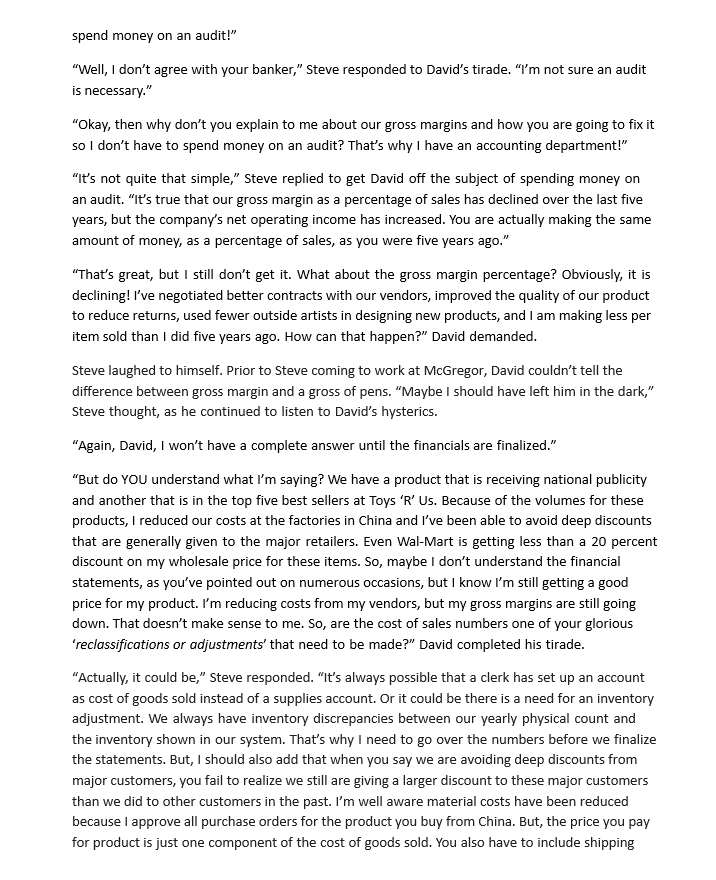

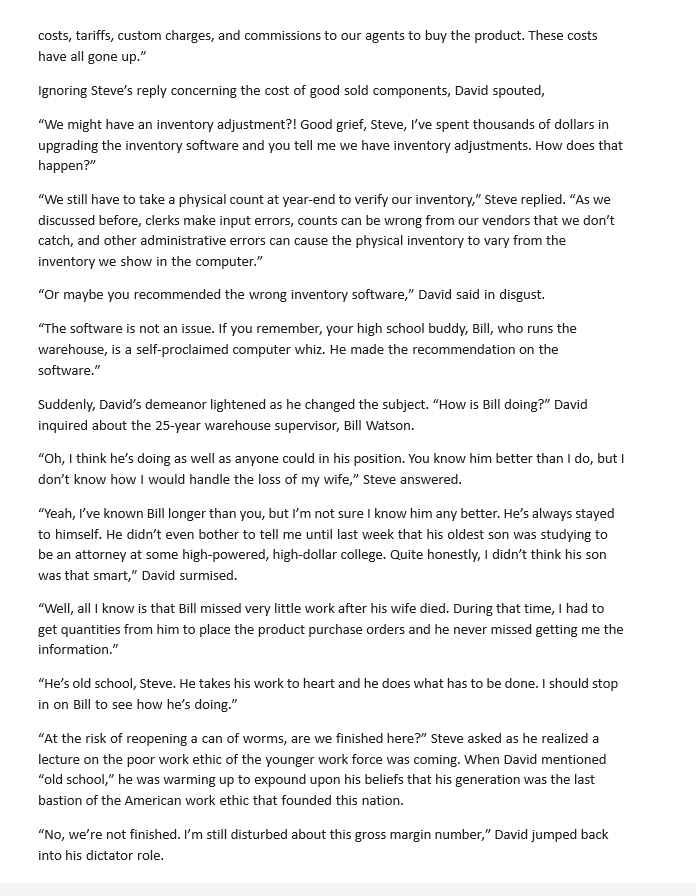

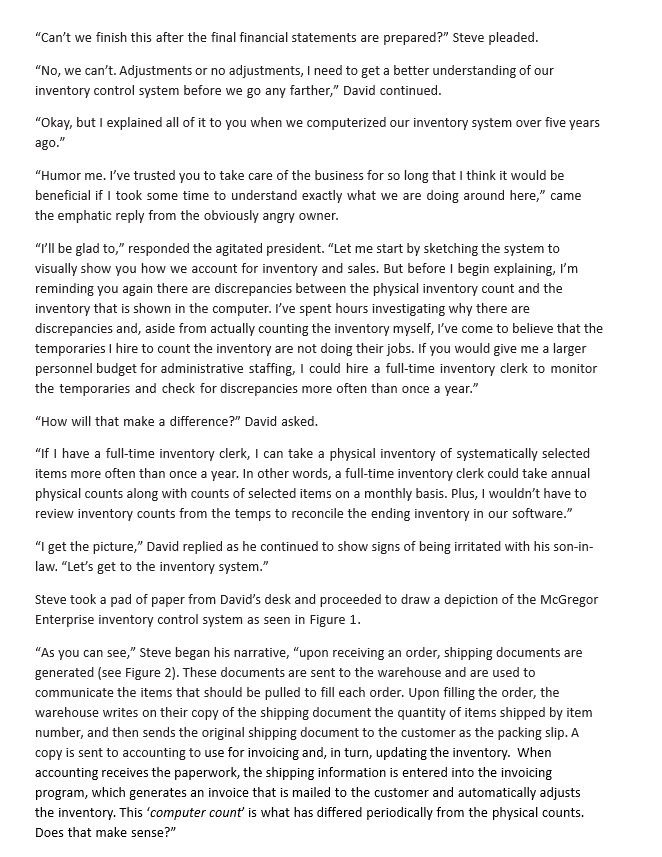

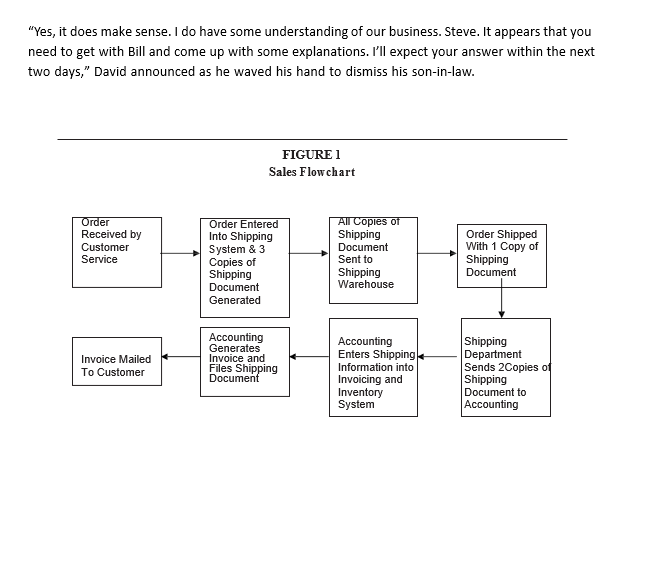

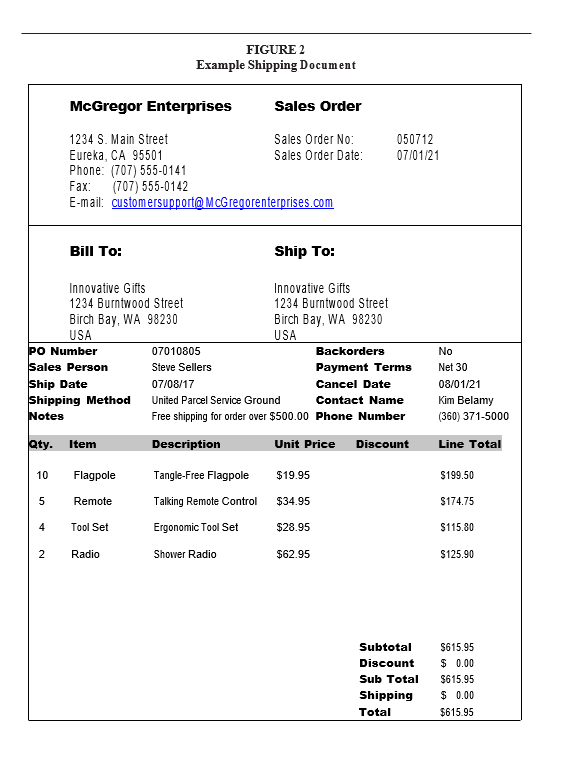

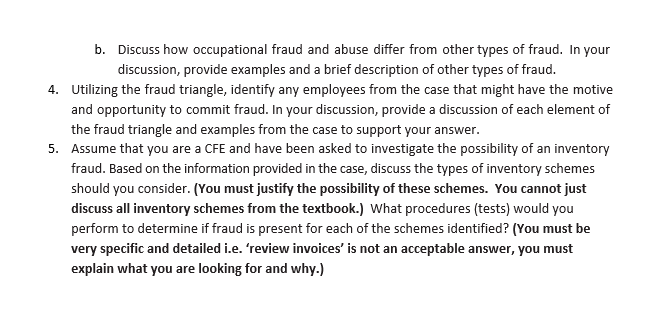

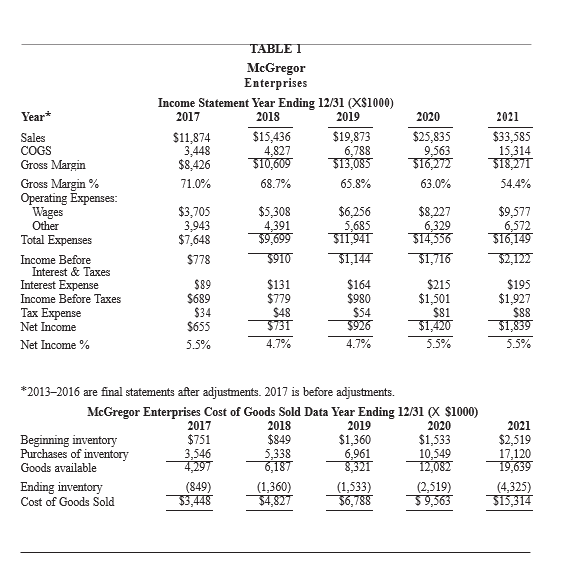

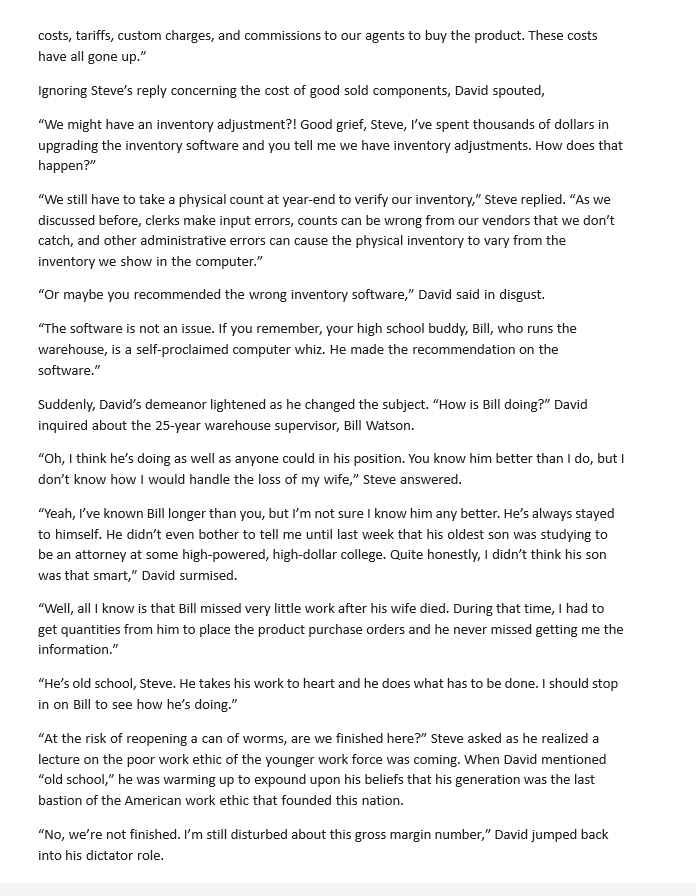

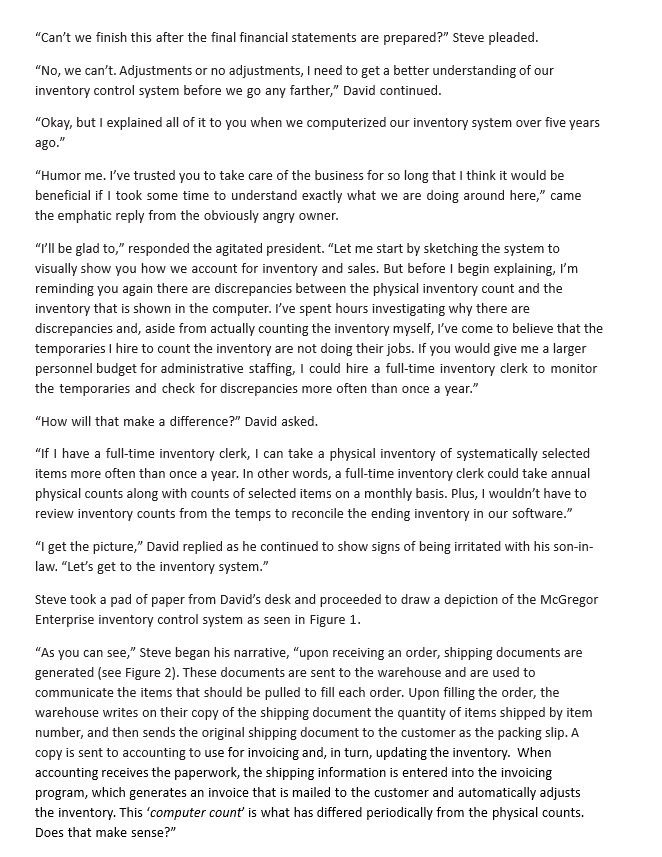

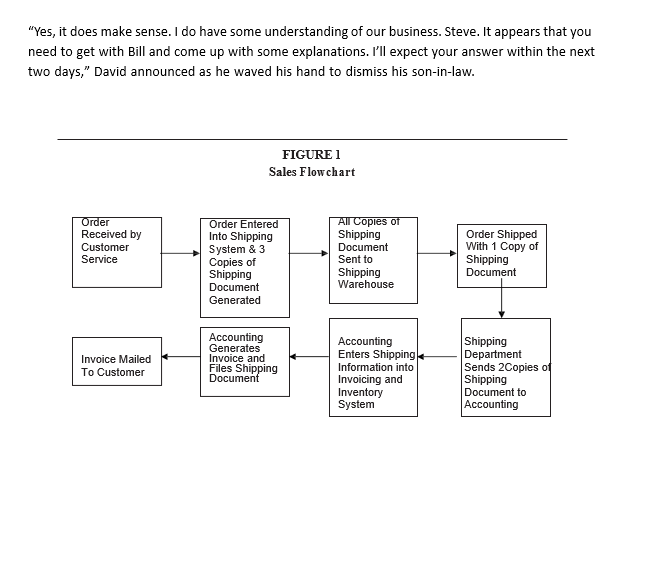

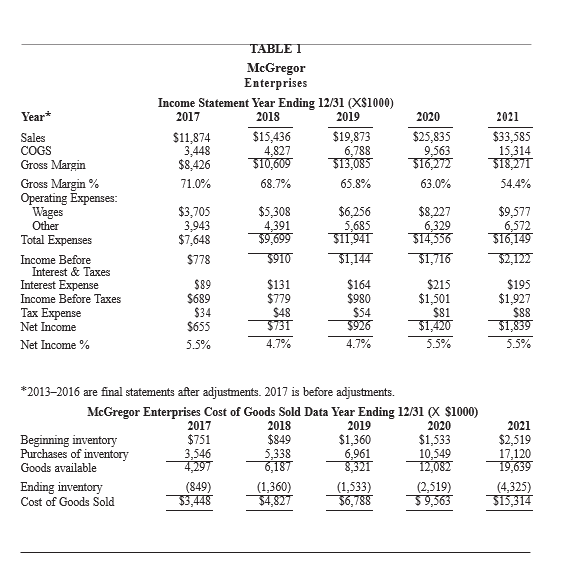

McGregor Enterprise Steve Simpson is a very average man. He wears classes, weighs barely 145 pounds and stands at just 57. If you even noticed Steve, his baby face and full head of short, brown hair gave the look of a college accounting student absorbed with how to survive finals week. But, looks can be deceiving. The 35 -year-old son-in-law of the town's wealthiest man is the president and the driving force behind McGregor Enterprises, one of the nation's largest, privately held gift wholesalers. Certainly, marrying the owner and chairman of the board's daughter didn't hurt Steve's ascent through the ranks of McGregor Enterprises. His ability to quickly grasp numbers and their relationships to the gift business, though, was the overriding reason Steve became president and chief operating officer (COO); his marriage to David McGregor' only daughter was why he achieved his current position at the young age of 29. Now, as Steve Simpson met with David McGregor to discuss the owner and chief executive officer's (CEO) concerns with the latest financial statements of the company, it became, once again, apparent to Steve why he needed to break away from his father-in-law and start a business of his own. When David McGregor failed to understand the financials of the company or got a half-baked idea about someone stealing money, Steve was subjected to tirades of epic proportions. David McGregor knew how to design and sell innovative gift products, but he knew nothing about how to manage corporate finances-a fact that he often failed to recognize. This led to hours of listening to the rants and raves about the financial health of the company. "At times, I wonder what my daughter sees in you!" David McGregor yelled. "I've spent 30 years building this company. I've got the two hottest products in the gift market today. Then I look at the preliminary financials that your wonder boy accountant gives me and our profits are pathetic. Can you explain that to me?" "With all due respect, Mr. McGregor, the 2021 figures are only preliminary numbers. Every year there are reclassifications and accrual adjustments that are made by Andy, our wonder boy accountant, as you call him. Afterwards, I review the financials. You've never looked at the preliminary financials in the past, so I can see why you might be confused. Until these adjustments are completed, let's not jump to the conclusion that our financial results are disappointing. I will admit, though, gross margins have decreased slightly over the past few years." "I don't know how many of these adjustments you're expecting to make, but I'd better see a more positive bottom line when you are done! And when you begin your clarification of these numbers, you can first explain why my gross margin appears to be down. I can't go to the bank and ask for a larger credit line with these financials! How do I explain to my ultraconservative banker that I've increased sales but made less money per sale? He's been on me to spend money for an outside audit, and if he sees these numbers, I'll have to agree. I don't want to spend money on an audit!" "Well, I don't agree with your banker," Steve responded to David's tirade. "I'm not sure an audit is necessary." "Okay, then why don't you explain to me about our gross margins and how you are going to fix it so I don't have to spend money on an audit? That's why I have an accounting department!" "It's not quite that simple," Steve replied to get David off the subject of spending money on an audit. "It's true that our gross margin as a percentage of sales has declined over the last five years, but the company's net operating