Answered step by step

Verified Expert Solution

Question

1 Approved Answer

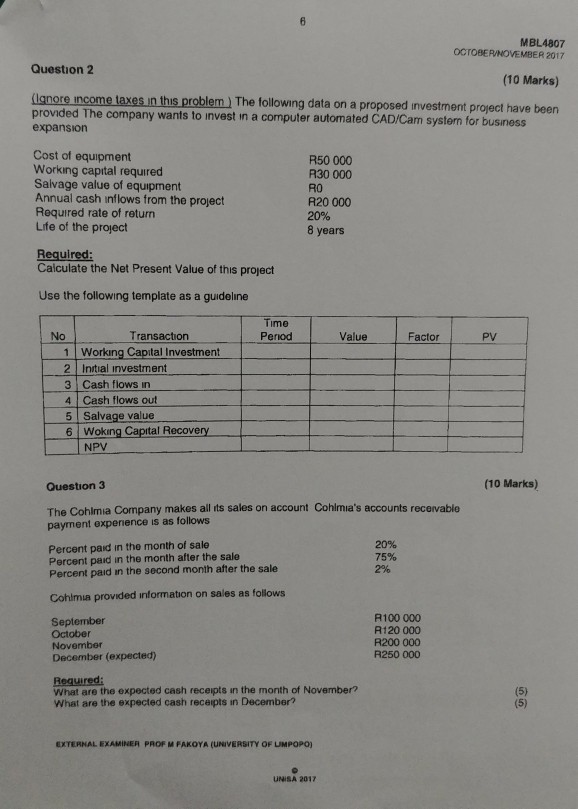

MBL4807 OCTOBER/NOVEMBER 2017 Question2 (10 Marks) lgnore income taxes in this problem) The following data on a proposed investment project have been provided The company

MBL4807 OCTOBER/NOVEMBER 2017 Question2 (10 Marks) lgnore income taxes in this problem) The following data on a proposed investment project have been provided The company wants to invest in a computer automated CAD/Cam system for business expansion Cost of equipment Working capital required Salvage value of equipment Annual cash inflows from the project Required rate of returr Life of the project R50 000 R30 000 R0 A20 000 20% 8 years Calculate the Net Present Value of this project Use the following template as a guideline Time Penod No Transaction Value Factor PV 1 Working Capital Investment 2 Intial investment 3 Cash flows in 4 Cash flows out 5 Salvage value 6 Woking Captal Recovery NPV (10 Marks) Question 3 The Cohlmia Company makes all its sales on account Cohlmia's accounts recevable payment expenence is as follows Percent paid in the month of sale Percent paid in the month after the sale Percent paid in the second month after the sale 20% 75% 2% Cohlmua provided information on sales as follows September October November December (expected) R100 000 A120 000 R200 000 R250 000 What are the expected cash receipts in the month of November? What are the expected cash receipts in December? EXTERNAL EXAMINER PROF M FAKOYA (UNIVERSITY OF UIMPOPO) UNISA 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started