Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MBA Finance Course - I am lost. Need detailed guidance on what values to plug in to correct formulas. Near the beginning of COVID-19, interest

MBA Finance Course - I am lost. Need detailed guidance on what values to plug in to correct formulas.

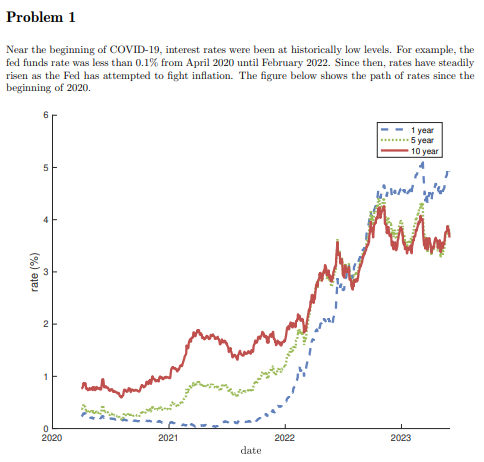

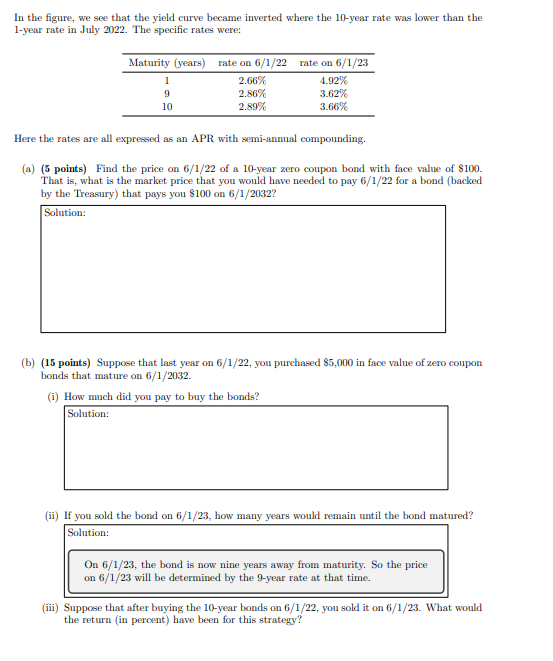

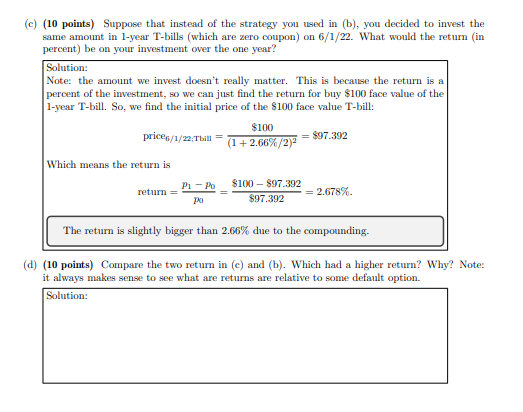

Near the beginning of COVID-19, interest rates were been at historically low levels. For example, the fed funds rate was less than 0.1% from April 2020 until February 2022. Since then, rates have steadily risen as the Fed has attempted to fight inflation. The figure below shows the path of rates since the beginning of 2020 . In the figure, we see that the yield curve became inverted where the 10-year rate was lower than the 1-year rate in July 2022 . The specific rates were: Here the rates are all expressed as an APR with semi-annual compounding. (a) (5 points) Find the price on 6/1/22 of a 10-year zero coupon bond with face value of 8100 . That is, what is the market price that you would have needed to pay 6/1/22 for a bond (backed by the Treasury) that pays you $100 on 6/1/2032 ? (b) (15 points) Suppose that last year on 6/1/22, you purchased 85,000 in face value of zero coupon bonds that mature on 6/1/2032. (i) How much did you pay to buy the bonds? Solution: (ii) If you sold the bond on 6/1/23, how many years would remain until the bond matured? Solution: On 6/1/23, the bond is now nine years away from maturity. So the price on 6/1/23 will be determined by the 9 -year rate at that time. (iii) Suppose that after buying the 10-year bonds on 6/1/22, you sold it on 6/1/23. What would the return (in percent) have been for this strategy? c) (10 points) Suppose that instead of the strategy you used in (b), you decided to invest the same amount in 1-year T-bills (which are zero coupon) on 6/1/22. What would the return (in percent) be on your investment over the one year? Solution: Note: the amount we invest doesn't really matter. This is because the return is a percent of the investment, so we can just find the return for buy $100 face value of the 1-year T-bill. So, we find the initial price of the $100 face value T-bill: price6/1/22,Tbill=(1+2.66%/2)2$100=$97.392 Which means the return is return=p0p1p0=$97.392$100$97.392=2.678%. The return is slightly bigger than 2.66% due to the compounding. d) (10 points) Compare the two return in (c) and (b). Which had a higher return? Why? Note: it always makes sense to see what are returns are relative to some default option

Near the beginning of COVID-19, interest rates were been at historically low levels. For example, the fed funds rate was less than 0.1% from April 2020 until February 2022. Since then, rates have steadily risen as the Fed has attempted to fight inflation. The figure below shows the path of rates since the beginning of 2020 . In the figure, we see that the yield curve became inverted where the 10-year rate was lower than the 1-year rate in July 2022 . The specific rates were: Here the rates are all expressed as an APR with semi-annual compounding. (a) (5 points) Find the price on 6/1/22 of a 10-year zero coupon bond with face value of 8100 . That is, what is the market price that you would have needed to pay 6/1/22 for a bond (backed by the Treasury) that pays you $100 on 6/1/2032 ? (b) (15 points) Suppose that last year on 6/1/22, you purchased 85,000 in face value of zero coupon bonds that mature on 6/1/2032. (i) How much did you pay to buy the bonds? Solution: (ii) If you sold the bond on 6/1/23, how many years would remain until the bond matured? Solution: On 6/1/23, the bond is now nine years away from maturity. So the price on 6/1/23 will be determined by the 9 -year rate at that time. (iii) Suppose that after buying the 10-year bonds on 6/1/22, you sold it on 6/1/23. What would the return (in percent) have been for this strategy? c) (10 points) Suppose that instead of the strategy you used in (b), you decided to invest the same amount in 1-year T-bills (which are zero coupon) on 6/1/22. What would the return (in percent) be on your investment over the one year? Solution: Note: the amount we invest doesn't really matter. This is because the return is a percent of the investment, so we can just find the return for buy $100 face value of the 1-year T-bill. So, we find the initial price of the $100 face value T-bill: price6/1/22,Tbill=(1+2.66%/2)2$100=$97.392 Which means the return is return=p0p1p0=$97.392$100$97.392=2.678%. The return is slightly bigger than 2.66% due to the compounding. d) (10 points) Compare the two return in (c) and (b). Which had a higher return? Why? Note: it always makes sense to see what are returns are relative to some default option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started