income has increased. You are actually making the same amount of money, as a percentage of sales, as you were five years ago." "That's great, but I still don't get it. What about the gross margin percentage? Obviously, it is declining! I've negotiated better contracts with our vendors, improved the quality of our product to reduce returns, used fewer outside artists in designing new products, and I am making less per item sold than I did five years ago. How can that happen?" David demanded. Steve laughed to himself. Prior to Steve coming to work at McGregor, David couldn't tell the difference between gross margin and a gross of pens. "Maybe I should have left him in the dark," Steve thought, as he continued to listen to David's hysterics. "Again, David, I won't have a complete answer until the financials are finalized." "But do YOU understand what I'm saying? We have a product that is receiving national publicity and another that is in the top five best sellers at Toys ' R ' Us. Because of the volumes for these products, I reduced our costs at the factories in China and I've been able to avoid deep discounts that are generally given to the major retailers. Even Wal-Mart is getting less than a 20 percent discount on my wholesale price for these items. So, maybe I don't understand the financial statements, as you've pointed out on numerous occasions, but I know I'm still getting a good price for my product. I'm reducing costs from my vendors, but my gross margins are still going down. That doesn't make sense to me. So, are the cost of sales numbers one of your glorious 'reclassifications or adjustments' that need to be made?" David completed his tirade. "Actually, it could be," Steve responded. "It's always possible that a clerk has set up an account as cost of goods sold instead of a supplies account. Or it could be there is a need for an inventory adjustment. We always have inventory discrepancies between our yearly physical count and the inventory shown in our system. That's why I need to go over the numbers before we finalize the statements. But, I should also add that when you say we are avoiding deep discounts from major customers, you fail to realize we still are giving a larger discount to these major customers than we did to other customers in the past. I'm well aware material costs have been reduced because I approve all purchase orders for the product you buy from China. But, the price you pay for product is just one component of the cost of goods sold. You also have to include shipping costs, tariffs, custom charges, and commissions to our agents to buy the product. These costs have all gone up." Ignoring Steve's reply concerning the cost of good sold components, David spouted, "We might have an inventory adjustment?! Good grief, Steve, I've spent thousands of dollars in upgrading the inventory software and you tell me we have inventory adjustments. How does that happen?" "We still have to take a physical count at year-end to verify our inventory," Steve replied. "As we discussed before, clerks make input errors, counts can be wrong from our vendors that we don't catch, and other administrative errors can cause the physical inventory to vary from the inventory we show in the computer." "Or maybe you recommended the wrong inventory software," David said in disgust. "The software is not an issue. If you remember, your high school buddy, Bill, who runs the warehouse, is a self-proclaimed computer whiz. He made the recommendation on the software." Suddenly, David's demeanor lightened as he changed the subject. "How is Bill doing?" David inquired about the 25-year warehouse supervisor, Bill Watson. "Oh, I think he's doing as well as anyone could in his position. You know him better than I do, but I don't know how I would handle the loss of my wife," Steve answered. "Yeah, I've known Bill longer than you, but I'm not sure I know him any better. He's always stayed to himself. He didn't even bother to tell me until last week that his oldest son was studying to be an attorney at some high-powered, high-dollar college. Quite honestly, I