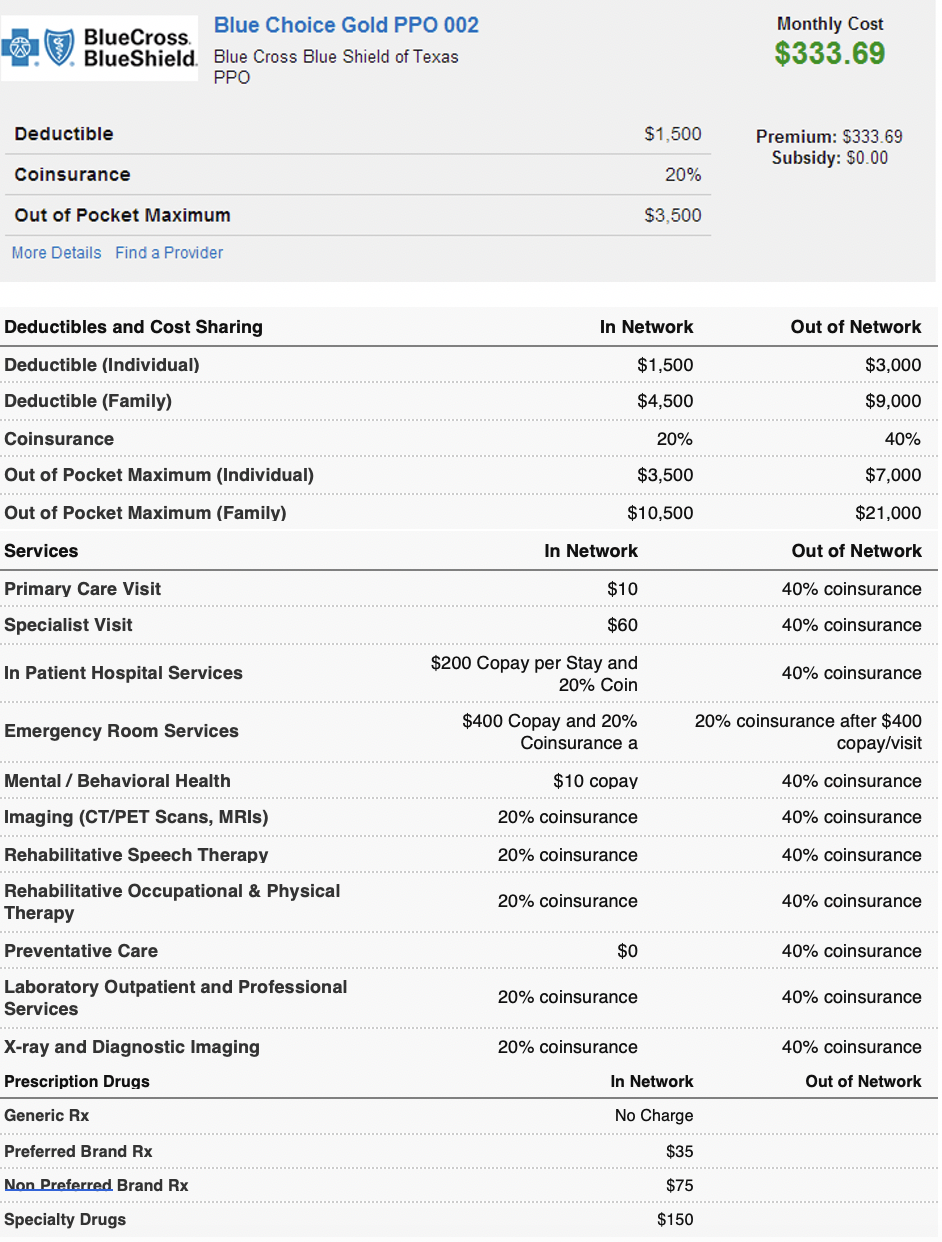

- Help Max and Sarah to determine which of the three plans to choose. They want to know which plan would be best if they estimate their medical costs at approximately $2,500 per year and which plan to use if they estimate their medical costs closer to $25,000 per year. Help the Smiths determine how much of their risk they should transfer and how much they should retain (for example a higher deductible means they are retaining more risk).

(Hint 1: Find out which one provides sufficient coverage at a reasonable cost.)

