Question

Max owns a factory. The premises were purchased on 1 January 2011 for $550,000 and depreciation charged at 2% pa straight line. Max now

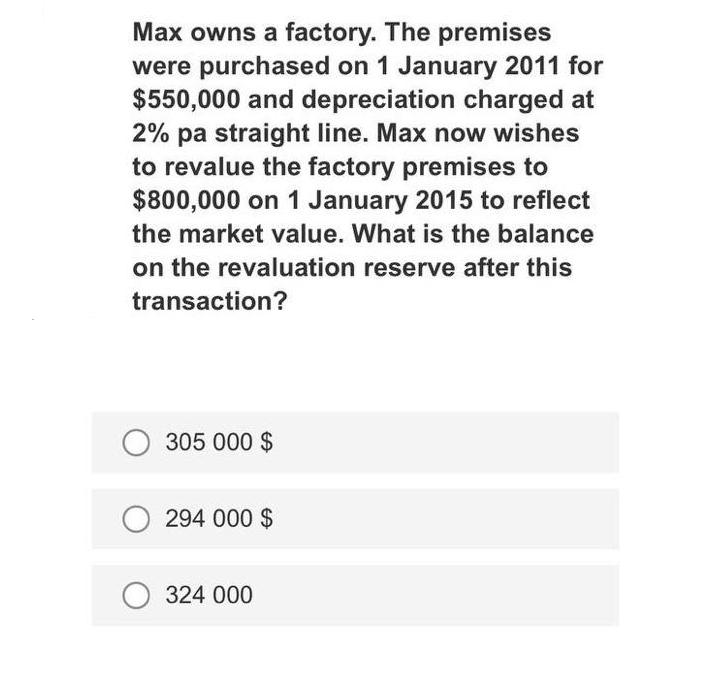

Max owns a factory. The premises were purchased on 1 January 2011 for $550,000 and depreciation charged at 2% pa straight line. Max now wishes to revalue the factory premises to $800,000 on 1 January 2015 to reflect the market value. What is the balance on the revaluation reserve after this transaction? O 305 000 $ 294 000 $ 324 000

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Balance on the revaluation reserve 294000 Workings i Premises we...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting

Authors: Barry Elliott, Jamie Elliott

14th Edition

978-0273744535, 273744445, 273744534, 978-0273744443

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App