Question

May 1, 2019 Business owner Open Renovation design company and invested $200,000 in business bunk account 2) Mayi, 2019 Business bought supplies S1000, but the

May 1, 2019 Business owner Open Renovation design company and invested $200,000 in business bunk account 2) Mayi, 2019 Business bought supplies S1000, but the money will be paid in the future 3)May 1, 2019 business paid a one year rent for $24,000 4) May2, 2019 Business bought a computer and a printer for $9,000 paid in cash, the useful life of the machine is 10 years 5) May3, 2019 business bought the floor materials required to complete upcoming renovation Projects for $3500, paid in cash 6) May3, 2019 business use the 5 year auto financing $24,000 to purchase a truck (toan interest is 10%, which will be paid at the end of 5 years with the principal and truck's useful life is 5 years) 7) May5, 2019 business signed a Projectni $35,000 agreement. The project will be finished during the month and hired a group of contractors to help the projecta1 8)May7, 2019 business paid the owing money for the purchase of the supplies in transaction 2) 9)May 14, 2019 business paid the front desk employee $1,500 wages in cash 10)May15, 2019 business completed the projecta1 and received the money $35.000 11) May 16, 2019 business paid $10,000 to the contractors for help to complete the projectes 12) May 16, 2019 business confirm $2000 materials already been used for projects 13) May 17, 2019 business complete the basement design service project 2 58,000 for the customer. The money will be received in the near future 14) May 18, 2019 business owner withdrew $3,000 cash from the business bank acc 15) May 28, 2019 business paid front employee wages again in cash 16) May 30, 2019 received the utility bill 5500 for the electricity and energy used during the month paid in cash 17) May31. 2019 business found only 5400 supplies left over there 18) May31, 2019 business need to record the current month rent expense since the business has been tenant for the whole month of May 19) May 31, 2019 Business need to record the used up part of the equipment 20) May31. 2019 business need to record the used to part of the truck 21) May 1, 2019 business record the monthly interest of the above truck loan

provide the answer of this question?

provide the proper balansheet of the same question?

can you please provide me answer in proper format?

