Answered step by step

Verified Expert Solution

Question

1 Approved Answer

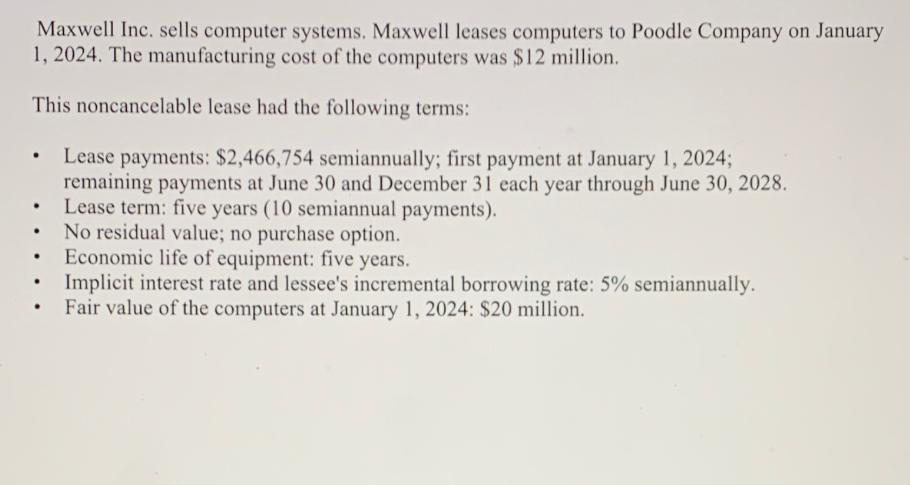

Maxwell Inc. sells computer systems. Maxwell leases computers to Poodle Company on January 1, 2024. The manufacturing cost of the computers was $12 million.

Maxwell Inc. sells computer systems. Maxwell leases computers to Poodle Company on January 1, 2024. The manufacturing cost of the computers was $12 million. This noncancelable lease had the following terms: Lease payments: $2,466,754 semiannually; first payment at January 1, 2024; remaining payments at June 30 and December 31 each year through June 30, 2028. Lease term: five years (10 semiannual payments). . . No residual value; no purchase option. Economic life of equipment: five years. Implicit interest rate and lessee's incremental borrowing rate: 5% semiannually. Fair value of the computers at January 1, 2024: $20 million. 4. Maxwell would account for this as: 5. What is the interest revenue that Maxwell would report for this lease in its 2025 income statement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 4 Maxwell would account for this lease as a finance lease since it meets the criteria for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started