Question

Maxis Communications reported earnings before interest and taxes of $850 Million in 2017, with a depreciation allowance of $400 million and capital expenditures of $500

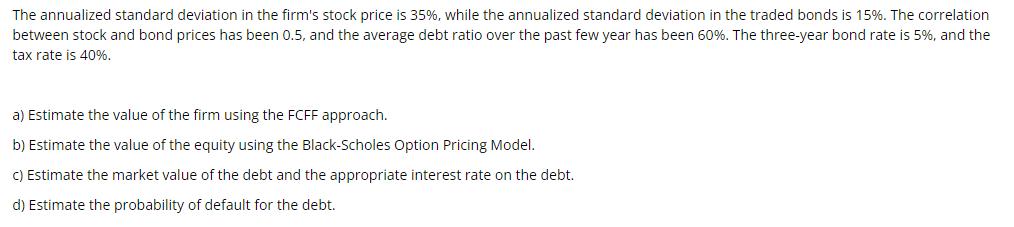

Maxis Communications reported earnings before interest and taxes of $850 Million in 2017, with a depreciation allowance of $400 million and capital expenditures of $500 million in that year; the working capital requirements were negligible. The earnings before interest and taxes and net cap ex are expected to grow 20% a year for the next five years. The cost of capital is 10% and the return on capital is expected to be 15% in perpetuity after year 5; the growth rate in perpetuity is 5%.

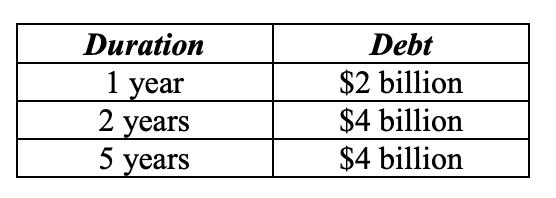

The firm has $10 billion in debt outstanding with the following characteristics:

Duration 1 year 2 years 5 years Debt $2 billion $4 billion $4 billion

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the value of the firm using the Free Cash Flow to the Firm FCFF approach we need to calculate the FCFF for each of the next five years and the terminal value beyond year five Then we can d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started