Answered step by step

Verified Expert Solution

Question

1 Approved Answer

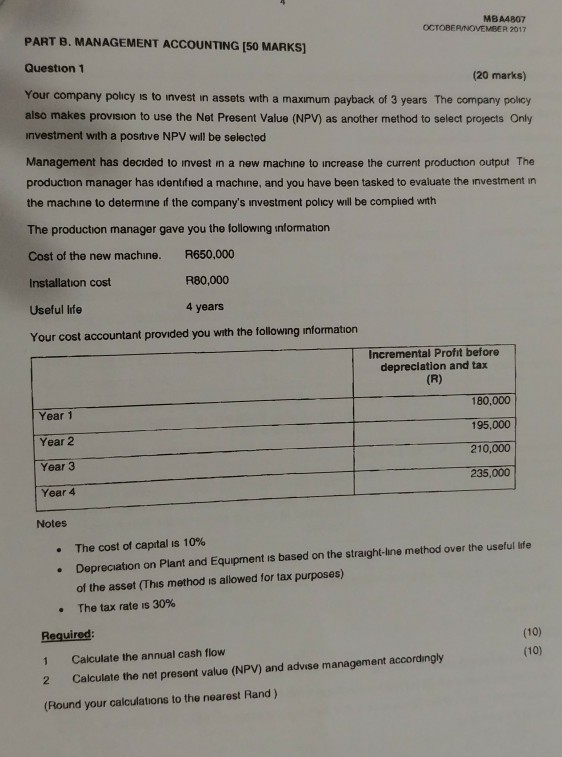

MBA4807 OCTOBERUNOVEMBER 2017 PART B. MANAGEMENT ACCOUNTING (50 MARKS] Question 1 (20 marks) Your company policy is to invest in assets with a maximum payback

MBA4807 OCTOBERUNOVEMBER 2017 PART B. MANAGEMENT ACCOUNTING (50 MARKS] Question 1 (20 marks) Your company policy is to invest in assets with a maximum payback of 3 years The company polkcy also makes provision to use the Net Present Value (NPV) as another method to select projects Only investment with a positive NPV will be selected Management has decided to invest in a new machine to increase the current production output The production manager has identfied a machine, and you have been tasked to evaluate the investment in the machine to determine f the company's investment policy will be complied with The production manager gave you the following information Cost of the new machine. R650,000 Installation cost Useful lIfe R80,000 4 years Your cost accountant provided you with the following information Incremental Proft before depreciation and tax Year 1 Year 2 Year 3 Year 4 180,000 195,000 210,000 235,000 Notes The cost of capital is 10% Depreciation on Plant and Equipment is based on the straight-ine method over the useful life of the asset (This method is allowed for tax purposes) . The tax rate is 30% Required: 1 Calculate the annual cash flow 2 Calculate the net present value (NPV) and advise management accordingly (Round your calculations to the nearest Rand )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started