Question

Wetherby Co purchased a machine on 1 July 20X7 for $500,000. It is being depreciated on a straight-line basis over its useful life of

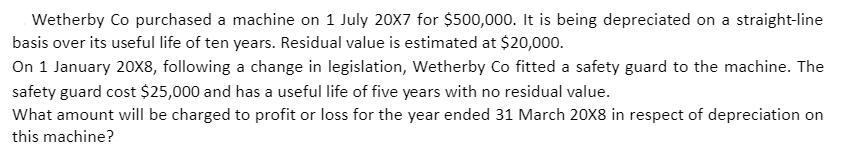

Wetherby Co purchased a machine on 1 July 20X7 for $500,000. It is being depreciated on a straight-line basis over its useful life of ten years. Residual value is estimated at $20,000. On 1 January 20X8, following a change in legislation, Wetherby Co fitted a safety guard to the machine. The safety guard cost $25,000 and has a useful life of five years with no residual value. What amount will be charged to profit or loss for the year ended 31 March 20X8 in respect of depreciation on this machine?

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation expense for the year en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Reporting Standards An Introduction

Authors: Belverd Needles, Marian Powers

2nd edition

053847680X, 978-1111793234, 1111793239, 978-0538476805

Students also viewed these Organizational Behavior questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App