Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maximum Public Limited is a public company listed on the Caribbean Stock Exchange. The issued share capital was 10 million for ordinary shares and

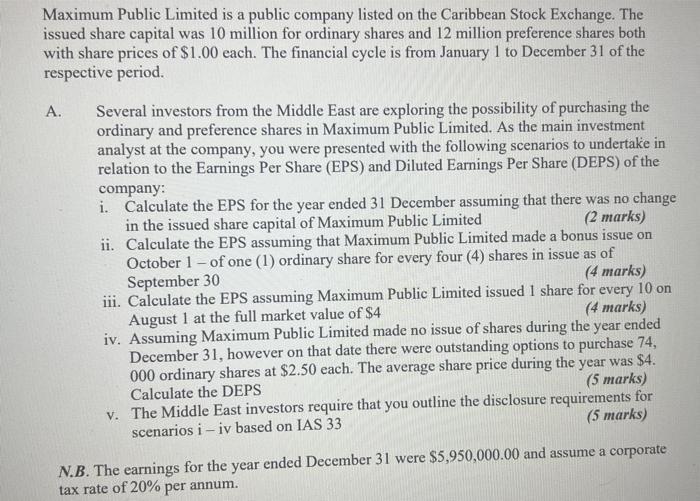

Maximum Public Limited is a public company listed on the Caribbean Stock Exchange. The issued share capital was 10 million for ordinary shares and 12 million preference shares both with share prices of $1.00 each. The financial cycle is from January 1 to December 31 of the respective period. A. Several investors from the Middle East are exploring the possibility of purchasing the ordinary and preference shares in Maximum Public Limited. As the main investment analyst at the company, you were presented with the following scenarios to undertake in relation to the Earnings Per Share (EPS) and Diluted Earnings Per Share (DEPS) of the company: i. Calculate the EPS for the year ended 31 December assuming that there was no change (2 marks) in the issued share capital of Maximum Public Limited ii. Calculate the EPS assuming that Maximum Public Limited made a bonus issue on October 1- of one (1) ordinary share for every four (4) shares in issue as of September 30 (4 marks) iii. Calculate the EPS assuming Maximum Public Limited issued I share for every 10 on (4 marks) August 1 at the full market value of $4 iv. Assuming Maximum Public Limited made no issue of shares during the year ended December 31, however on that date there were outstanding options to purchase 74, 000 ordinary shares at $2.50 each. The average share price during the year was $4. (5 marks) Calculate the DEPS v. The Middle East investors require that you outline the disclosure requirements for scenarios i- iv based on IAS 33 (5 marks) N.B. The earnings for the year ended December 31 were $5,950,000.00 and assume a corporate tax rate of 20% per annum.

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

i Earnings Per Share EPS Net Profit After Tax Number of Ordinary Shares EPS 595000000 595000000 x 02...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started