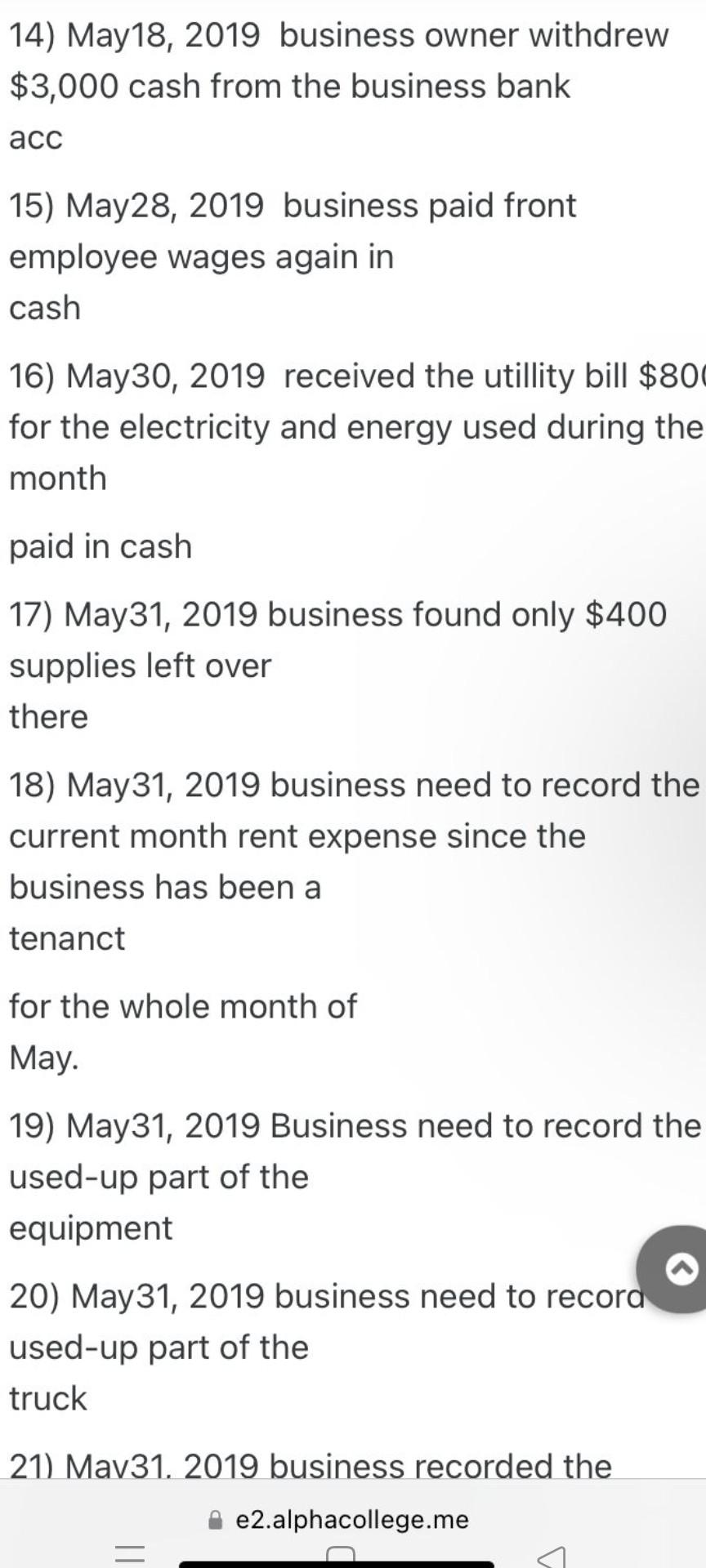

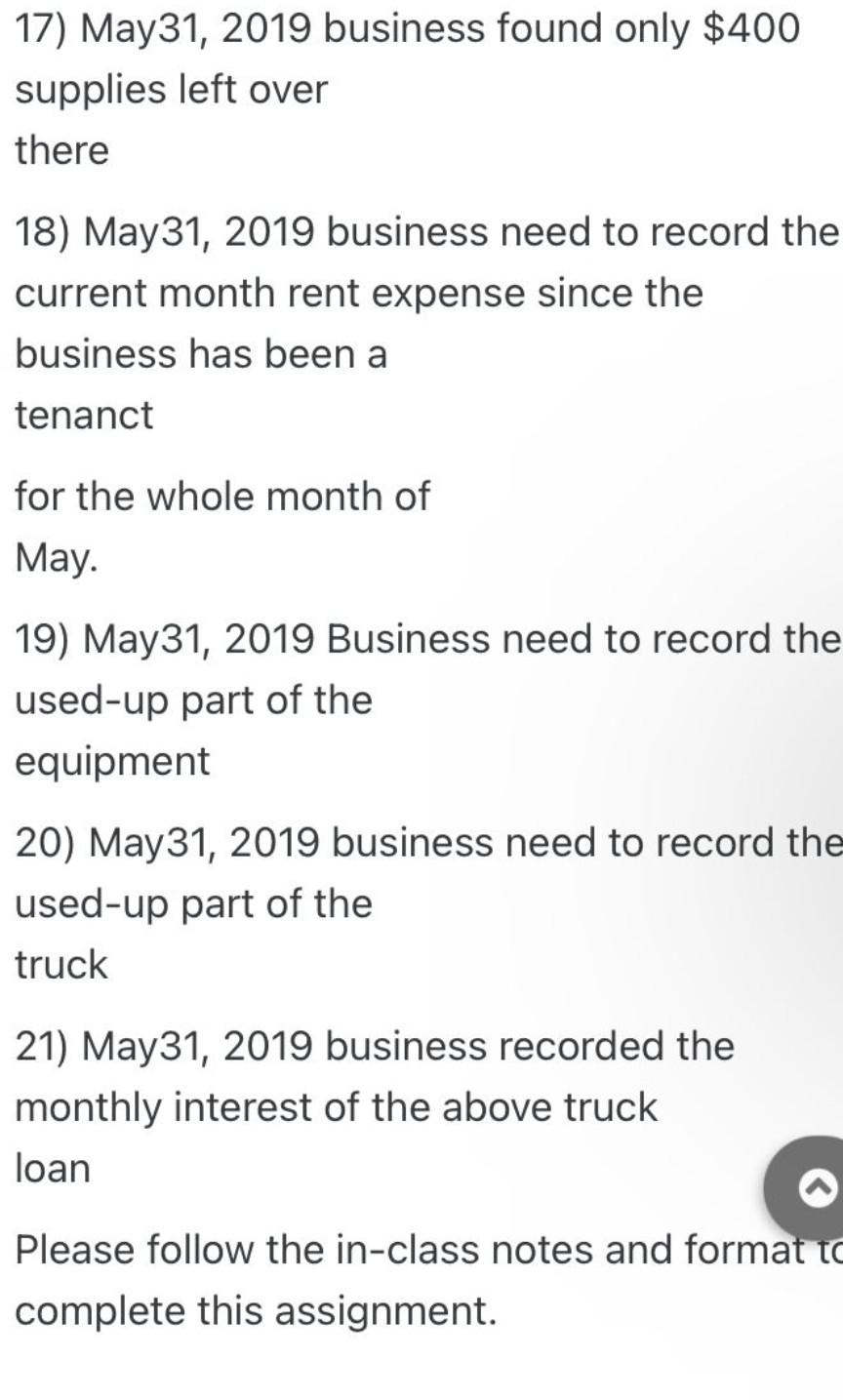

6) May3, 2019 business use the 5 year auto financing $24,000 to purchase a truck ( Loan interest is 10%, which will be paid at the end of 5 years with the principal and truck's useful life is 5 years) 7)May5, 2019 business signed a Project\#1 $35,000 agreement. The project will be finished during the month and hired a group of contractors to help the project\#1 8)May7, 2019 business paid the owing money for the purchase of the supplies in transaction 2) 9)May14, 2019 business paid the front desk employee $1,500 wages in cash 10)May15, 2019 business completed the project\#1 and received the money $35,000 11) May16, 2019 business paid $10,000 to contractors for help to complete the Project\# 14) May18, 2019 business owner withdrew $3,000 cash from the business bank acc 15) May28, 2019 business paid front employee wages again in cash 16) May30, 2019 received the utillity bill $80 for the electricity and energy used during the month paid in cash 17) May31, 2019 business found only $400 supplies left over there 18) May31, 2019 business need to record the current month rent expense since the business has been a tenanct for the whole month of May. 19) May31, 2019 Business need to record the used-up part of the equipment 20) May31, 2019 business need to record used-up part of the truck 21) Mav31. 