MBA - Accounting, Finance, & Economics.

Develop a 12-month cash flow forecast in excel for RMD Enterprises. Information on RMD Enterprises is provided in the summary document of the assignment.

After completing the forecast, construct a 1-2 page review of your forecast that includes a listing of specific strengths and weaknesses for the organization. Be sure to explain the significance of both strengths and weaknesses.

Question: List the strengths and weaknesses for the organization as well as explaining the significance of both strengths and weaknesses.

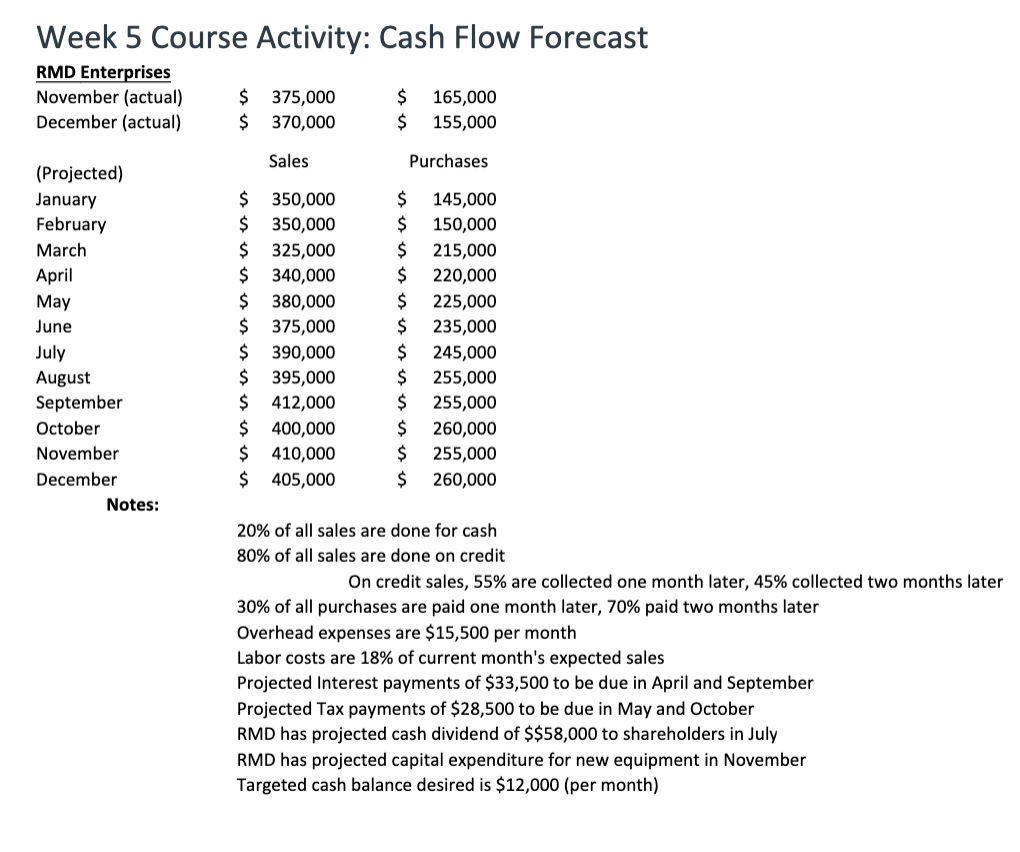

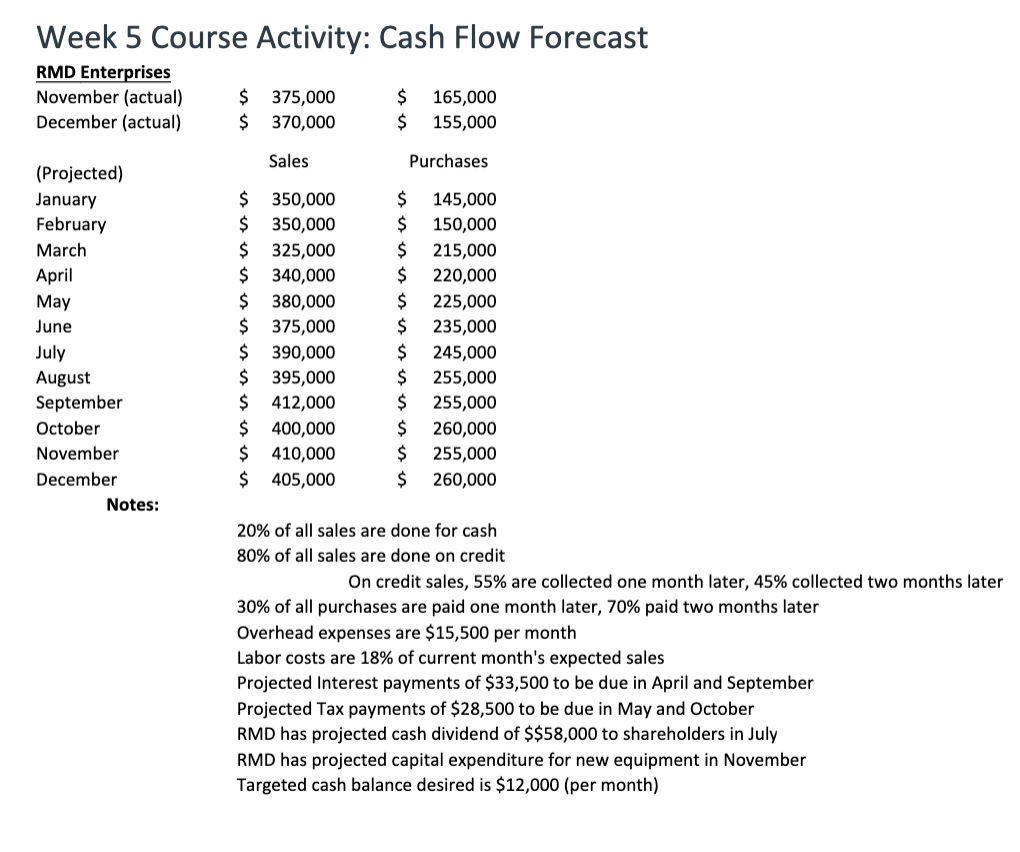

Below is RMD Enterprises Summary Document

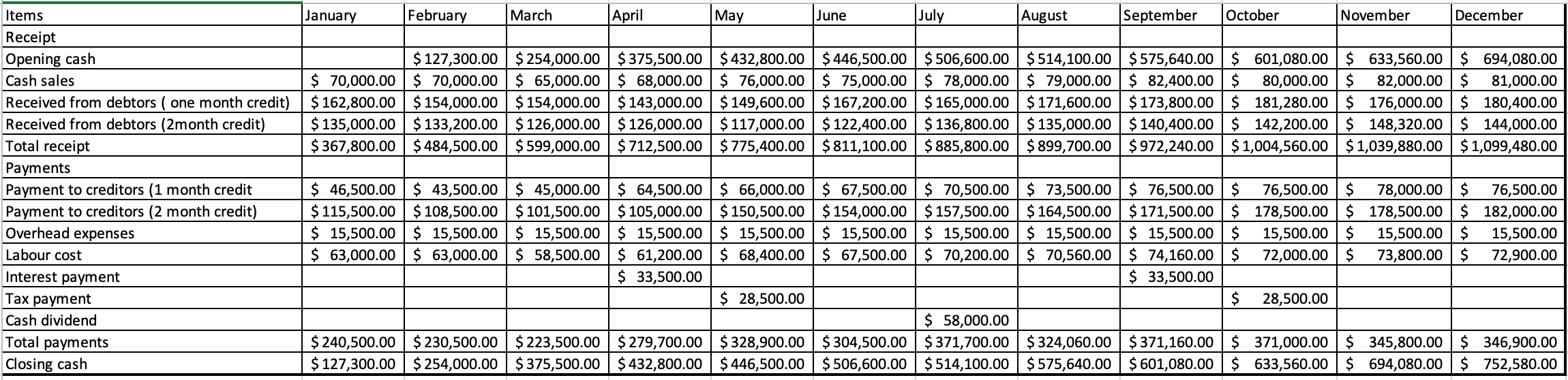

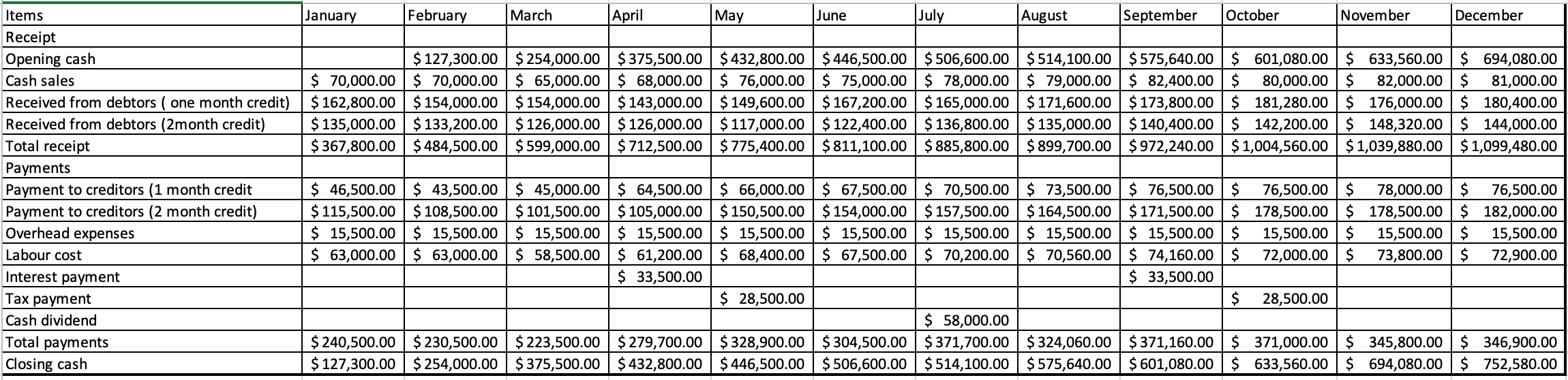

Below is the 12 month cash flow forecast that was developed from the above summary.