didn't think his son was that smart, "David surmised. "Well, all I know is that Bill missed very little work after his wife died. During that time, I had to get quantities from him to place the product purchase orders and he never missed getting me the information." "He's old school, Steve. He takes his work to heart and he does what has to be done. I should stop in on Bill to see how he's doing." "At the risk of reopening a can of worms, are we finished here?" Steve asked as he realized a lecture on the poor work ethic of the younger work force was coming. When David mentioned "old school," he was warming up to expound upon his beliefs that his generation was the last bastion of the American work ethic that founded this nation. "No, we're not finished. I'm still disturbed about this gross margin number," David jumped back into his dictator role. "Can't we finish this after the final financial statements are prepared?" Steve pleaded. "No, we can't. Adjustments or no adjustments, I need to get a better understanding of our inventory control system before we go any farther," David continued. "Okay, but I explained all of it to you when we computerized our inventory system over five years ago." "Humor me. I've trusted you to take care of the business for so long that I think it would be beneficial if I took some time to understand exactly what we are doing around here," came the emphatic reply from the obviously angry owner. "I'll be glad to," responded the agitated president. "Let me start by sketching the system to visually show you how we account for inventory and sales. But before I begin explaining, I'm reminding you again there are discrepancies between the physical inventory count and the inventory that is shown in the computer. I've spent hours investigating why there are discrepancies and, aside from actually counting the inventory myself, I've come to believe that the temporaries I hire to count the inventory are not doing their jobs. If you would give me a larger personnel budget for administrative staffing, I could hire a full-time inventory clerk to monitor the temporaries and check for discrepancies more often than once a year." "How will that make a difference?" David asked. "If I have a full-time inventory clerk, I can take a physical inventory of systematically selected items more often than once a year. In other words, a full-time inventory clerk could take annual physical counts along with counts of selected items on a monthly basis. Plus, I wouldn't have to review inventory counts from the temps to reconcile the ending inventory in our software." "I get the picture," David replied as he continued to show signs of being irritated with his son-inlaw. "Let's get to the inventory system." Steve took a pad of paper from David's desk and proceeded to draw a depiction of the McGregor Enterprise inventory control system as seen in Figure 1. "As you can see," Steve began his narrative, "upon receiving an order, shipping documents are generated (see Figure 2). These documents are sent to the warehouse and are used to communicate the items that should be pulled to fill each order. Upon filling the order, the warehouse writes on their copy of the shipping document the quantity of items shipped by item number, and then sends the original shipping document to the customer as the packing slip. A copy is sent to accounting to use for invoicing and, in turn, updating the inventory. When accounting receives the paperwork, the shipping information is entered into the invoicing program, which generates an invoice that is mailed to the customer and automatically adjusts the inventory. This 'computer count' is what has differed periodically from the physical counts. Does that make sense?" "Yes, it does make sense. I do have some understanding of our business. Steve. It appears that you need to get with Bill and come up with some explanations. I'll expect your answer within the next two days," David announced as he waved his hand to dismiss his son-in-law. FIGURE 2 Example Shipping Document McGregor Enterprises Sales Order 