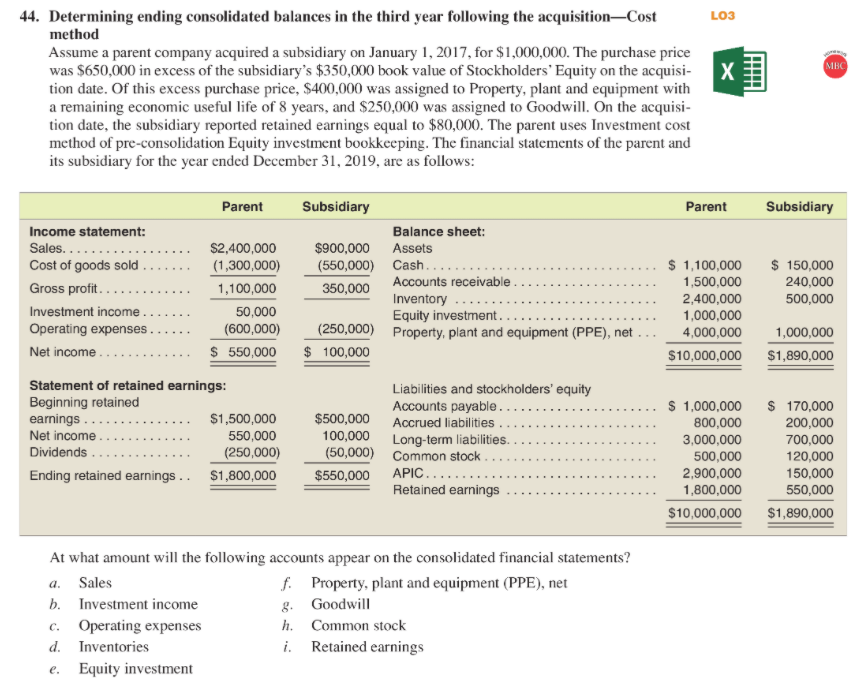

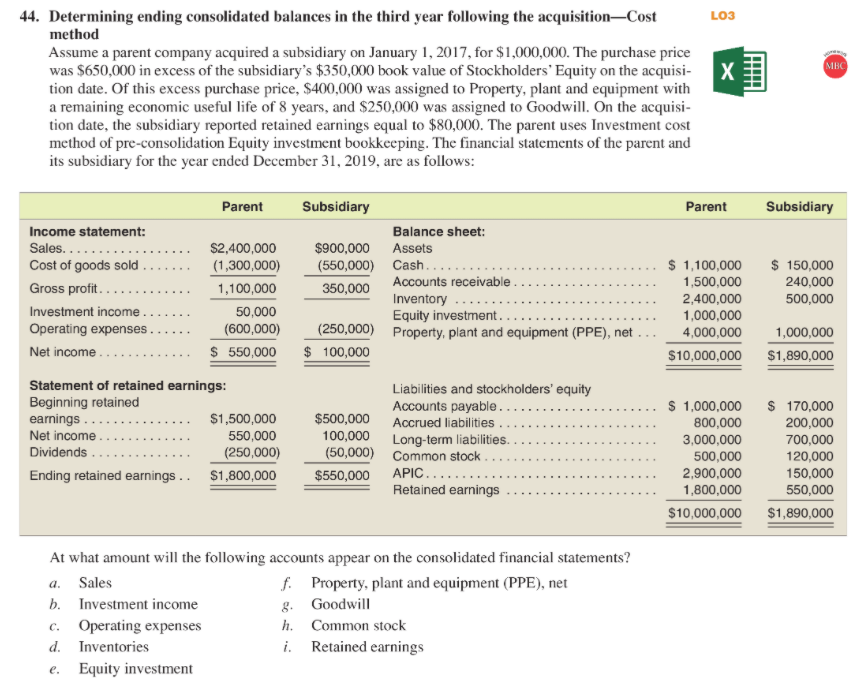

MBC 44. Determining ending consolidated balances in the third year following the acquisition-Cost LO3 method Assume a parent company acquired a subsidiary on January 1, 2017, for $1,000,000. The purchase price was $650,000 in excess of the subsidiary's $350,000 book value of Stockholders' Equity on the acquisi- X tion date. Of this excess purchase price, $400,000 was assigned to Property, plant and equipment with a remaining economic useful life of 8 years, and $250,000 was assigned to Goodwill. On the acquisi- tion date, the subsidiary reported retained earnings equal to $80,000. The parent uses Investment cost method of pre-consolidation Equity investment bookkeeping. The financial statements of the parent and its subsidiary for the year ended December 31, 2019, are as follows: Parent Parent Subsidiary Income statement: Sales... Cost of goods sold Gross profit. .. Investment income Operating expenses. Net income $2,400,000 (1,300,000) 1,100,000 50,000 (600,000) $ 550,000 Subsidiary Balance sheet: $900,000 Assets (550,000) Cash... 350,000 Accounts receivable Inventory Equity investment.... (250,000) Property, plant and equipment (PPE), net $ 100,000 $ 150,000 240,000 500,000 $ 1,100,000 1,500,000 2,400,000 1,000,000 4,000,000 $10,000,000 1,000,000 $1,890,000 Statement of retained earnings: Beginning retained earnings ... $1,500,000 Net income 550,000 Dividends (250,000) Ending retained earnings .. $1,800,000 Liabilities and stockholders' equity Accounts payable. $500,000 Accrued liabilities 100,000 Long-term liabilities. (50,000) Common stock $550,000 APIC....... Retained earnings $ 1,000,000 800,000 3,000,000 500,000 2,900,000 1,800,000 $10,000,000 $ 170,000 200,000 700,000 120,000 150,000 550,000 $1,890,000 At what amount will the following accounts appear on the consolidated financial statements? a. Sales f. Property, plant and equipment (PPE), net b. Investment income g. Goodwill c. Operating expenses h. Common stock d. Inventories