Answered step by step

Verified Expert Solution

Question

1 Approved Answer

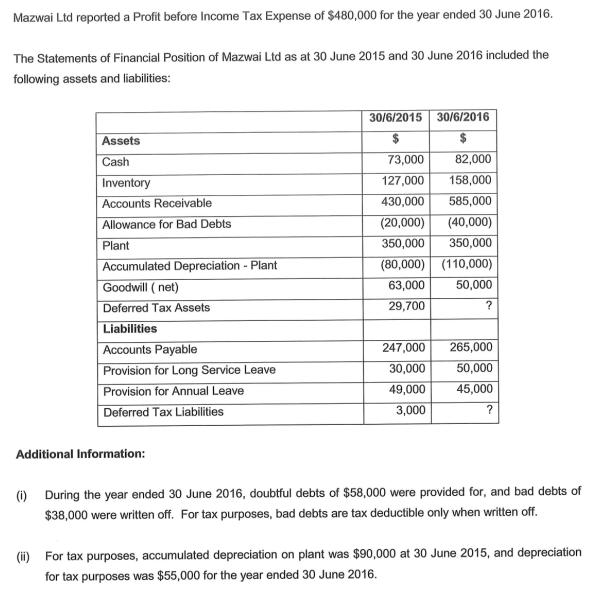

Mazwai Ltd reported a Profit before Income Tax Expense of $480,000 for the year ended 30 June 2016. The Statements of Financial Position of

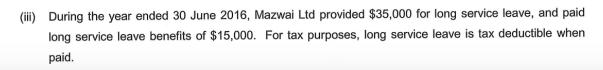

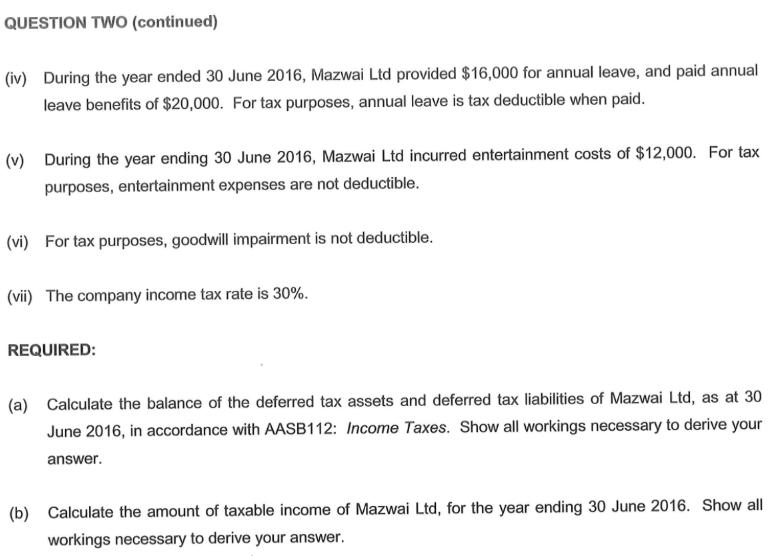

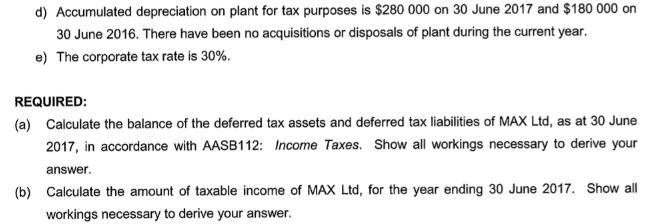

Mazwai Ltd reported a Profit before Income Tax Expense of $480,000 for the year ended 30 June 2016. The Statements of Financial Position of Mazwai Ltd as at 30 June 2015 and 30 June 2016 included the following assets and liabilities: Assets 30/6/2015 $ 30/6/2016 $ Cash Inventory Accounts Receivable Allowance for Bad Debts Plant 73,000 82,000 127,000 158,000 430,000 585,000 (20,000) (40,000) 350,000 350,000 Accumulated Depreciation - Plant (80,000) (110,000) Goodwill (net) 63,000 50,000 Deferred Tax Assets 29,700 ? Liabilities Accounts Payable 247,000 265,000 Provision for Long Service Leave 30,000 50,000 Provision for Annual Leave 49,000 45,000 Deferred Tax Liabilities 3,000 ? Additional Information: (i) During the year ended 30 June 2016, doubtful debts of $58,000 were provided for, and bad debts of $38,000 were written off. For tax purposes, bad debts are tax deductible only when written off. (ii) For tax purposes, accumulated depreciation on plant was $90,000 at 30 June 2015, and depreciation for tax purposes was $55,000 for the year ended 30 June 2016. (iii) During the year ended 30 June 2016, Mazwai Ltd provided $35,000 for long service leave, and paid long service leave benefits of $15,000. For tax purposes, long service leave is tax deductible when paid. QUESTION TWO (continued) (iv) During the year ended 30 June 2016, Mazwai Ltd provided $16,000 for annual leave, and paid annual leave benefits of $20,000. For tax purposes, annual leave is tax deductible when paid. (v) During the year ending 30 June 2016, Mazwai Ltd incurred entertainment costs of $12,000. For tax purposes, entertainment expenses are not deductible. (vi) For tax purposes, goodwill impairment is not deductible. (vii) The company income tax rate is 30%. REQUIRED: (a) Calculate the balance of the deferred tax assets and deferred tax liabilities of Mazwai Ltd, as at 30 June 2016, in accordance with AASB112: Income Taxes. Show all workings necessary to derive your answer. (b) Calculate the amount of taxable income of Mazwai Ltd, for the year ending 30 June 2016. Show all workings necessary to derive your answer. You have been asked by the management of MAX Ltd to assist with the preparation of the income tax entries for the year ended 30 June 2017. The company reported a profit before tax for the year to 30 June 2017 of $900 000. The company's statements of financial position include assets and liabilities as follows: Accounts receivable 2017 $ 245 000 2016 $ 200 000 Allowance for doubtful debts (20 000) (10000) Plant - at cost 600 000 600 000 Accumulated depreciation (190 000) (120 000) Development asset - at cost 360 000 200 000 Accumulated amortisation (130 000) (80 000) Interest receivable 10 000 20 000 Provision for long-service leave 48 000 62 000 Deferred tax asset ? 21600 Deferred tax liability ? 60 000 Additional Information: a) The company is entitled to claim a tax deduction of 125% on development costs when incurred. b) Interest revenue of $10 000 is included in the profit for the year to 30 June 2017. c) Expenses included in profit for the year to 30 June 2017 are as follows: 1. parking and other fines $10 000 II. III. IV. depreciation expense for plant $70 000 doubtful debts expense $25 000 amortisation of development asset $50 000 V. long-service leave expense $36 000. d) Accumulated depreciation on plant for tax purposes is $280 000 on 30 June 2017 and $180 000 on 30 June 2016. There have been no acquisitions or disposals of plant during the current year. e) The corporate tax rate is 30%. REQUIRED: (a) Calculate the balance of the deferred tax assets and deferred tax liabilities of MAX Ltd, as at 30 June 2017, in accordance with AASB112: Income Taxes. Show all workings necessary to derive your answer. (b) Calculate the amount of taxable income of MAX Ltd, for the year ending 30 June 2017. Show all workings necessary to derive your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Deferred Tax Assets 3062015 29700 Deferred Tax Liabilities 3062015 3000 Accumulated Deprec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started