1234S.MainStreetEureka,CA95501SalesOrderNo:SalesOrderDate:05071207/01/21 Phone: (707) 555-0141 Fax: (707) 555-0142 E-mail: customersupport@McGregorenterprises.com Bill To: Ship To: Innovative Gifts Innovative Gifts 1234 Burntwood Street 1234 Burntwood Street Birch Bay, WA 98230 Birch Bay, WA 98230 USA USA 5 Remote Talking Remote Control $34.95$174.75 4 Tool Set Ergonomic Tool Set $28.95$115.80 \begin{tabular}{ll} Subtotal & $615.95 \\ Discount & $0.00 \\ Sub Total & $615.95 \\ Shipping & $0.00 \\ Total & $615.95 \\ \hline \end{tabular} Required format for the case. - Case must be typed. - When answering questions, first repeat the question and then provide the answer. - Complete sentences are required, no bullet points. - Discussion means more than one or two sentences. Points will be deducted for discussions of one or two sentences. - Refer to the grading rubric for distribution of case points. 1. Refer to Table 1 and assume you are a student intern working part-time in the accounting department for McGregor Enterprises. Steve has asked you to prepare a memo to the CEO explaining the possible explanations for the decrease in the gross profit percentage over the past several years. Include in your memo a detailed discussion of the increase in sales, cost of goods sold, and the impact on cost of good sold and gross profit due to under-or over-stated ending inventory. In addition to the gross margin and net income percentages that are provided in Table 1, what other performance measures could be calculated to help isolate the problem of declining gross margins (provide a calculation of the measures you recommend)? As support for your possible explanations, include, as an appendix to your memo, both a horizontal analysis and vertical analysis using all 5 years. Format and professionalism is extremely important for this memo and the appendices. 2. A system of internal control consists of policies and procedures designed to provide management with reasonable assurance that a company achieves its objectives and goals. Segregation of duties is a control procedure that is instrumental in the prevention of intentional or unintentional misstatement and/or fraud. Discuss the segregation of duties concept as it relates to fraud and any violations that appear in the case. 3. Assume that David McGregor is interested in investigating the reasons for the percentage decline in gross profit as a percent of sales. He has read the memo you prepared in question (1) and believes he has a better grasp of the information reported on the income statement. Although you are simply an intern, you suggest to the CEO that he consider hiring a local Certified Public Accountant (CPA) firm or Certified Fraud Examiner (CFE) to investigate possible reasons behind the lower-than-anticipated annual gross margins. Mr. McGregor is still concerned about the cost of either of these services and given the level of trust among David and his employees, he initially scoffs at the idea of a possible fraud taking place. However, he is worried about the financial results and decides an investigation may be warranted. a. Discuss whether fraud investigations are the same as audits. Discuss whether an audit or a fraud investigation would be more appropriate to reveal any b. Discuss how occupational fraud and abuse differ from other types of fraud. In your discussion, provide examples and a brief description of other types of fraud. 4. Utilizing the fraud triangle, identify any employees from the case that might have the motive and opportunity to commit fraud. In your discussion, provide a discussion of each element of the fraud triangle and examples from the case to support your answer. 5. Assume that you are a CFE and have been asked to investigate the possibility of an inventory fraud. Based on the information provided in the case, discuss the types of inventory schemes should you consider. (You must justify the possibility of these schemes. You cannot just discuss all inventory schemes from the textbook.) What procedures (tests) would you perform to determine if fraud is present for each of the schemes identified? (You must be very specific and detailed i.e. 