i. Retained earnings Equity investment e. MBC 44. Determining ending consolidated balances in the third year following the acquisition-Cost LO3 method Assume a parent company acquired a subsidiary on January 1, 2017, for $1,000,000. The purchase price was $650,000 in excess of the subsidiary's $350,000 book value of Stockholders' Equity on the acquisi- X tion date. Of this excess purchase price, $400,000 was assigned to Property, plant and equipment with a remaining economic useful life of 8 years, and $250,000 was assigned to Goodwill. On the acquisi- tion date, the subsidiary reported retained earnings equal to $80,000. The parent uses Investment cost method of pre-consolidation Equity investment bookkeeping. The financial statements of the parent and its subsidiary for the year ended December 31, 2019, are as follows: Parent Parent Subsidiary Income statement: Sales... Cost of goods sold Gross profit. .. Investment income Operating expenses. Net income $2,400,000 (1,300,000) 1,100,000 50,000 (600,000) $ 550,000 Subsidiary Balance sheet: $900,000 Assets (550,000) Cash... 350,000 Accounts receivable Inventory Equity investment.... (250,000) Property, plant and equipment (PPE), net $ 100,000 $ 150,000 240,000 500,000 $ 1,100,000 1,500,000 2,400,000 1,000,000 4,000,000 $10,000,000 1,000,000 $1,890,000 Statement of retained earnings: Beginning retained earnings ... $1,500,000 Net income 550,000 Dividends (250,000) Ending retained earnings .. $1,800,000 Liabilities and stockholders' equity Accounts payable. $500,000 Accrued liabilities 100,000 Long-term liabilities. (50,000) Common stock $550,000 APIC....... Retained earnings $ 1,000,000 800,000 3,000,000 500,000 2,900,000 1,800,000 $10,000,000 $ 170,000 200,000 700,000 120,000 150,000 550,000 $1,890,000 At what amount will the following accounts appear on the consolidated financial statements? a. Sales f. Property, plant and equipment (PPE), net b. Investment income g. Goodwill c. Operating expenses h. Common stock d. Inventories i. Retained earnings Equity investment e