Answered step by step

Verified Expert Solution

Question

1 Approved Answer

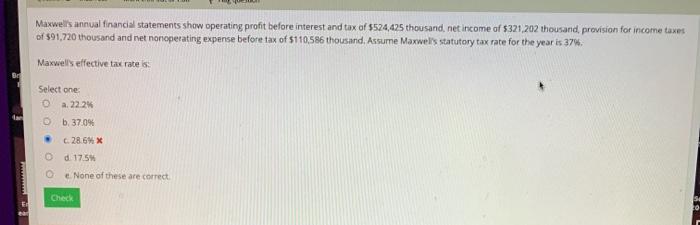

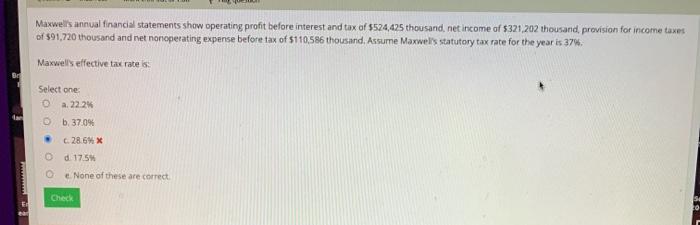

Maxwell's annual financial statements show operating profit before interest and tax of 5524,425 thousand, net income of 5321202 thousand, provision for income taxes of $91,720

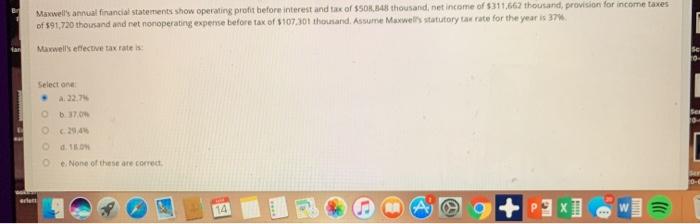

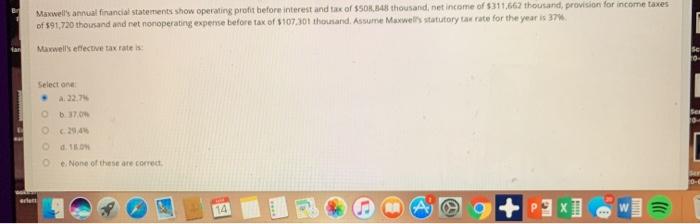

Maxwell's annual financial statements show operating profit before interest and tax of 5524,425 thousand, net income of 5321202 thousand, provision for income taxes of $91,720 thousand and net nonoperating expense before tax of 5110,586 thousand, Assume Maxwell's statutory tax rate for the year is 37% Maxwell's effective tax rates Select one a. 22.2% b. 37.0% c. 28.6% d 17.5 None of these are correct Check Maxwell's annual financial statements show operating profit before interest and tax of $0.148 thousand, net income of $311,662 thousand, provision for income taxes of 591.720 thousand and ret nonoperating expense before tax of $107.30 thousand. Assume Maxwel's statutorytat rate for the year is 37 Maxwell's effective tax rates Select one 37.00 d. De None of these are correct 14 )))

Maxwell's annual financial statements show operating profit before interest and tax of 5524,425 thousand, net income of 5321202 thousand, provision for income taxes of $91,720 thousand and net nonoperating expense before tax of 5110,586 thousand, Assume Maxwell's statutory tax rate for the year is 37% Maxwell's effective tax rates Select one a. 22.2% b. 37.0% c. 28.6% d 17.5 None of these are correct Check Maxwell's annual financial statements show operating profit before interest and tax of $0.148 thousand, net income of $311,662 thousand, provision for income taxes of 591.720 thousand and ret nonoperating expense before tax of $107.30 thousand. Assume Maxwel's statutorytat rate for the year is 37 Maxwell's effective tax rates Select one 37.00 d. De None of these are correct 14 )))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started