Answered step by step

Verified Expert Solution

Question

1 Approved Answer

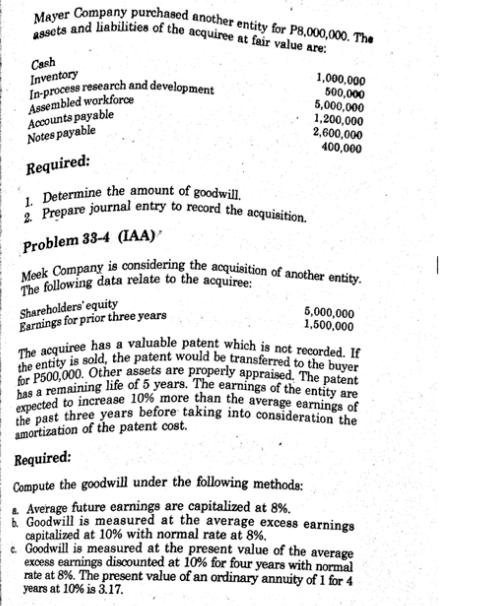

Mayer Company purchased another entity for P8,000,000. The assets and liabilities of the acquiree at fair value are: Cash Inventory In-process research and development

Mayer Company purchased another entity for P8,000,000. The assets and liabilities of the acquiree at fair value are: Cash Inventory In-process research and development Assembled workforce Accounts payable Notes payable Required: 1,000,000 500,000 5,000,000 1,200,000 2,600,000 400,000 1. Determine the amount of goodwill. 2. Prepare journal entry to record the acquisition. Problem 33-4 (IAA) Meek Company is considering the acquisition of another entity. The following data relate to the acquiree: Shareholders' equity Earnings for prior three years 5,000,000 1,500,000 The acquiree has a valuable patent which is not recorded. If the entity is sold, the patent would be transferred to the buyer for P500,000. Other assets are properly appraised. The patent expected to increase 10% more than the average earnings of has a remaining life of 5 years. The earnings of the entity are the past three years before taking into consideration the amortization of the patent cost. Required: Compute the goodwill under the following methods: & Average future earnings are capitalized at 8%. Goodwill is measured at the average excess earnings capitalized at 10% with normal rate at 8%. e. Goodwill is measured at the present value of the average excess earnings discounted at 10% for four years with normal rate at 8%. The present value of an ordinary annuity of 1 for 4 years at 10% is 3.17.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Determine the Amount of Goodwill Fair Value of Identifiable Net Assets Cash Inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started