Answered step by step

Verified Expert Solution

Question

1 Approved Answer

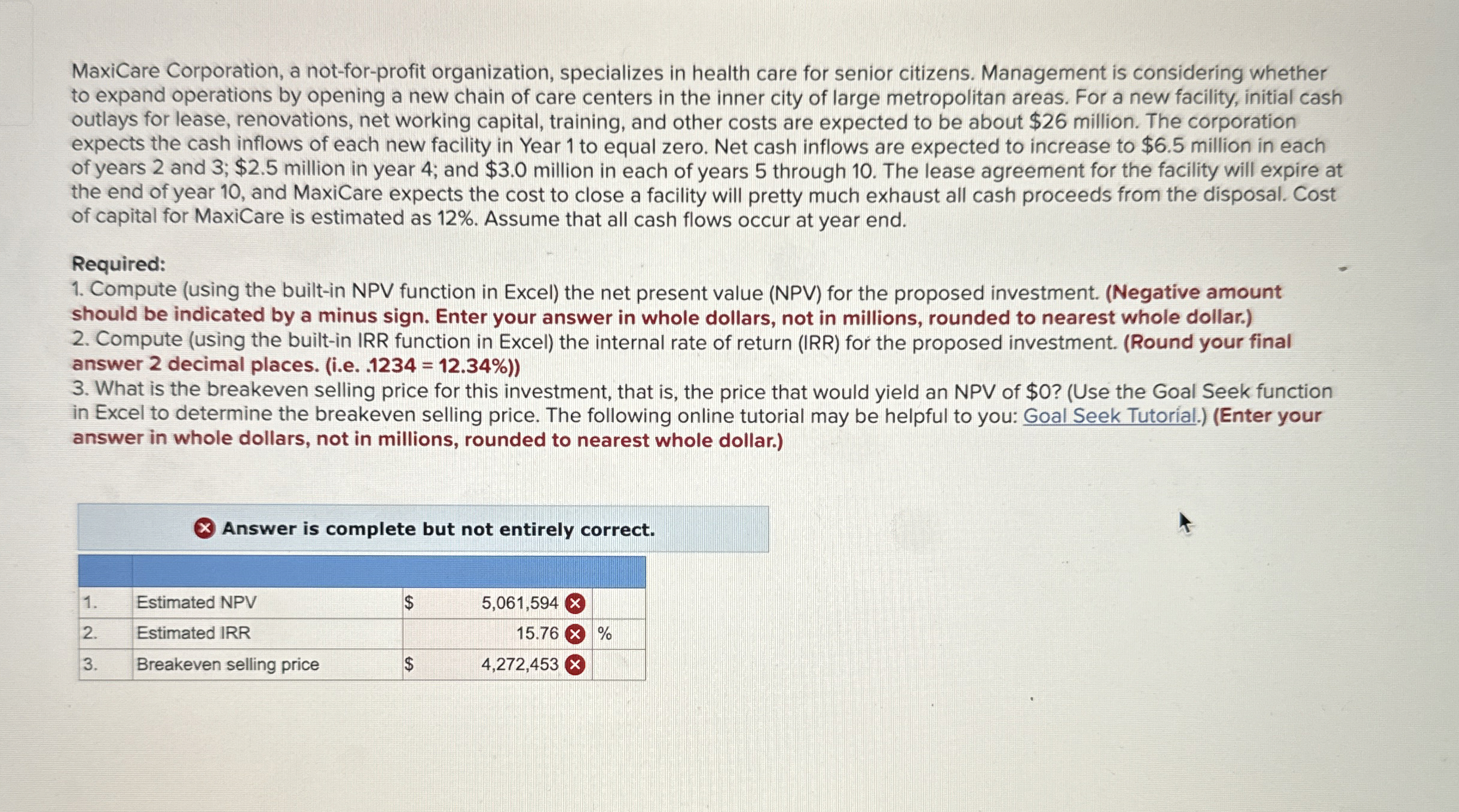

MaxiCare Corporation, a not - for - profit organization, specializes in health care for senior citizens. Management is considering whether to expand operations by opening

MaxiCare Corporation, a notforprofit organization, specializes in health care for senior citizens. Management is considering whether to expand operations by opening a new chain of care centers in the inner city of large metropolitan areas. For a new facility, initial cash outlays for lease, renovations, net working capital, training, and other costs are expected to be about $ million. The corporation expects the cash inflows of each new facility in Year to equal zero. Net cash inflows are expected to increase to $ million in each of years and ;$ million in year ; and $ million in each of years through The lease agreement for the facility will expire at the end of year and MaxiCare expects the cost to close a facility will pretty much exhaust all cash proceeds from the disposal. Cost of capital for MaxiCare is estimated as Assume that all cash flows occur at year end.

Required:

Compute using the builtin NPV function in Excel the net present value NPV for the proposed investment. Negative amount should be indicated by a minus sign. Enter your answer in whole dollars, not in millions, rounded to nearest whole dollar.

Compute using the builtin IRR function in Excel the internal rate of return IRR for the proposed investment. Round your final answer decimal places. ie

What is the breakeven selling price for this investment, that is the price that would yield an NPV of $Use the Goal Seek function in Excel to determine the breakeven selling price. The following online tutorial may be helpful to you: Goal Seek Tutorial.Enter your answer in whole dollars, not in millions, rounded to nearest whole dollar.

table Answer is complete but not entirely correct.Estimated NPV$Estimated IRR,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started