Question

Max Ltd acquires an item of machinery on 1 july 2016 for a total acquisition cost of $61,000. The life of the asset is accessed

Max Ltd acquires an item of machinery on 1 july 2016 for a total acquisition cost of $61,000. The life of the asset is accessed as being six(6) years, after which time Max Ltd expects to be able to dispose of the asset for $6,000. It is expected that the benefits will be generated in a pattern that is best reflected by the sum-of- digits depreciation approach. On 1 July 2019, owing to unforeseen circumstances, the machinery is exchanged for a motor vehicle. Note the motor vehicle is two years old, originally cost $17,000 and has a fair value of $11,000. Required: Provide the necessary journal entries for the disposal of the machinery and the acquisition of the motor vehicle on 1 July 2019.

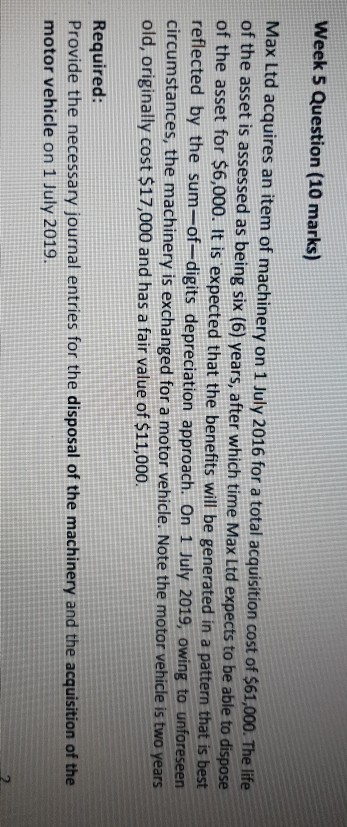

Week 5 Question (10 marks) Max Ltd acquires an item of machinery on 1 July 2016 for a total acquisition cost of $61,000. The life of the asset is assessed as being six (6) years, after which time Max Ltd expects to be able to dispose of the asset for $6,000. It is expected that the benefits will be generated in a pattern that is best reflected by the sum-of-digits depreciation approach. On 1 July 2019, owing to unforeseen circumstances, the machinery is exchanged for a motor vehicle. Note the motor vehicle is two years old, originally cost $17,000 and has a fair value of $11,000. Required: Provide the necessary journal entries for the disposal of the machinery and the acquisition of the motor vehicle on 1 July 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started