'review invoices' is not an acceptable answer, you must explain what you are looking for and why.) *2013-2016 are final statements after adjustments. 2017 is before adjustments. McGregor Enterprise Steve Simpson is a very average man. He wears classes, weighs barely 145 pounds and stands at just 57. If you even noticed Steve, his baby face and full head of short, brown hair gave the look of a college accounting student absorbed with how to survive finals week. But, looks can be deceiving. The 35 -year-old son-in-law of the town's wealthiest man is the president and the driving force behind McGregor Enterprises, one of the nation's largest, privately held gift wholesalers. Certainly, marrying the owner and chairman of the board's daughter didn't hurt Steve's ascent through the ranks of McGregor Enterprises. His ability to quickly grasp numbers and their relationships to the gift business, though, was the overriding reason Steve became president and chief operating officer (COO); his marriage to David McGregor' only daughter was why he achieved his current position at the young age of 29. Now, as Steve Simpson met with David McGregor to discuss the owner and chief executive officer's (CEO) concerns with the latest financial statements of the company, it became, once again, apparent to Steve why he needed to break away from his father-in-law and start a business of his own. When David McGregor failed to understand the financials of the company or got a half-baked idea about someone stealing money, Steve was subjected to tirades of epic proportions. David McGregor knew how to design and sell innovative gift products, but he knew nothing about how to manage corporate finances-a fact that he often failed to recognize. This led to hours of listening to the rants and raves about the financial health of the company. "At times, I wonder what my daughter sees in you!" David McGregor yelled. "I've spent 30 years building this company. I've got the two hottest products in the gift market today. Then I look at the preliminary financials that your wonder boy accountant gives me and our profits are pathetic. Can you explain that to me?" "With all due respect, Mr. McGregor, the 2021 figures are only preliminary numbers. Every year there are reclassifications and accrual adjustments that are made by Andy, our wonder boy accountant, as you call him. Afterwards, I review the financials. You've never looked at the preliminary financials in the past, so I can see why you might be confused. Until these adjustments are completed, let's not jump to the conclusion that our financial results are disappointing. I will admit, though, gross margins have decreased slightly over the past few years." "I don't know how many of these adjustments you're expecting to make, but I'd better see a more positive bottom line when you are done! And when you begin your clarification of these numbers, you can first explain why my gross margin appears to be down. I can't go to the bank and ask for a larger credit line with these financials! How do I explain to my ultraconservative banker that I've increased sales but made less money per sale? He's been on me to spend money for an outside audit, and if he sees these numbers, I'll have to agree. I don't want to spend money on an audit!" "Well, I don't agree with your banker," Steve responded to David's tirade. "I'm not sure an audit is necessary." "Okay, then why don't you explain to me about our gross margins and how you are going to fix it so I don't have to spend money on an audit? That's why I have an accounting department!" "It's not quite that simple," Steve replied to get David off the subject of spending money on an audit. "It's true that our gross margin as a percentage of sales has declined over the last five years, but the company's net operating income has increased. You are actually making the same amount of money, as a percentage of sales, as you were five years ago." "That's great, but I still don't get it. What about the gross margin percentage? Obviously, it is