Week 5 Course Activity: Cash Flow Forecast RMD Enterprises November (actual) $375,000 $ 165,000 December (actual) $ 370,000 $ 155,000 Sales Purchases (Projected) January February March April May June $ 350,000 $ 350,000 $ 325,000 $ 340,000 $ 380,000 $ 375,000 $ 390,000 $ 395,000 $ 412,000 $ 400,000 $ 410,000 $ 405,000 $ 145,000 $ 150,000 $ 215,000 $ 220,000 $ 225,000 $ 235,000 $ 245,000 $ 255,000 $ 255,000 $ 260,000 $ 255,000 $ 260,000 July August September October November December Notes: 20% of all sales are done for cash 80% of all sales are done on credit On credit sales, 55% are collected one month later, 45% collected two months later 30% of all purchases are paid one month later, 70% paid two months later Overhead expenses are $15,500 per month Labor costs are 18% of current month's expected sales Projected Interest payments of $33,500 to be due in April and September Projected Tax payments of $28,500 to be due in May and October RMD has projected cash dividend of $$58,000 to shareholders in July RMD has projected capital expenditure for new equipment in November Targeted cash balance desired is $12,000 (per month) January February March April May June July August September October November December $ 127,300.00 $ 254,000.00 $375,500.00 $ 432,800.00 $ 446,500.00 $ 506,600.00 $ 514,100.00 $ 575,640.00 $ 601,080.00 $ 633,560.00 $ 694,080.00 $ 70,000.00 $ 70,000.00 $ 65,000.00 $ 68,000.00 $ 76,000.00 $ 75,000.00 $ 78,000.00 $ 79,000.00 $ 82,400.00 $ 80,000.00 $ 82,000.00 $ 81,000.00 $ 162,800.00 $ 154,000.00 $ 154,000.00 $ 143,000.00 $ 149,600.00 $ 167,200.00 $ 165,000.00 $ 171,600.00 $ 173,800.00 $ 181,280.00 $ 176,000.00 $ 180,400.00 $ 135,000.00 $ 133,200.00 $ 126,000.00 $ 126,000.00 $ 117,000.00 $ 122,400.00 $ 136,800.00 $ 135,000.00 $ 140,400.00 $ 142,200.00 $ 148,320.00$ 144,000.00 $367,800.00 $ 484,500.00 $ 599,000.00 $ 712,500.00 $ 775,400.00 $ 811,100.00 $ 885,800.00 $ 899,700.00 $ 972,240.00 $ 1,004,560.00 $ 1,039,880.00 $ 1,099,480.00 Items Receipt Opening cash Cash sales Received from debtors ( one month credit) Received from debtors (2month credit) Total receipt Payments Payment to creditors (1 month credit Payment to creditors (2 month credit) Overhead expenses Labour cost Interest payment Tax payment Cash dividend Total payments Closing cash $ 46,500.00 $ 43,500.00 $ 45,000.00 $ 64,500.00 $ 66,000.00 $ 67,500.00 $ 70,500.00 $ 73,500.00 $ 76,500.00 $ 76,500.00 $ 78,000.00 $ 76,500.00 $ 115,500.00 $ 108,500.00 $ 101,500.00 $ 105,000.00 $ 150,500.00 $ 154,000.00 $ $ 157,500.00 $ 164,500.00 $ 171,500.00 $ 178,500.00 $ 178,500.00 $ 182,000.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 15,500.00 $ 63,000.00 $ 63,000.00 $ 58,500.00 $ 61,200.00 $ 68,400.00 $ 67,500.00 $ 70,200.00 $ 70,560.00 $ 74,160.00 $ 72,000.00 $ 73,800.00 $ 72,900.00 $ 33,500.00 $ 33,500.00 $ 28,500.00 $ 28,500.00 $ 58,000.00 $ 240,500.00 $ 230,500.00 $ 223,500.00 $ 279,700.00 $ 328,900.00 $ 304,500.00 $ 371,700.00 $ 324,060.00 $ 371,160.00 $ 371,000.00 $ 345,800.00 $ 346,900.00 $ 127,300.00 $ 254,000.00 $375,500.00 $ 432,800.00 $ 446,500.00 $ 506,600.00 $ 514,100.00 $575,640.00 $ 601,080.00 $ 633,560.00 $ 694,080.00 $ 752,580.00