Question

Maxell Auto Ltd. has an authorized capital of 500,000 $1 ordinary shares, of which 400,000 have been issued as fully paid. The following information was

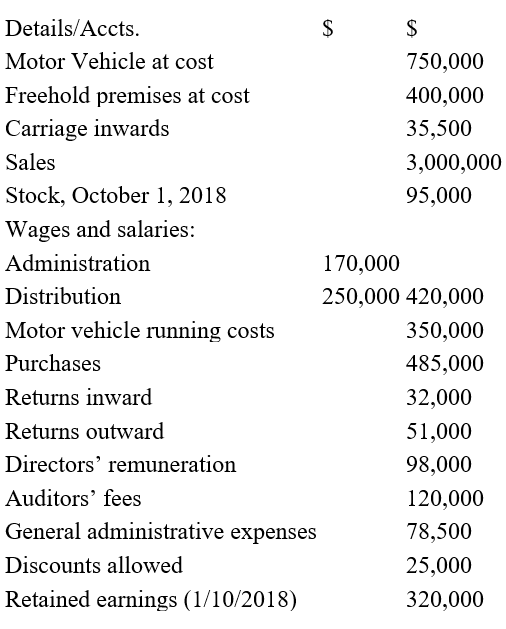

Maxell Auto Ltd. has an authorized capital of 500,000 $1 ordinary shares, of which 400,000 have been issued as fully paid. The following information was extracted from the accounts for the year ended September 30, 2019:

Additional Information:

(i) The closing stock was valued at $160,000.

(ii) The ordinary share dividends for the year were: Interim 10% already paid; Final 15% proposed.

(iii) The directors decided to transfer $130,000 to General Reserve.

(iv) Expenses in arrears at September 30, 2019 were:

Motor vehicle running costs $14,000 and Salaries and wages: Distribution staff $20,000.

(v) Expenses paid in advance were: General administrative costs $8,000 and Auditors fees $20,000.

(vi) The liability for corporation tax for the year ended September 30, 2019, had been agreed at $150,000.

(vii) The company depreciated freehold premises at 8% per annum on costs.

(viii) The company depreciated Motor Vehicle at 12% per annum using the reducing balance method. Aggregate depreciation to September 30, 2018 was $250,000.

(ix) The companys motor vehicles were used by staff as follows:

Distribution staff 400,000 miles per annum

Administration staff 300,000 miles per annum

As the Accountant, you are required to prepare:

(a) The Trading and Profit and Loss Account

(b) The Appropriation Account

(c) From your answer to (a) above, list two items which the company would be required to include in its published accounts under the Companies Acts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started