declining! I've negotiated better contracts with our vendors, improved the quality of our product to reduce returns, used fewer outside artists in designing new products, and I am making less per item sold than I did five years ago. How can that happen?" David demanded. Steve laughed to himself. Prior to Steve coming to work at McGregor, David couldn't tell the difference between gross margin and a gross of pens. "Maybe I should have left him in the dark," Steve thought, as he continued to listen to David's hysterics. "Again, David, I won't have a complete answer until the financials are finalized." "But do YOU understand what I'm saying? We have a product that is receiving national publicity and another that is in the top five best sellers at Toys ' R ' Us. Because of the volumes for these products, I reduced our costs at the factories in China and I've been able to avoid deep discounts that are generally given to the major retailers. Even Wal-Mart is getting less than a 20 percent discount on my wholesale price for these items. So, maybe I don't understand the financial statements, as you've pointed out on numerous occasions, but I know I'm still getting a good price for my product. I'm reducing costs from my vendors, but my gross margins are still going down. That doesn't make sense to me. So, are the cost of sales numbers one of your glorious 'reclassifications or adjustments' that need to be made?" David completed his tirade. "Actually, it could be," Steve responded. "It's always possible that a clerk has set up an account as cost of goods sold instead of a supplies account. Or it could be there is a need for an inventory adjustment. We always have inventory discrepancies between our yearly physical count and the inventory shown in our system. That's why I need to go over the numbers before we finalize the statements. But, I should also add that when you say we are avoiding deep discounts from major customers, you fail to realize we still are giving a larger discount to these major customers than we did to other customers in the past. I'm well aware material costs have been reduced because I approve all purchase orders for the product you buy from China. But, the price you pay for product is just one component of the cost of goods sold. You also have to include shipping costs, tariffs, custom charges, and commissions to our agents to buy the product. These costs have all gone up." Ignoring Steve's reply concerning the cost of good sold components, David spouted, "We might have an inventory adjustment?! Good grief, Steve, I've spent thousands of dollars in upgrading the inventory software and you tell me we have inventory adjustments. How does that happen?" "We still have to take a physical count at year-end to verify our inventory," Steve replied. "As we discussed before, clerks make input errors, counts can be wrong from our vendors that we don't catch, and other administrative errors can cause the physical inventory to vary from the inventory we show in the computer." "Or maybe you recommended the wrong inventory software," David said in disgust. "The software is not an issue. If you remember, your high school buddy, Bill, who runs the warehouse, is a self-proclaimed computer whiz. He made the recommendation on the software." Suddenly, David's demeanor lightened as he changed the subject. "How is Bill doing?" David inquired about the 25-year warehouse supervisor, Bill Watson. "Oh, I think he's doing as well as anyone could in his position. You know him better than I do, but I don't know how I would handle the loss of my wife," Steve answered. "Yeah, I've known Bill longer than you, but I'm not sure I know him any better. He's always stayed to himself. He didn't even bother to tell me until last week that his oldest son was studying to be an attorney at some high-powered, high-dollar college. Quite honestly, I didn't think his son was that smart, "David surmised. "Well, all I know is that Bill missed very little work after his wife died. During that time, I had to get quantities from him to place the product purchase orders and he never