2019 business recorded the 1) May1, 2019 Business owner open Renovation\& design company and investe $300,000 in business bank account 2) May1, 2019 Business bought supplies $1000, but the money will be paid in the future 3)May1, 2019 business paid a one year re for $24,000 4) May2, 2019 Business bought a comput and a printer for $9,000 paid in cash, the useful life of t machine is 10 years 5) May3, 2019 business bought the floor materials required to complete upcoming renovation Project\#1 for $350 paid in cash 6) May3, 2019 business use the 5 year au financing $24,000 to purchase a truck ( Loan interest is 10%, which will be paid the end of 5 years with the principal and truck's useful life is 5 years) 8)May7, 2019 business paid the owing money for the purchase of the supplies in transaction 2) 9)May14, 2019 business paid the front desk employee $1,500 wages in cash 10)May15, 2019 business completed the project\#1 and received the money $35,000 11) May16, 2019 business paid $10,000 to the contractors for help to complete the Project\# 12) May 16, 2019 business confirm $2000 materials already been used for project\#1 13) May 17, 2019 business complete the basement design service project\#2 $8,000 for the customer. The money will be received in the near future 14) May18, 2019 business owner withdrew $3,000 cash from the business bank acc 15) May28, 2019 business paid front employee wages again in rachStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started