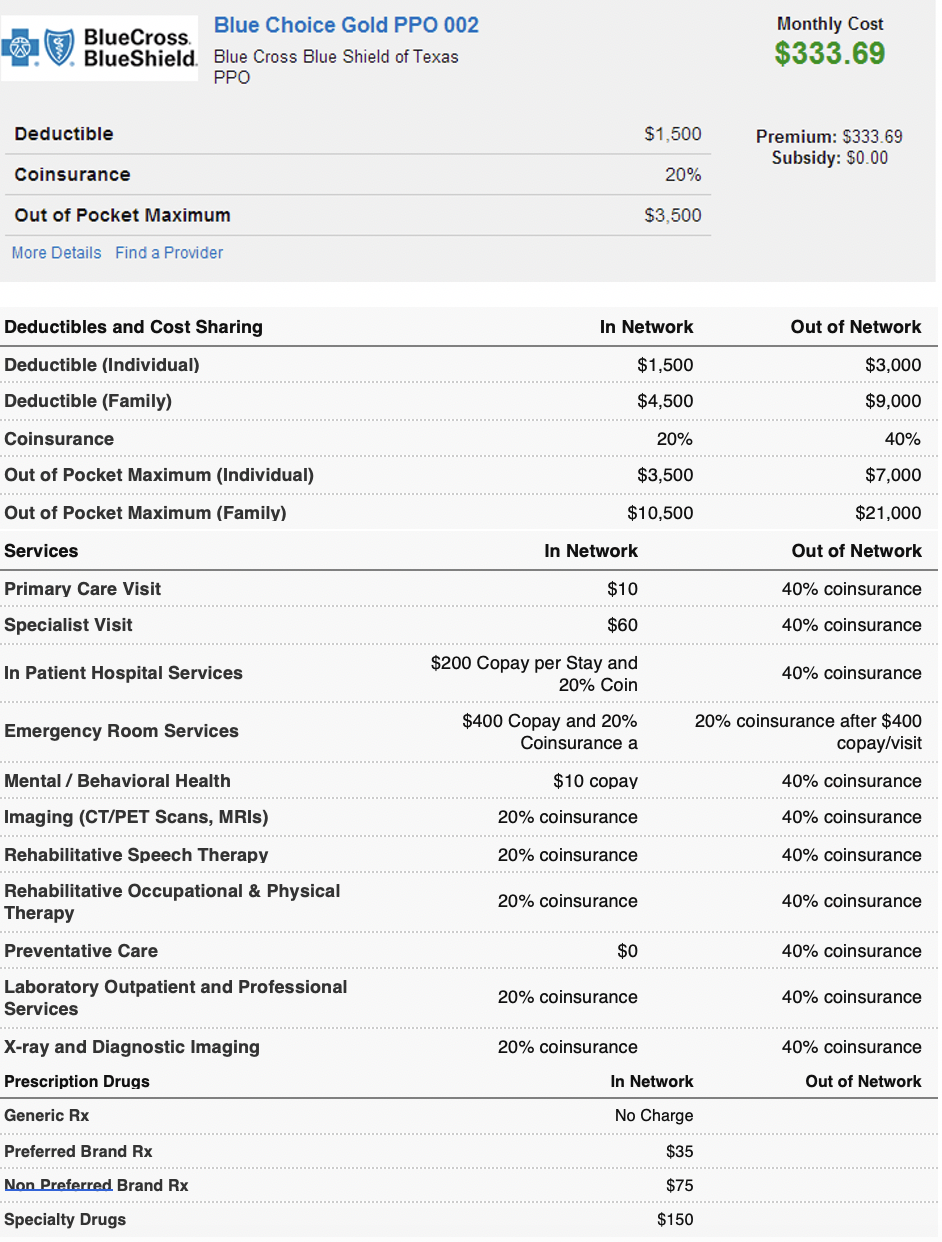

| | Low Medical Expenses (~$2,500/year) | High Medical Expenses (~$25, 000/year) |

| Estimated Medical Cost: | FirstCare Bronze | FirstCare Gold | Blue Choice Gold | FirstCare Bronze | FirstCare Gold | Blue Choice Gold |

| Out of Pocket Expense: | | | | | | |

| Annual Premium: Cost: | | | | | | |

| Total Cost: | | | | | | |

| Which plan should they choose? And Why? | | |

Please help me fill in the chart and explain why the numbers go there. The information for each plan is attached below.

