Answered step by step

Verified Expert Solution

Question

1 Approved Answer

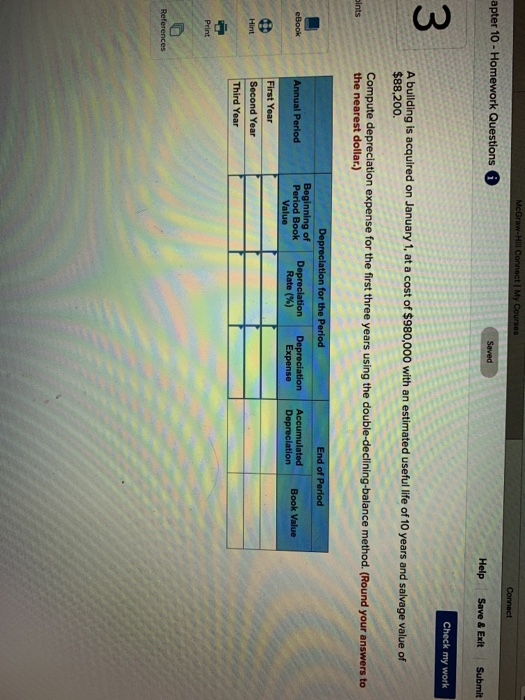

McGraw-Hill Connect My Courses Connect apter 10 - Homework Questions Saved Help Save & Exit Submit Check my work 3 A building is acquired on

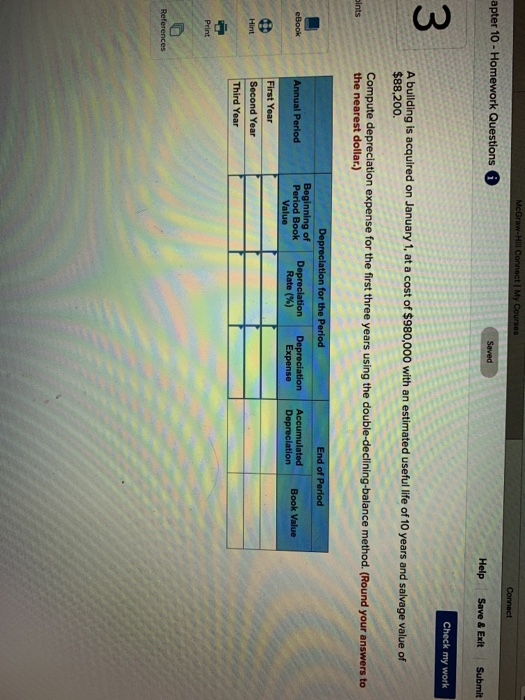

McGraw-Hill Connect My Courses Connect apter 10 - Homework Questions Saved Help Save & Exit Submit Check my work 3 A building is acquired on January 1, at a cost of $980,000 with an estimated useful life of 10 years and salvage value of $88,200. Compute depreciation expense for the first three years using the double-declining-balance method. (Round your answers to the nearest dollar.) bints End of Period Depreciation for the Period Beginning of Period Book Depreciation Depreciation Value Rate(%) Expense eBook Annual Period Accumulated Depreciation Book Value God Hint First Year Second Year Third Year Print References

McGraw-Hill Connect My Courses Connect apter 10 - Homework Questions Saved Help Save & Exit Submit Check my work 3 A building is acquired on January 1, at a cost of $980,000 with an estimated useful life of 10 years and salvage value of $88,200. Compute depreciation expense for the first three years using the double-declining-balance method. (Round your answers to the nearest dollar.) bints End of Period Depreciation for the Period Beginning of Period Book Depreciation Depreciation Value Rate(%) Expense eBook Annual Period Accumulated Depreciation Book Value God Hint First Year Second Year Third Year Print References

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started