Question

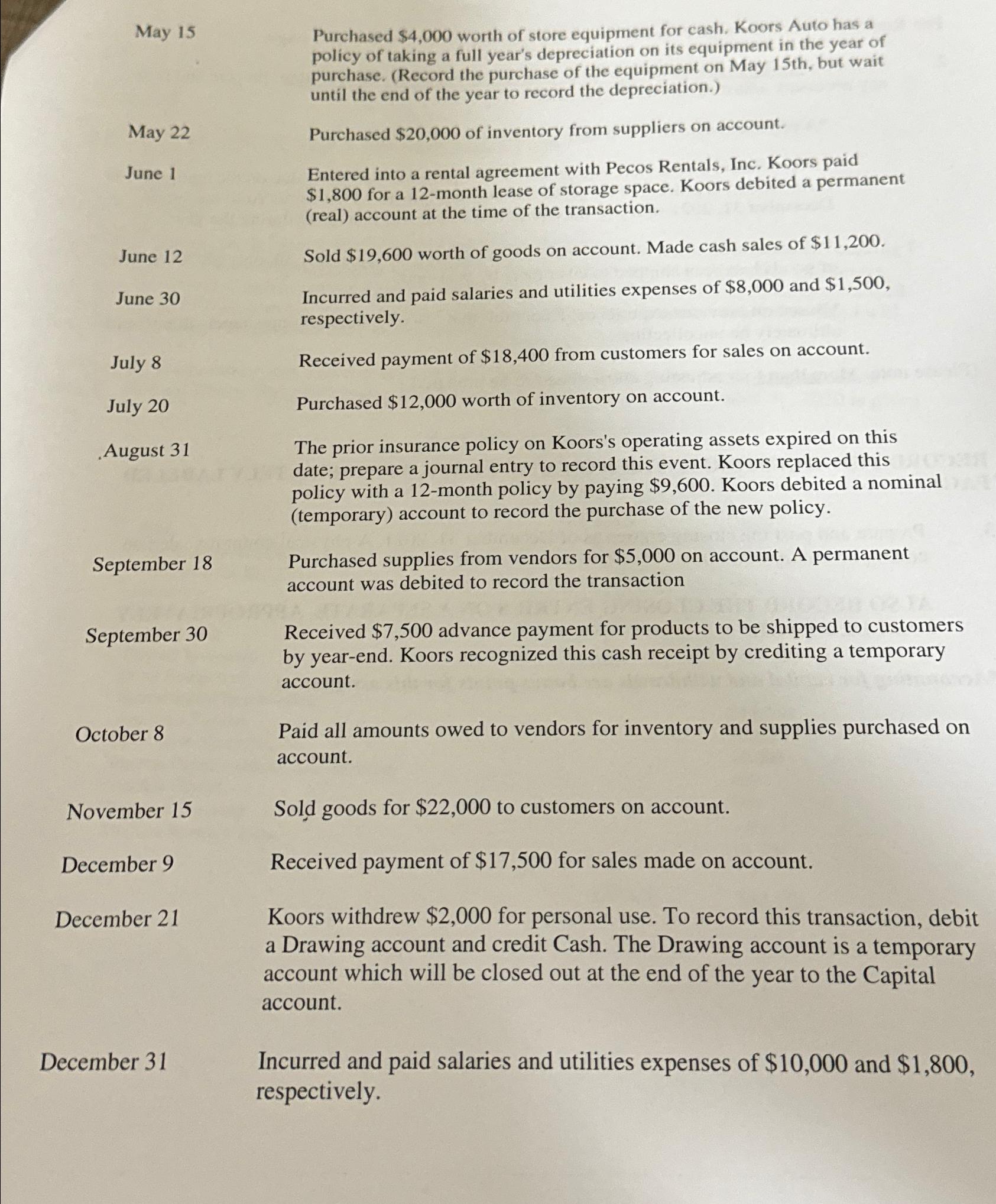

May 15 May 22 June 1 June 12 June 30 July 8 July 20 August 31 September 18 September 30 October 8 November 15 December

May 15\ May 22\ June 1\ June 12\ June 30\ July 8\ July 20\ August 31\ September 18\ September 30\ October 8\ November 15\ December 9\ December 21\ December 31\ Purchased

$4,000worth of store equipment for cash. Koors Auto has a policy of taking a full year's depreciation on its equipment in the year of purchase. (Record the purchase of the equipment on May 15th, but wait until the end of the year to record the depreciation.)\ Purchased

$20,000of inventory from suppliers on account.\ Entered into a rental agreement with Pecos Rentals, Inc. Koors paid

$1,800for a 12-month lease of storage space. Koors debited a permanent (real) account at the time of the transaction.\ Sold

$19,600worth of goods on account. Made cash sales of

$11,200.\ Incurred and paid salaries and utilities expenses of

$8,000and

$1,500, respectively.\ Received payment of

$18,400from customers for sales on account.\ Purchased

$12,000worth of inventory on account.\ The prior insurance policy on Koors's operating assets expired on this date; prepare a journal entry to record this event. Koors replaced this policy with a 12-month policy by paying

$9,600. Koors debited a nominal (temporary) account to record the purchase of the new policy.\ Purchased supplies from vendors for

$5,000on account. A permanent account was debited to record the transaction\ Received

$7,500advance payment for products to be shipped to customers by year-end. Koors recognized this cash receipt by crediting a temporary account.\ Paid all amounts owed to vendors for inventory and supplies purchased on account.\ Sold goods for

$22,000to customers on account.\ Received payment of

$17,500for sales made on account.\ Koors withdrew

$2,000for personal use. To record this transaction, debit a Drawing account and credit Cash. The Drawing account is a temporary account which will be closed out at the end of the year to the Capital account.\ Incurred and paid salaries and utilities expenses of

$10,000and

$1,800, respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started