Question

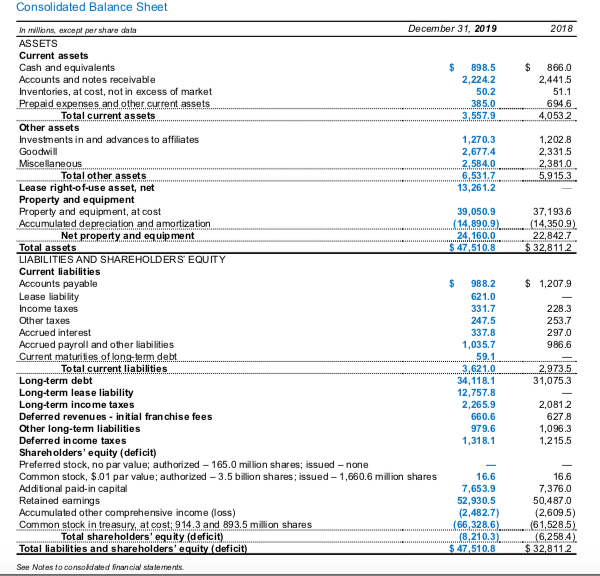

McDonald's - Prepare the Accounting Equation for years 2019 and 2018. Use - sign for negative amount, as needed. Use commas and decimal, as needed.

McDonald's - Prepare the Accounting Equation for years 2019 and 2018. Use "-" sign for negative amount, as needed. Use commas and decimal, as needed.

2019: _______ = __________. + __________

2018: _______ = ___________. + __________

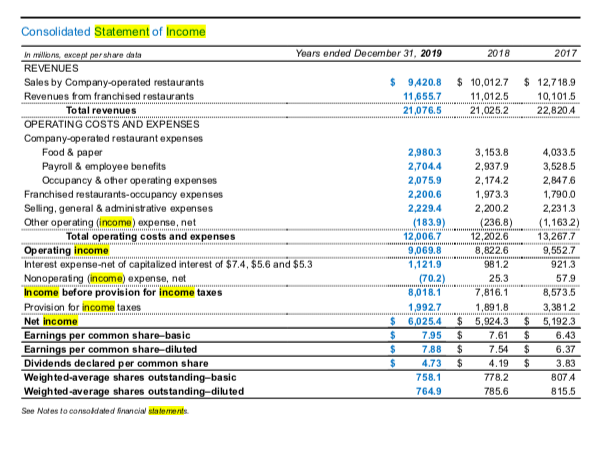

McDonalds: What is the Operating Income and the Net Income for 2019, 2018 and 2017? Use - sign for negative amount, as needed. Use commas and decimal, as needed.

2019: _______. ; _______ 2018: ________. ; ________ 2017: _________ ; ________

Two Parts: 1) McDonalds: What is McDonalds common stock symbol? _______ 2) McDonalds: What was McDonalds closing common stock price on July 31, 2020? $ ________ Use commas and decimal, as needed.

McDonalds: Compute McDonalds Net Worth for 2019 and 2018?

__________

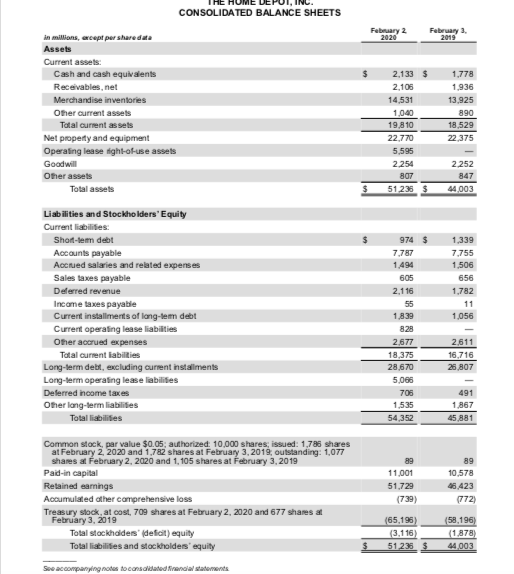

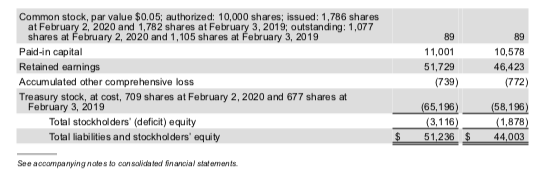

Home Depot: Prepare the Accounting Equation for 2020 and 2019. Use - sign for negative amount, as needed. Use commas, as needed.

