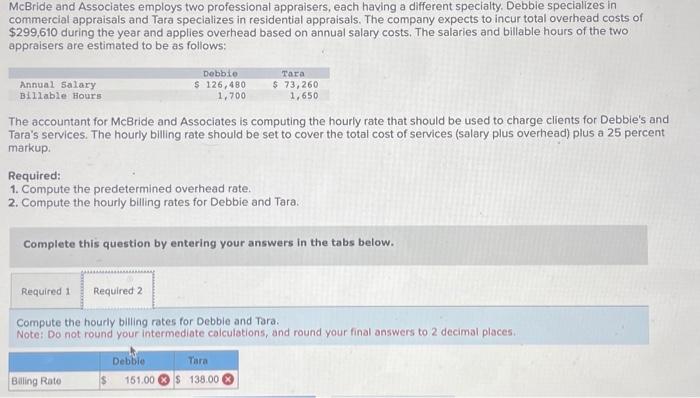

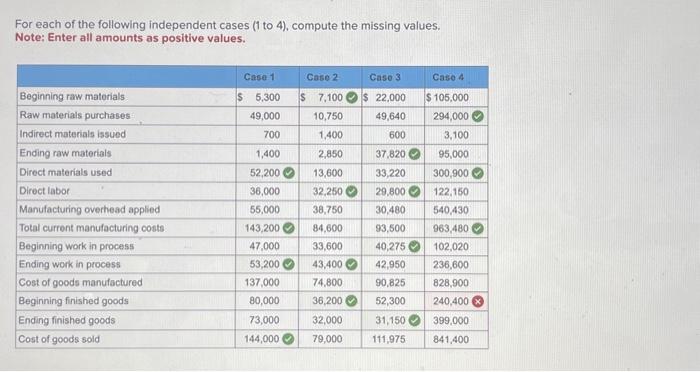

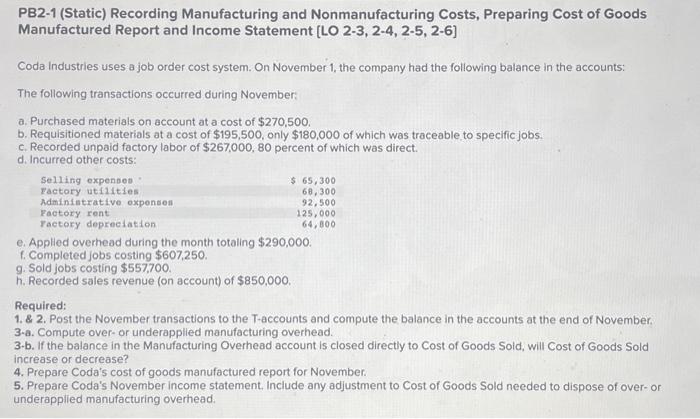

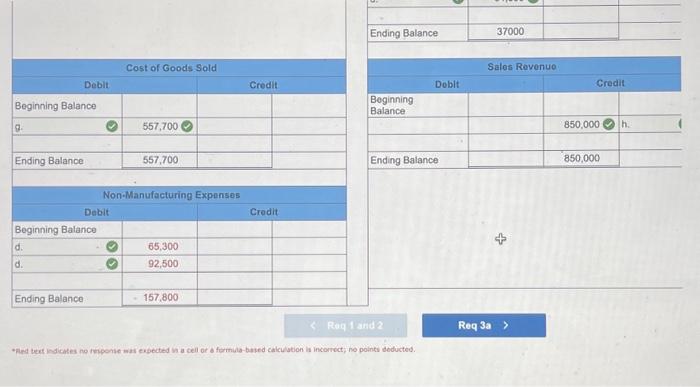

McBride and Associates employs two professional appraisers, each having a different specialty. Debbie specializes in commercial appraisals and Tara specializes in residential appraisals. The company expects to incur total overhead costs of $299,610 during the year and applies overhead based on annual salary costs. The salaries and billable hours of the two appraisers are estimated to be as follows: The accountant for McBride and Associates is computing the hourly rate that should be used to charge clients for Debble's and Tara's services. The hourly billing rate should be set to cover the total cost of services (salary plus overhead) plus a 25 percent markup. Required: 1. Compute the predetermined overhead rate. 2. Compute the hourly billing rates for Debbie and Tara. Complete this question by entering your answers in the tabs below. Compute the hourly billing rates for Debbie and Tara. Note: Do not round your intermediate colculations, and round your final answers to 2 decimal places. For each of the following independent cases (1 to 4), compute the missing values. Note; Enter all amounts as positive values. PB2-1 (Static) Recording Manufacturing and Nonmanufacturing Costs, Preparing Cost of Goods Manufactured Report and Income Statement [LO 2-3, 2-4, 2-5, 2-6] Coda Industries uses a job order cost system. On November 1 , the company had the following balance in the accounts: The following transactions occurred during November: a. Purchased materials on account at a cost of $270,500. b. Requisitioned materials at a cost of $195,500, only $180,000 of which was traceable to specific jobs. c. Recorded unpaid factory labor of $267,000,80 percent of which was direct. d. Incurred other costs: e. Applied overhead during the month totaling $290,000. f. Completed jobs costing $607,250. g. Sold jobs costing $557,700. h. Recorded sales revenue (on account) of $850,000. Required: 1. \& 2. Post the November transactions to the T-accounts and compute the balance in the accounts at the end of November. 3-a. Compute over- or underapplled manufacturing overhead. 3-b. If the balance in the Manufacturing Overhead account is closed directly to Cost of Goods Sold, will Cost of Goods Sold increase or decrease? 4. Prepare Coda's cost of goods manufactured report for November. 5. Prepare Coda's November income statement. Include any adjustment to Cost of Goods Sold needed to dispose of over- or underapplied manufacturing overhead. \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Sales Rovenue } \\ \hline \multicolumn{1}{|c|}{ Doblt } & \multicolumn{2}{c|}{ Credit } \\ \hline BoginningBalance & & & \\ \hline & & 850,000 & h. \\ \hline & & & \\ \hline Ending Balance & & 850,000 & \\ \hline \end{tabular}