missed getting me the information." "He's old school, Steve. He takes his work to heart and he does what has to be done. I should stop in on Bill to see how he's doing." "At the risk of reopening a can of worms, are we finished here?" Steve asked as he realized a lecture on the poor work ethic of the younger work force was coming. When David mentioned "old school," he was warming up to expound upon his beliefs that his generation was the last bastion of the American work ethic that founded this nation. "No, we're not finished. I'm still disturbed about this gross margin number," David jumped back into his dictator role. "Can't we finish this after the final financial statements are prepared?" Steve pleaded. "No, we can't. Adjustments or no adjustments, I need to get a better understanding of our inventory control system before we go any farther," David continued. "Okay, but I explained all of it to you when we computerized our inventory system over five years ago." "Humor me. I've trusted you to take care of the business for so long that I think it would be beneficial if I took some time to understand exactly what we are doing around here," came the emphatic reply from the obviously angry owner. "I'll be glad to," responded the agitated president. "Let me start by sketching the system to visually show you how we account for inventory and sales. But before I begin explaining, I'm reminding you again there are discrepancies between the physical inventory count and the inventory that is shown in the computer. I've spent hours investigating why there are discrepancies and, aside from actually counting the inventory myself, I've come to believe that the temporaries I hire to count the inventory are not doing their jobs. If you would give me a larger personnel budget for administrative staffing, I could hire a full-time inventory clerk to monitor the temporaries and check for discrepancies more often than once a year." "How will that make a difference?" David asked. "If I have a full-time inventory clerk, I can take a physical inventory of systematically selected items more often than once a year. In other words, a full-time inventory clerk could take annual physical counts along with counts of selected items on a monthly basis. Plus, I wouldn't have to review inventory counts from the temps to reconcile the ending inventory in our software." "I get the picture," David replied as he continued to show signs of being irritated with his son-inlaw. "Let's get to the inventory system." Steve took a pad of paper from David's desk and proceeded to draw a depiction of the McGregor Enterprise inventory control system as seen in Figure 1. "As you can see," Steve began his narrative, "upon receiving an order, shipping documents are generated (see Figure 2). These documents are sent to the warehouse and are used to communicate the items that should be pulled to fill each order. Upon filling the order, the warehouse writes on their copy of the shipping document the quantity of items shipped by item number, and then sends the original shipping document to the customer as the packing slip. A copy is sent to accounting to use for invoicing and, in turn, updating the inventory. When accounting receives the paperwork, the shipping information is entered into the invoicing program, which generates an invoice that is mailed to the customer and automatically adjusts the inventory. This 'computer count' is what has differed periodically from the physical counts. Does that make sense?" "Yes, it does make sense. I do have some understanding of our business. Steve. It appears that you need to get with Bill and come up with some explanations. I'll expect your answer within the next two days," David announced as he waved his hand to dismiss his son-in-law. FIGURE 2 Example Shipping Document McGregor Enterprises Sales Order 1234S.MainStreetEureka,CA95501SalesOrderNo:SalesOrderDate:05071207/01/21 Phone: (707) 555-0141 Fax: (707) 555-0142 E-mail: customersupport@McGregorenterprises.com Bill To: Ship To: Innovative Gifts Innovative Gifts 1234 Burntwood Street 1234 Burntwood