2020: Blank 1. Fill in the blank_______ = Blank 2. Fill in the blank_______+ Blank 3. Fill in the blank_______ 2019: Blank 4. Fill in the blank_________ = Blank 5. Fill in the blank_________ + Blank 6. Fill in the blank_______

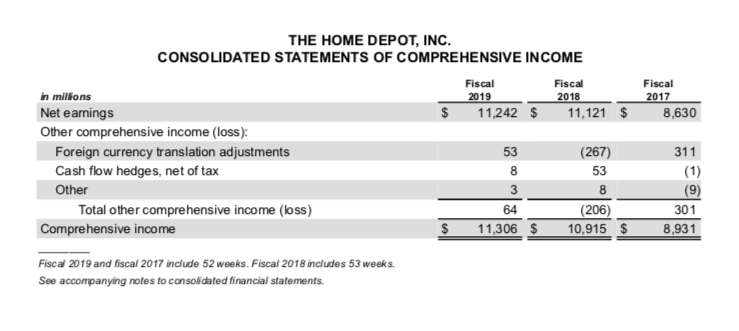

Home Depot: What is the Operating Income and the Net Earnings for 2019, 2018 and 2017? Use - sign for negative amount, as needed. Use commas and decimal, as needed. 2019: Blank 1. Fill in the blank________. ; Blank 2. Fill in the blank________ 2018: Blank 3. Fill in the blank_________. ; Blank 4. Fill in the blank________ 2017: Blank 5. Fill in the blank_______ ; Blank 6. Fill in the blank,________

Two Parts: 1) Home Depot: What is Home Depots common stock symbol? Blank 1. Fill in the blank________ 2) Home Depot: What was Home Depots closing common stock price on July 31, 2020? $ Blank 2. Fill in the blank_______ Use commas and decimal, as needed.

Home Depot: Compute Home Depots Net Worth for 2019 and 2018? 2020: Blank 1. Fill in the blank______ 2019: Blank 2. Fill in the blank,________

