Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MBACO has an annual production capacityof 20,000 units. The costs associated with the production and sale of the company's product are given below: LE

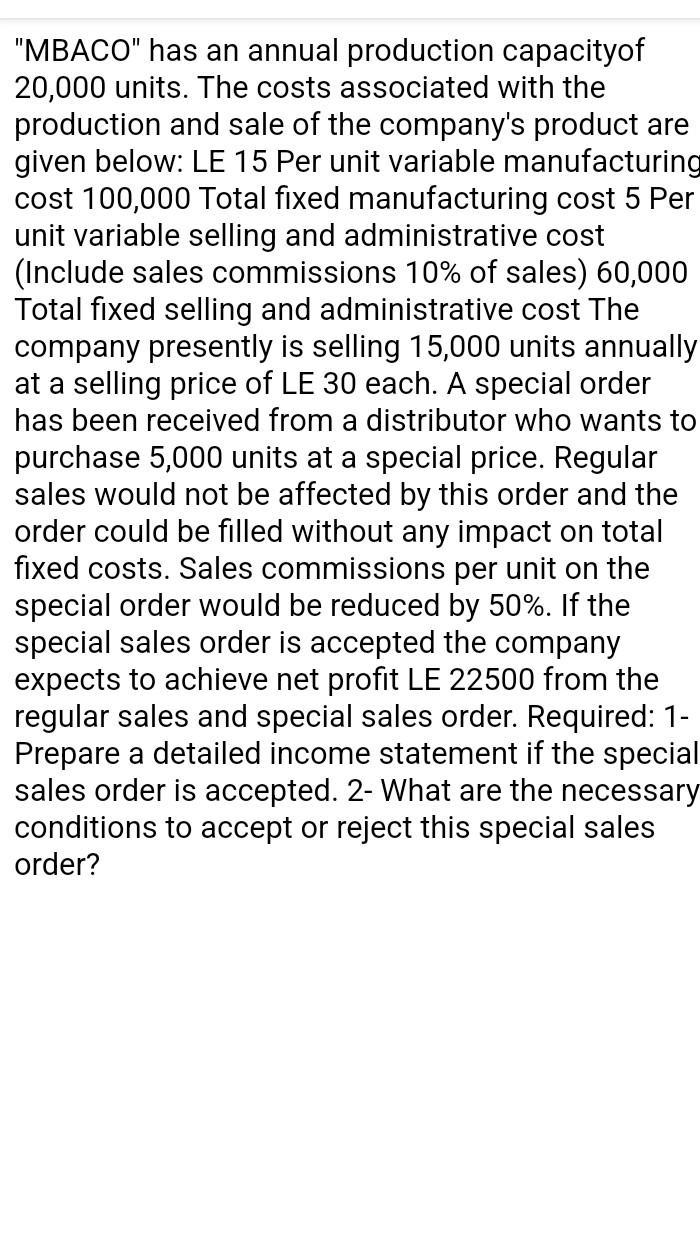

"MBACO" has an annual production capacityof 20,000 units. The costs associated with the production and sale of the company's product are given below: LE 15 Per unit variable manufacturing cost 100,000 Total fixed manufacturing cost 5 Per unit variable selling and administrative cost (Include sales commissions 10% of sales) 60,000 Total fixed selling and administrative cost The company presently is selling 15,000 units annually at a selling price of LE 30 each. A special order has been received from a distributor who wants to purchase 5,000 units at a special price. Regular sales would not be affected by this order and the order could be filled without any impact on total fixed costs. Sales commissions per unit on the special order would be reduced by 50%. If the special sales order is accepted the company expects to achieve net profit LE 22500 from the regular sales and special sales order. Required: 1- Prepare a detailed income statement if the special sales order is accepted. 2- What are the necessary conditions to accept or reject this special sales order?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Step1 Contribution Margin Selling price per unit less variable cost per unit equals contribution margin CM also known as dollar contribution per unit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started