FirstCare FirstCare Health Plans Bronze Monthly Cost $209.97 HEALTH PLANS Firstcare Health Plans HMO Deductible $4,500 Premium: $209.97 Subsidy: $0.00 Coinsurance 30% Out of Pocket Maximum $6,350 More Details Find a Provider In Network Out of Network Deductibles and Cost Sharing Deductible (Individual) $4,500 $0 Deductible (Family) $10,000 $0 Coinsurance 30% $0 Out of Pocket Maximum (Individual) $6,350 $0 Out of Pocket Maximum (Family) $12,700 $0 Services In Network Out of Network Primary Care Visit $0 $60 $70 Copay after deductible Specialist Visit $0 $0 In Patient Hospital Services Emergency Room Services 30% Coinsurance after deductible $300 Copay after deductible $300 copay Mental / Behavioral Health $70 copay $0 Imaging (CT/PET Scans, MRIs) 30% coinsurance $0 $70 copay $0 Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy $70 copay $0 Preventative Care $0 $0 $0 $0 Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs 30% coinsurance $0 Out of Network In Network Generic Rx $20 Copay after deductible Preferred Brand Rx $50 Copay after deductible Non Preferred Brand Rx $70 Copay after deductible Specialty Drugs 30% Coinsurance after deductible Blue Choice Gold PPO 002 BlueCross BlueShield. Blue Cross Blue Shield of Texas PPO Monthly Cost $333.69 Deductible $1,500 Premium: $333.69 Subsidy: $0.00 Coinsurance 20% Out of Pocket Maximum $3.500 More Details Find a Provider Deductibles and Cost Sharing In Network Out of Network Deductible (Individual) $1,500 $3,000 Deductible (Family) $4,500 $9,000 Coinsurance 20% 40% Out of Pocket Maximum (Individual) $3,500 $7,000 Out of Pocket Maximum (Family) $10,500 $21,000 Services In Network Out of Network Primary Care Visit $10 40% coinsurance Specialist Visit $60 40% coinsurance In Patient Hospital Services $200 Copay per Stay and 20% Coin 40% coinsurance Emergency Room Services $400 Copay and 20% Coinsurance a 20% coinsurance after $400 copay/visit Mental / Behavioral Health $10 copay 40% coinsurance Imaging (CT/PET Scans, MRIs) 20% coinsurance 40% coinsurance Rehabilitative Speech Therapy 20% coinsurance 40% coinsurance Rehabilitative Occupational & Physical Therapy 20% coinsurance 40% coinsurance Preventative Care $0 40% coinsurance Laboratory Outpatient and Professional Services 20% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance X-ray and Diagnostic Imaging Prescription Drugs In Network Out of Network Generic Rx No Charge Preferred Brand Rx $35 Non Preferred Brand Rx $75 Specialty Drugs $150 FirstCare FirstCare Health Plans Bronze Monthly Cost $209.97 HEALTH PLANS Firstcare Health Plans HMO Deductible $4,500 Premium: $209.97 Subsidy: $0.00 Coinsurance 30% Out of Pocket Maximum $6,350 More Details Find a Provider In Network Out of Network Deductibles and Cost Sharing Deductible (Individual) $4,500 $0 Deductible (Family) $10,000 $0 Coinsurance 30% $0 Out of Pocket Maximum (Individual) $6,350 $0 Out of Pocket Maximum (Family) $12,700 $0 Services In Network Out of Network Primary Care Visit $0 $60 $70 Copay after deductible Specialist Visit $0 $0 In Patient Hospital Services Emergency Room Services 30% Coinsurance after deductible $300 Copay after deductible $300 copay Mental / Behavioral Health $70 copay $0 Imaging (CT/PET Scans, MRIs) 30% coinsurance $0 $70 copay $0 Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy $70 copay $0 Preventative Care $0 $0 $0 $0 Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs 30% coinsurance $0 Out of Network In Network Generic Rx $20 Copay after deductible Preferred Brand Rx $50 Copay after deductible Non Preferred Brand Rx $70 Copay after deductible Specialty Drugs 30% Coinsurance after deductible Blue Choice Gold PPO 002 BlueCross BlueShield. Blue Cross Blue Shield of Texas PPO Monthly Cost $333.69 Deductible $1,500 Premium: $333.69 Subsidy: $0.00 Coinsurance 20% Out of Pocket Maximum $3.500 More Details Find a Provider Deductibles and Cost Sharing In Network Out of Network Deductible (Individual) $1,500 $3,000 Deductible (Family) $4,500 $9,000 Coinsurance 20% 40% Out of Pocket Maximum (Individual) $3,500 $7,000 Out of Pocket Maximum (Family) $10,500 $21,000 Services In Network Out of Network Primary Care Visit $10 40% coinsurance Specialist Visit $60 40% coinsurance In Patient Hospital Services $200 Copay per Stay and 20% Coin 40% coinsurance Emergency Room Services $400 Copay and 20% Coinsurance a 20% coinsurance after $400 copay/visit Mental / Behavioral Health $10 copay 40% coinsurance Imaging (CT/PET Scans, MRIs) 20% coinsurance 40% coinsurance Rehabilitative Speech Therapy 20% coinsurance 40% coinsurance Rehabilitative Occupational & Physical Therapy 20% coinsurance 40% coinsurance Preventative Care $0 40% coinsurance Laboratory Outpatient and Professional Services 20% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance X-ray and Diagnostic Imaging Prescription Drugs In Network Out of Network Generic Rx No Charge Preferred Brand Rx $35 Non Preferred Brand Rx $75 Specialty Drugs $150