Consolidated Balance Sheet 2018 $ 866.0 2,441.5 51.1 694.6 4,053.2 1,2028 2,331.5 2,381.0 5,9 15.3 37,193.6 (14,350.9). 22,842.7 $32,8112 $ 1,207.9 in millions, except per share data December 31, 2019 ASSETS Current assets Cash and equivalents $ 898.5 Accounts and notes receivable 2,224.2 Inventories, at cost, not in excess of market 50.2 Prepaid expenses and other current assets 385.0 Total current assets 3.557.9 Other assets Investments in and advances to affiliates 1,270.3 Goodwill 2,677.4 Miscellaneous 2,584,0 Total other assets 6,53 1.7 Lease right-of-use asset, net 13,26 1.2 Property and equipment Property and equipment, at cost 39,050.9 Accumulated depreciation and amortization (14,890.9) Net property and equipment 24,160.0 Total assets $ 47,510,8 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable $ 988.2 Lease liability 621.0 Income taxes 33 1.7 Other taxes 247.5 Accrued interest 337.8 Accrued payroll and other liabilities 1,035.7 Current maturities of long-term debt 59.1 Total current liabilities 3.621.0 Long-term debt 34,118.1 Long-term lease liability 12,757.8 Long-term income taxes 2,265.9 Deferred revenues - initial franchise fees 660.6 Other long-term liabilities 979.6 Deferred income taxes 1,318.1 Shareholders' equity (deficit) Preferred stock, no par value; authorized - 165.0 million shares; issued - none Common stock, $.01 par value; authorized 3.5 billion shares; issued - 1,660.6 million shares 16.6 Additional paid-in capital 7,653.9 Retained earnings 52,930.5 Accumulated other comprehensive income (loss) (2,482.7) Common stock in treasury at cost: 914.3 and 893.5 million shares (66.328,6) Total shareholders' equity (deficit) (8.210.3) Total liabilities and shareholders' equity (deficit) $ 47,510.8 See Nates to consoldated financial statements 228.3 253.7 297.0 986.6 2.973.5 31.075.3 2,081.2 627.8 1,096.3 1,215.5 16.6 7,376.0 50,487.0 (2,609.5) (61.528.5), (6,258.4). $ 32,8112 2018 2017 $ 10,012.7 11,012.5 21,025.2 $ 12,718.9 10,101.5 22,8204 Consolidated Statement of Income in millions, except per shave data Years ended December 31, 2019 REVENUES Sales by Company-operated restaurants $ 9,420.8 Revenues from franchised restaurants 11,655.7 Total revenues 21,076.5 OPERATING COSTS AND EXPENSES Company-operated restaurant expenses Food & paper 2,980.3 Payroll & employee benefits 2,704.4 Occupancy & other operating expenses 2,075.9 Franchised restaurants occupancy expenses 2,200.6 Selling, general & administrative expenses 2,229.4 Other operating (income) expense, net (183.9) Total operating costs and expenses 12,006.7 Operating income 9,069.8 Interest expense-net of capitalized interest of $7.4, $5.6 and $5.3 1,121.9 Nonoperating (income) expense, net (70.2) Income before provision for income taxes 8,018.1 Provision for income taxes 1,992.7 Net income $ 6,025.4 Earnings per common share-basic $ 7.95 Earnings per common share-diluted $ 7.88 Dividends declared per common share $ 4.73 Weighted-average shares outstanding-basic 758.1 Weighted-average shares outstanding-diluted 764.9 See Nates to consolated fruicial statements. 3,153,8 2,937.9 2,174.2 1,973.3 2,200.2 (236,8) 12,202.6 8,822.6 98 1.2 25.3 7,8161 1,89 1.8 $ 5,924.3 $ 7.61 $ 7.54 $ 4.19 778.2 785.6 4,033.5 3,528.5 2,847.6 1,790.0 2.231.3 (1.163.2) 13,267.7 9,552.7 921.3 57.9 8,573.5 3,38 1.2 $ 5,192.3 $ 6.43 $ 6.37 $ 3.83 8074 815.5 HOME INC. CONSOLIDATED BALANCE SHEETS February 2 2020 February 2019 $ in millions, except per share data Assets Current assets: Cash and cash equivalents Receivables.net Merchandise inventories Other current assets Total current assets Net property and equipment Operating lease fight-of-use assets Goodwill Other assets Total assets 2,133 $ 2,105 14,531 1,040 19,810 22,770 5.595 2.254 807 51 235 $ 1,778 1,936 13.925 890 18,529 22.375 2.252 847 44,003 Liabilities and Stockholders' Equity Current liabilities: Short-tem debt Accounts payable Accued salaries and related expenses Sales taxes payable Deferred revenue Income taxes payable Current installments of long-term debt Current operating lease liabilities Other accrued expenses Total current abilities Long-term debt, excluding current installments Long-term operating lease liabilities Deferred income taxes Other long-term liabilities Total liabilities 1,339 7,755 1,506 656 1.782 11 1,056 974 $ 7,787 1.494 605 2.116 55 1.839 828 2.677 18,375 28,670 5.068 708 1.535 54,352 2.611 16,716 25,807 491 1,867 45.881 Common stock, par value $0.05, authorized 10,000 shares, issued: 1,786 shares at February 2 2020 and 1,782 shares at February 3, 2019, outstanding: 1.077 shares at February 2, 2020 and 1,105 shares at February 3, 2019 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, al cost, 709 shares at February 2, 2020 and 677 shares at February 3, 2019 Total stockholders' deficit) equity Total liabilities and stockholders' equity 89 11,001 51,729 (739) 89 10.578 46.423 (772) (65,195) (3,116) 51 235$ (58,196) (1.878) 44,003 Se accompanying notes to consolidated financial statements Common stock, par value $0.05; authorized: 10,000 shares; issued: 1,786 shares at February 2, 2020 and 1,782 shares at February 3, 2019, outstanding: 1,077 shares at February 2, 2020 and 1,105 shares at February 3, 2019 Paid-in capital Retained oamings Accumulated other comprehensive loss Treasury stock, at cost, 709 shares at February 2, 2020 and 677 shares at February 3, 2019 Total stockholders' (deficit) equity Total liabilities and stockholders' equity 89 11,001 51,729 (739) 89 10,578 46,423 (772) (65,196) (3,116) 51,236 $ (58,196) (1,878 44,003 $ See accompanying notes to consolidated financial statements Fiscal 2017 8,630 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Fiscal Fiscal in millions 2019 2018 Net earnings $ 11,242 $ 11,121 $ Other comprehensive income (loss): Foreign currency translation adjustments 53 (267) Cash flow hedges, net of tax 8 53 Other Total other comprehensive income (loss) (206) Comprehensive income $ 11,306 $ 10,915 $ 3 8 311 (1) (9) 301 8,931 64 Fiscal 2019 and fiscal 2017 include 52 weeks.Fiscal 2018 includes 53 weeks. See accompanying notes to consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started