Question

May I have help with question 1 and 2? Image transcription text Assume you are practicing as a CPA. Fontenot Corporation has been your

May I have help with question 1 and 2?

Image transcription text

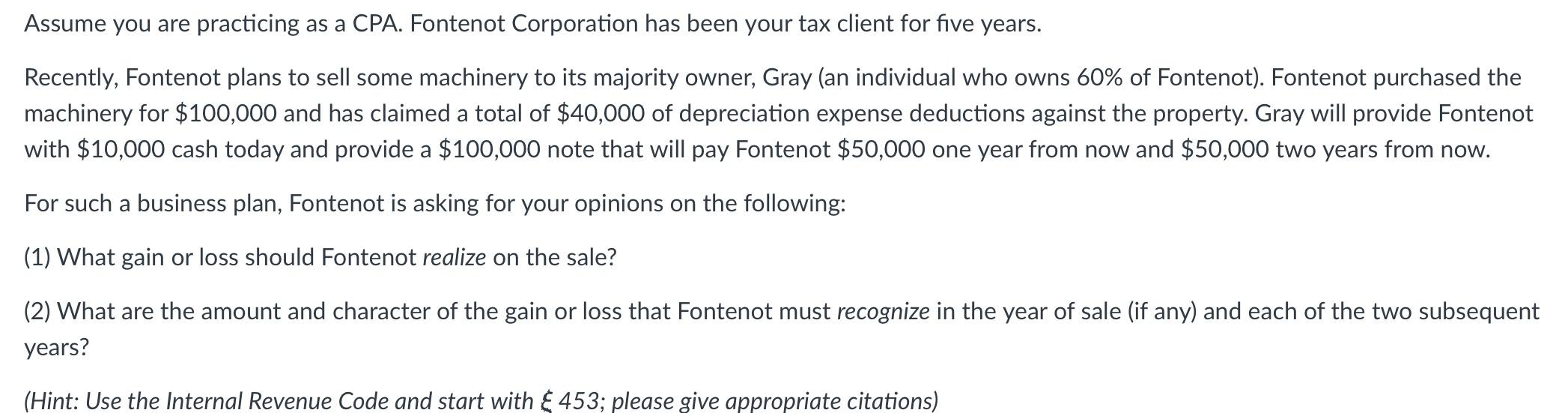

Assume you are practicing as a CPA. Fontenot Corporation has been your tax client for five years. Recently, Fontenot plans to sell some machinery to its majority owner, Gray (an individual who owns 60% of Fontenot). Fontenot purchased the machinery for $100,000 and has claimed a total of $40,000 of depreciation expense deductions against the property. Gray will provide Fontenot with $10,000 cash today and provide a $100,000 note that will pay Fontenot $50,000 one year from now and $50,000 two years from now. For such a business plan, Fontenot is asking for your opinions on the following: (1) What gain or loss should Fontenot realize on the sale? (2) What are the amount and character of the gain or loss that Fontenot must recognize in the year of sale (if any) and each of the two subsequent years? (Hint: Use the internal Revenue Code and start with E 453; please give appropriate citations)

Assume you are practicing as a CPA. Fontenot Corporation has been your tax client for five years. Recently, Fontenot plans to sell some machinery to its majority owner, Gray (an individual who owns 60% of Fontenot). Fontenot purchased the machinery for $100,000 and has claimed a total of $40,000 of depreciation expense deductions against the property. Gray will provide Fontenot with $10,000 cash today and provide a $100,000 note that will pay Fontenot $50,000 one year from now and $50,000 two years from now. For such a business plan, Fontenot is asking for your opinions on the following: (1) What gain or loss should Fontenot realize on the sale? (2) What are the amount and character of the gain or loss that Fontenot must recognize in the year of sale (if any) and each of the two subsequent years? (Hint: Use the Internal Revenue Code and start with $453; please give appropriate citations)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started