Street Birch Bay, WA 98230 Birch Bay, WA 98230 USA USA 5 Remote Talking Remote Control $34.95$174.75 4 Tool Set Ergonomic Tool Set $28.95$115.80 \begin{tabular}{ll} Subtotal & $615.95 \\ Discount & $0.00 \\ Sub Total & $615.95 \\ Shipping & $0.00 \\ Total & $615.95 \\ \hline \end{tabular} Required format for the case. - Case must be typed. - When answering questions, first repeat the question and then provide the answer. - Complete sentences are required, no bullet points. - Discussion means more than one or two sentences. Points will be deducted for discussions of one or two sentences. - Refer to the grading rubric for distribution of case points. 1. Refer to Table 1 and assume you are a student intern working part-time in the accounting department for McGregor Enterprises. Steve has asked you to prepare a memo to the CEO explaining the possible explanations for the decrease in the gross profit percentage over the past several years. Include in your memo a detailed discussion of the increase in sales, cost of goods sold, and the impact on cost of good sold and gross profit due to under-or over-stated ending inventory. In addition to the gross margin and net income percentages that are provided in Table 1, what other performance measures could be calculated to help isolate the problem of declining gross margins (provide a calculation of the measures you recommend)? As support for your possible explanations, include, as an appendix to your memo, both a horizontal analysis and vertical analysis using all 5 years. Format and professionalism is extremely important for this memo and the appendices. 2. A system of internal control consists of policies and procedures designed to provide management with reasonable assurance that a company achieves its objectives and goals. Segregation of duties is a control procedure that is instrumental in the prevention of intentional or unintentional misstatement and/or fraud. Discuss the segregation of duties concept as it relates to fraud and any violations that appear in the case. 3. Assume that David McGregor is interested in investigating the reasons for the percentage decline in gross profit as a percent of sales. He has read the memo you prepared in question (1) and believes he has a better grasp of the information reported on the income statement. Although you are simply an intern, you suggest to the CEO that he consider hiring a local Certified Public Accountant (CPA) firm or Certified Fraud Examiner (CFE) to investigate possible reasons behind the lower-than-anticipated annual gross margins. Mr. McGregor is still concerned about the cost of either of these services and given the level of trust among David and his employees, he initially scoffs at the idea of a possible fraud taking place. However, he is worried about the financial results and decides an investigation may be warranted. a. Discuss whether fraud investigations are the same as audits. Discuss whether an audit or a fraud investigation would be more appropriate to reveal any b. Discuss how occupational fraud and abuse differ from other types of fraud. In your discussion, provide examples and a brief description of other types of fraud. 4. Utilizing the fraud triangle, identify any employees from the case that might have the motive and opportunity to commit fraud. In your discussion, provide a discussion of each element of the fraud triangle and examples from the case to support your answer. 5. Assume that you are a CFE and have been asked to investigate the possibility of an inventory fraud. Based on the information provided in the case, discuss the types of inventory schemes should you consider. (You must justify the possibility of these schemes. You cannot just discuss all inventory schemes from the textbook.) What procedures (tests) would you perform to determine if fraud is present for each of the schemes identified? (You must be very specific and detailed i.e. 'review invoices' is not an acceptable answer, you must explain what you are looking for and why.) *2013-2016 are final statements after adjustments. 2017 is before adjustments